LEN Earnings Preview

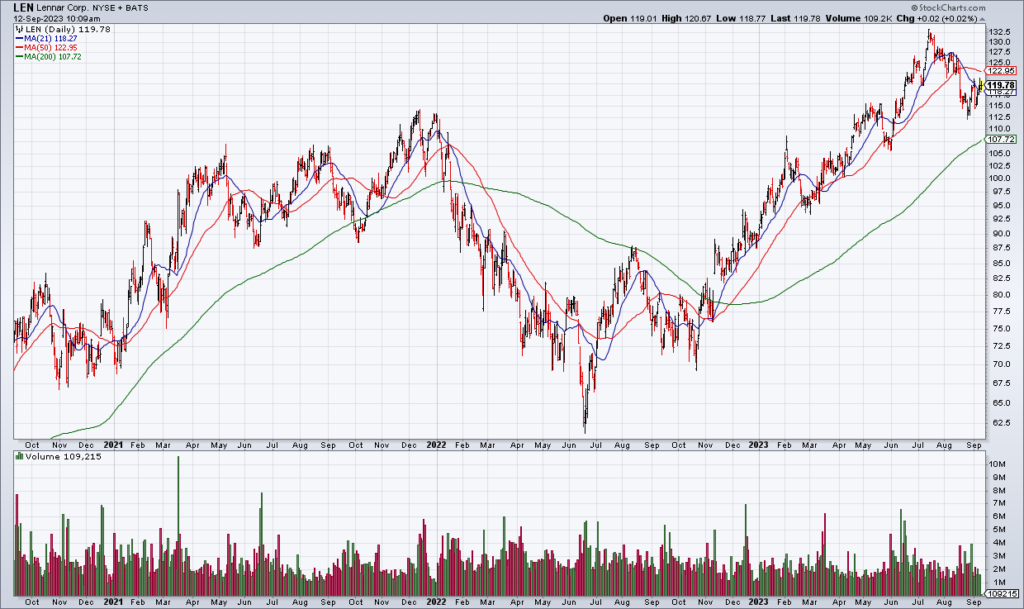

One stock reporting earnings that I did not cover in the weekly preview is homebuilder Lennar (LEN). With a $34 billion market cap, LEN is one of the larger publicly traded homebuilders, along with DR Horton (DHI).

As interest rates – and mortgage rates along with them – rose last year as the Fed tightened monetary conditions, I – along with the market – started to price in a housing downturn. And while new orders did decline from 10%-20% in 3Q22 through 1Q23, it wasn’t nearly as bad as expected.

And now – for the current quarter – LEN guided to 18,000-19,000 new orders which would be a 29% year over year increase at the midpoint. In other words, the housing market has defied expectations for a downturn and LEN’s guide – along with the stock price – are now pricing in a continued bull market in housing.

But I’m still not convinced that high mortgage rates and the effects of the Fed’s tightening on housing demand will not be felt – and so I’ve stayed short the homebuilders despite their relentless march higher. So I’m very interested in what LEN has to say when it reports 3Q23 earnings (their fiscal quarter ends a month early) on Thursday afternoon. I’m expecting volumes and prices to come down at some point and I’d sure like it to be this quarter.