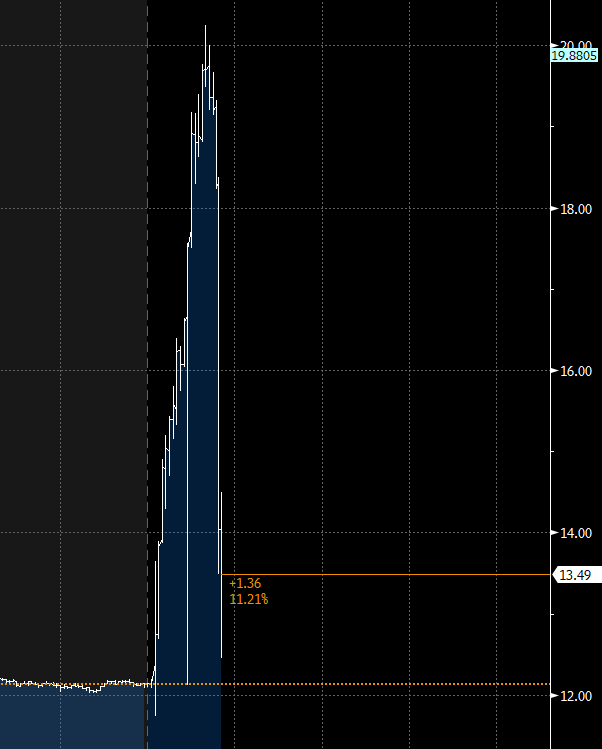

LYFT Adds An Extra Zero Briefly Skyrocketing Shares

Lyft (LYFT) reported earnings after the close Tuesday and a typo in its report briefly sent shares soaring more than 60% before coming back to earth. It’s literally the funniest thing I’ve seen in my almost 20 year career in the investment business.

What happened? In its 2024 guidance, LYFT said that Adjusted EBITDA – their core measure of profitability – Margin as a % of Gross Bookings would increase 500 basis points compared to 2023. Let me give you an idea of the magnitude of that increase. In 2023, that measure was 1.6% resulting in $222.4 million in Adjusted EBITDA. If 2024 Gross Bookings increased in line with their guidance and this measure really increased by 500 basis points and came in at 6.6%, Adjusted EBITDA would exceed $1 billion in 2024. In other words, that extra zero suggested that LYFT had gone from a barely profitable, second rate company to an extremely profitable, blue chip company with margins more than double competitor UBER’s.

During the conference call, LYFT’s CFO corrected the number to a 50 basis point increase and shares came crashing back to earth. A 50 basis point increase works out to a 2.1% margin (not 6.6%) and Adjusted EBITDA of ~$330 million. In other words, profitability is improving but the golden goose has not been discovered.