Market Themes/Trends Since The March 2020 COVID Lows: Tech, Reopen Value, Inflation

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

My view is that the Tech and Reopen trades are mostly played out and the really durable trend is The Inflation Trade $GLD $GDX $GDXJ $SLV $SIL $SILJ $XLP https://t.co/B3G22BsBfi

— Top Gun Financial (@TopGunFP) June 1, 2021

The stock market has been very thematic since the March 2020 COVID lows as investors try to invest in an environment of extreme uncertainty.

The first theme/trend was Tech outperformance which lasted from March 23, 2020 through September 2, 2020. As the pandemic raged and people hunkered down in their homes, they were on their computers and the internet almost 24/7. The Big 5 (AAPL MSFT AMZN GOOG GOOGL FB) dominated QQQ vastly outperformed the S&P 500 as you can see in the chart above.

The Reopen Value theme/trend began on Monday November 9, 2020 with the announcement of Pfizer’s COVID-19 vaccine. All of a sudden investors began to imagine and price in a normalized economy and value stocks as represented by the iShares Russell 1000 Value ETF (IWD) outperformed growth stocks as represented by the iShares Russell 1000 Growth ETF (IWF). However, I believe that trend peaked on March 8, 2021.

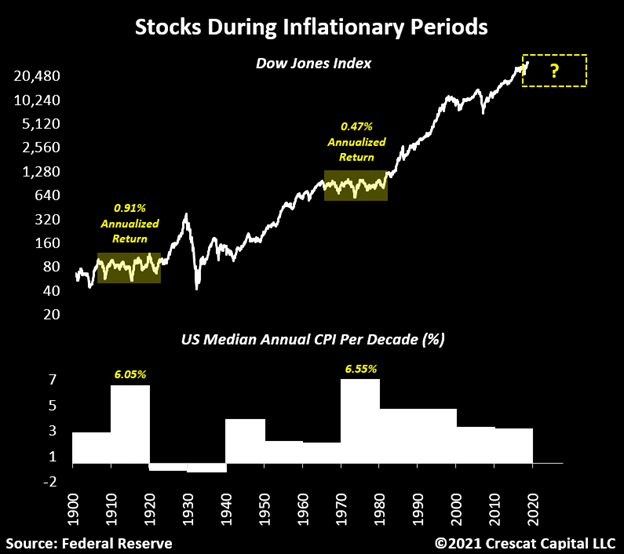

In my opinion, the next trend/trade is The Inflation Trade and it began on March 31, 2021. You can see this in the outperformance of the Junior Gold Miners ETF (GDXJ) versus the S&P 500 since that date. Most investors have accepted the Fed’s view that inflation will be “transitory”. As I’ve argued many times in the past, this is almost certainly wishful thinking and a minority of elite investors have started to buy up the precious metals miner stocks as an inflation play. The best thing that has been written on The Inflation Trade is Crescat Capital’s May Research Letter “The Three Pillars of Inflation” (May 19).

Not only do I believe that this is the next trend/trade, but I believe that it will prove to be far more durable and profitable than the Tech and Reopen Value trades. This is how I’m positioned and Top Gun has a had a terrific two months.