Investors Have Never Been More Euphoric, TSLA & Bitcoin, Emerging Markets Breaking Out, ACI Earnings Preview

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

[Permabears] are terrible people – JC Parets, “Financials Are Emerging Leaders”, January 10, 2021

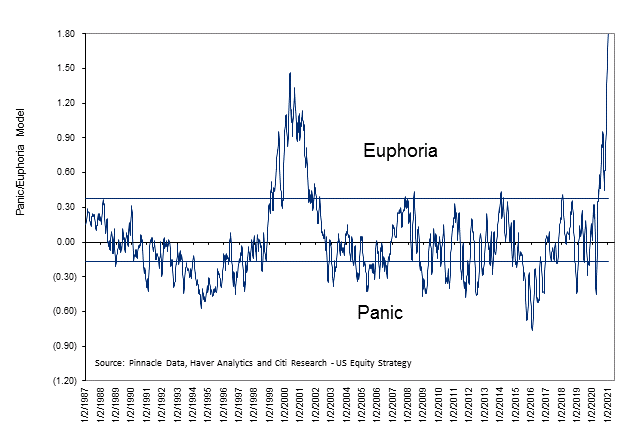

According to the Citi Panic/Euphoria Model, investors have never been more euphoric than they are now (Chart Source: Sentimentrader, “Moving beyond optimism to euphoria”, January 11, 2021).

It’s gotten to the point where, from the bulls perspective, being bearish not only makes you wrong but a “terrible person”!

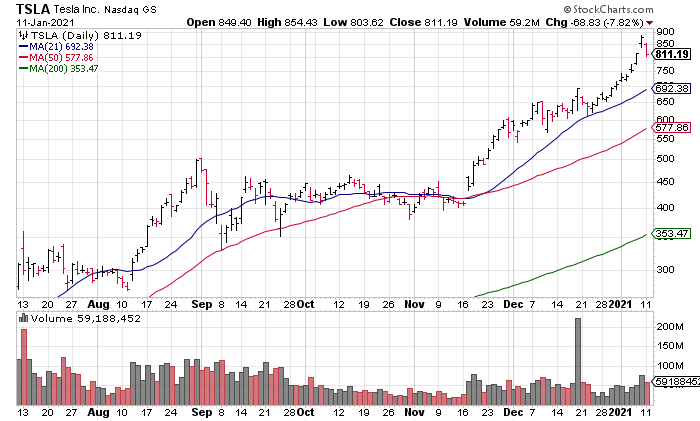

On Friday morning, I wrote “When The Chart Goes Parabolic It’s Time To Sell” in reference to Bitcoin and TSLA. To me, these two are the ones to watch as a gauge of investor risk appetite. If they start to crash, that could well be the canary in the coal mine for financial markets. Turns out my timing was pretty good as both have done poorly since Friday morning.

Here’s an excellent chart of Bitcoin’s Sunday from Market Wizard Linda Radschke (Chart Source: Linda Radschke Twitter, January 11, 6:20am PST).

Only time will tell, but that really looks like the beginning of the crash phase in the generic blow off top chart I posted in Friday morning’s blog.

TSLA also had a bad day Monday, down 7.82% on 1 1/3x average volume.

While a bounce in each of these assets wouldn’t be a surprise, renewed selling would be a sign for me that the music may be stopping.

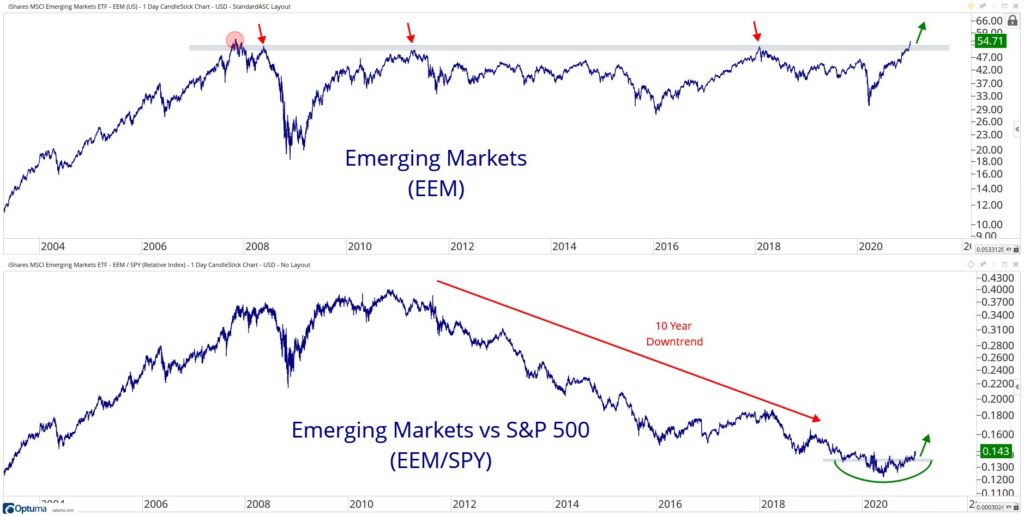

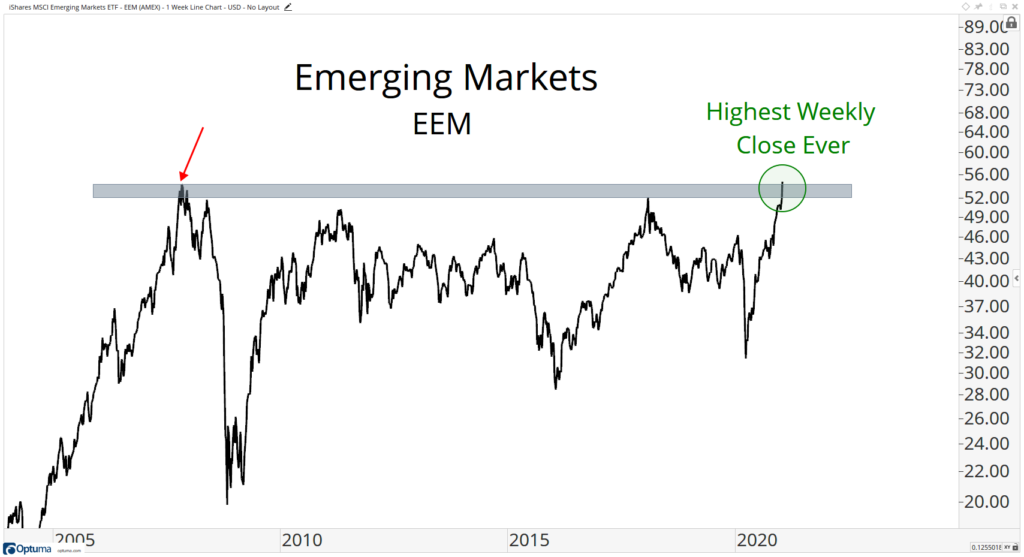

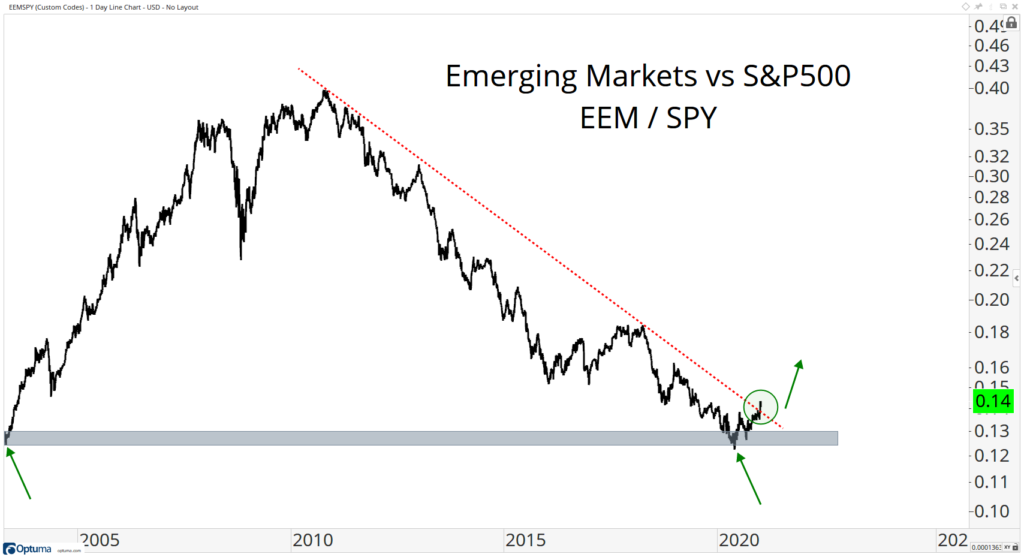

Nevertheless, the technicians remained all bulled up turning their focus to Emerging Markets now. Both Willie Delwiche and JC Parets recently pointed out the breakout in EEM, the leading emerging markets ETF (Chart Source: Willie Delwiche Twitter, January 11, 2021; Charts Source: JC Parets, “New Bullish Themes Are Emerging”, January 10, 2021).

The three charts show the same thing: EEM breaking out from its 2007 highs and relative to the S&P. So let’s keep an eye on EEM as well to see if it continues to move higher or if this is a “false breakout”. Parets points out that China now makes up 41.44% of the EEM.

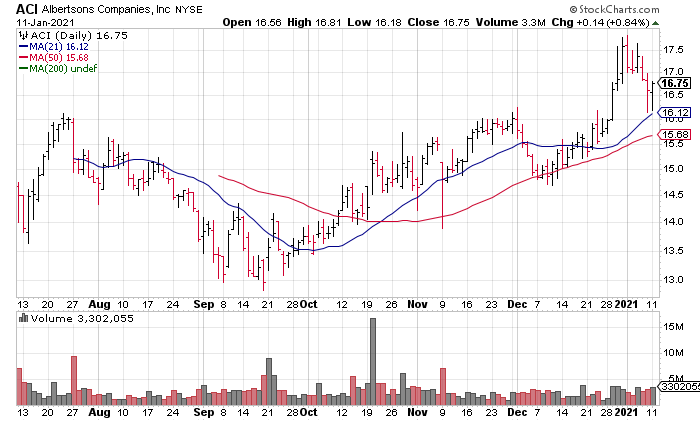

4Q20 Earnings Season gets kicked off in earnest Friday with JPM WFC & C but Albertson’s (ACI, market cap $10 billion), the nation’s 2nd leading grocery chain reports later this morning. As Top Gun has a position in Kroger (KR), the leading grocery chain in the country, I’m interested to see how ACI is doing for the light it could shed on KR.

Both ACI and KR are “Pandemic Beneficiaries” as restaurants were closed or restricted to takeout for much of 2020 leaving consumers with no choice but to prepare their own food. This can be seen in ACI’s most recently completed quarter, ended September 12, 2020, when their Identical Store Sales Growth was 13.8% resulting in an increase in Adjusted EPS to 60 cents from 17 cents a year ago (Source: Albertson’s FY2Q Earnings Report). While the vaccine and reopening later this year will put some pressure on grocery stores, both of these stocks offer excellent value IMO. They will also benefit if the bubble pops, pushing the economy into recession or worse.