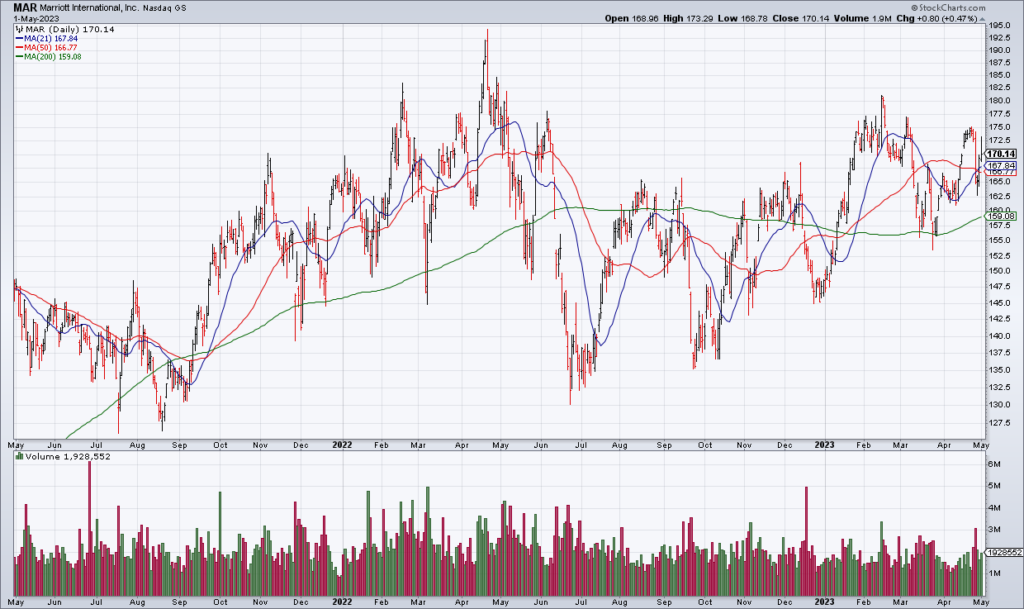

MAR: Travel Is Booming

One of the things that I like to do to gain insight into the broader economy is to look at the results of economically sensitive companies. When consumers are flush, they spend more money on discretionary items like travel. So it makes sense to look at hotel operator Marriott (MAR) – with more than 1.5 million rooms worldwide – as a window into travel. MAR reported 1Q23 earnings Tuesday morning.

The key metric for hotels is Revenue Per AvailaMble Room (RevPAR) – and it was up 34.3% Worldwide and 25.6% in the US & Canada compared to a year ago. As a result, MAR raised full year RevPAR guidance to 10-13% and EPS to $7.97-$8.42 – from 6-11% and $7.23-$7.91 three months ago, respectively. Shares are currently +2% in the premarket on the results.

My premise for 2023 has been that the cumulative effect of the Fed’s tightening would be felt, throwing the economy into recession. But that isn’t showing up in MAR’s results – or in other economically sensitive stocks I’ve analyzed recently like home builder DHI.