July CPI Doesn’t Move The Needle, EAT Bites The Dust

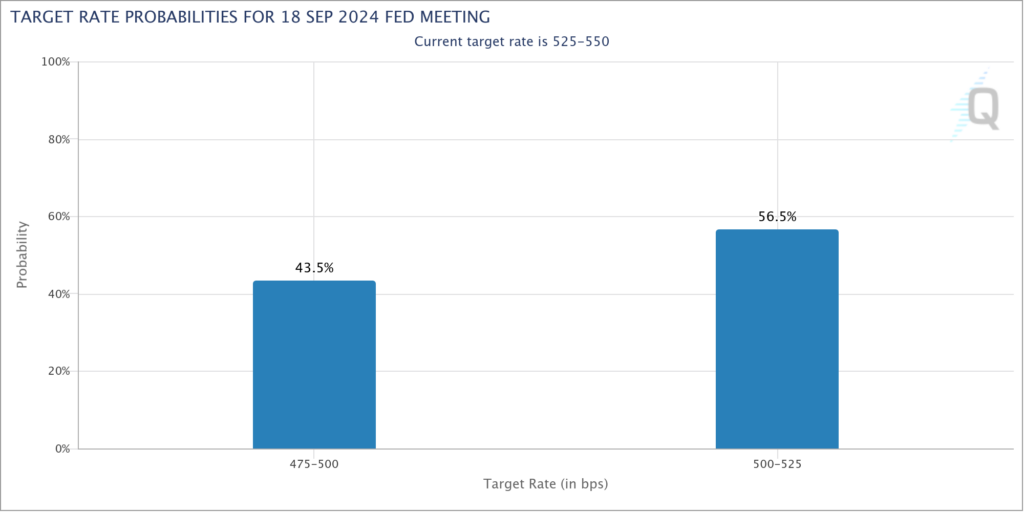

The July CPI Report out early Wednesday morning was inline with expectations – Headline CPI +0.2%, Core CPI +0.2% – and hasn’t much changed the calculus for whether the Fed will cut 25 or 50 basis points on September 18. As a result it didn’t provide much of a catalyst for the market either way and the major indexes are mostly flat a couple hours into the trading day – though small caps (IWM) are down 0.8%.

On the earnings front, Brinker International (EAT) – the $3 billion market cap owner of almost 1,600 Chili’s restaurants – is off almost 12% on weak FY25 guidance I suspect. The stock has been a huge winner over the last year as you can see in the chart above but the guidance calls for only 4% revenue growth in FY25.