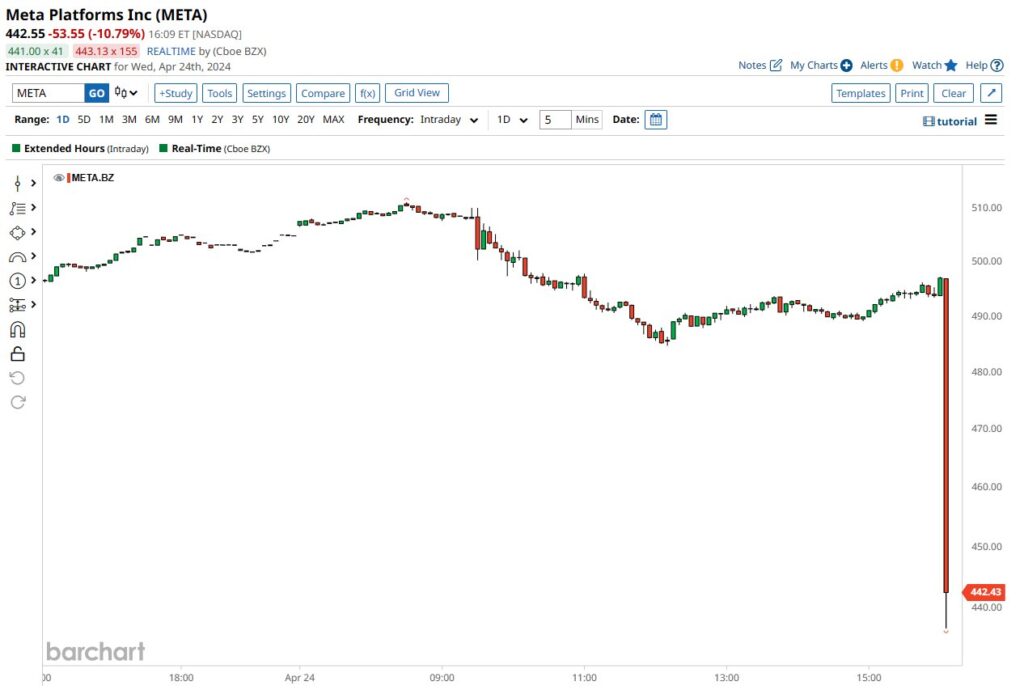

META Reports An Excellent Quarter – And The Stock Is -12%

Facebook (META) just reported an excellent 1Q24 – but the stock is off 12% in the after hours. Revenue was +27% and EPS +114% to $4.71 compared to the year ago quarter. Operating margin of 37.9% compares to 25.2% a year ago. 2Q24 revenue guidance of $36.5-$39.0 billion represents an 18% increase at the midpoint.

Why is the stock down if the report was good? Because expectations were so high and so much good news was already priced in. This is why I was bearish heading into the report as I tweeted this morning at 9:37am PST:

I’m leaning quite bearish heading into this afternoon’s 1Q24 $META earnings report. I’m not saying I think the report will be a bad one from a fundamental standpoint. I’m saying I think the upside is limited no matter how good it is fundamentally and that there is significant downside risk because expectations are so high. Feels like a lot is riding on it….

This is pretty much the exact opposite of what happened with Tesla (TSLA) where the report was not very good but expectations were so low that the stock was +12% in today’s session.

If this holds, the overall market will gap down at the open Thursday as well, likely putting an end to a powerful two day rally Monday and Tuesday which I suspected was a “bull trap”.