Inside Day, March CPI, 1Q Earnings Season

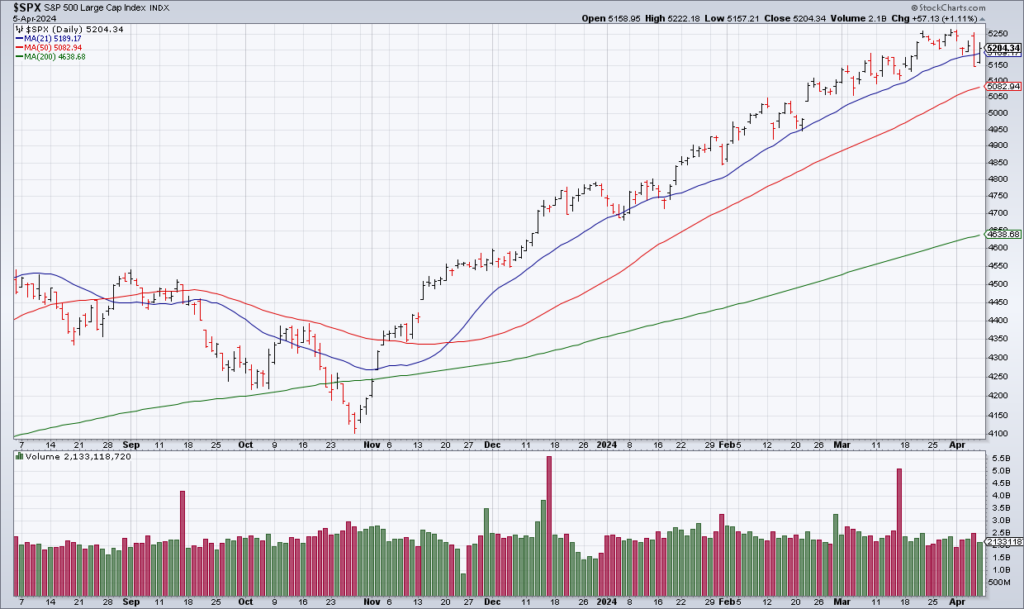

Friday was an interesting day as the market rallied in the wake of the stronger than expected March Jobs Report. Technically, it was an inside day with all of the price action taking place within Thursday’s range. Therefore, Thursday’s range of ~5150-5250 is still the relevant one technically until the market breaks out in one direction or the other. Only slightly more than 50% of stocks on the NYSE and NASDAQ rallied Friday as the market was led by the mega caps with the market cap weighted S&P +1.14% while the Equal Weight S&P was only +0.60%.

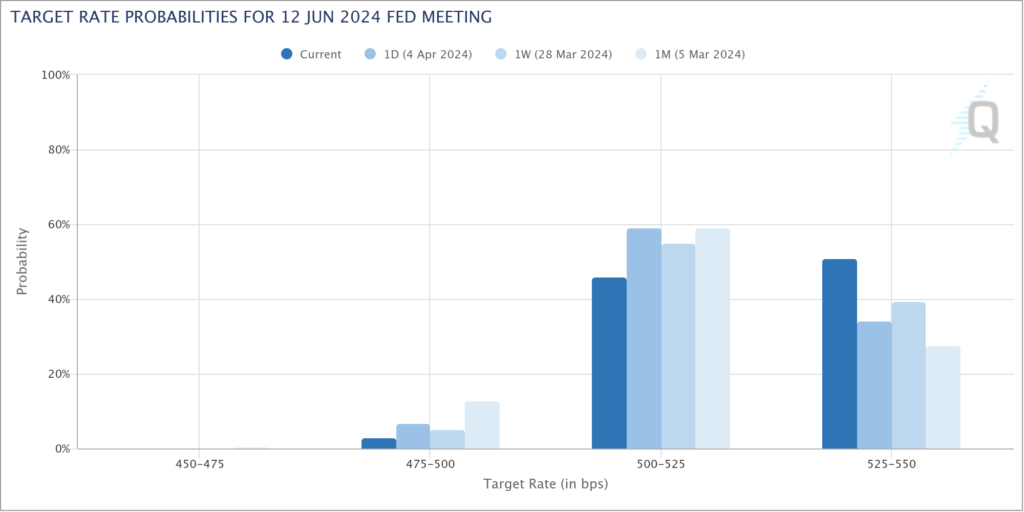

Due to the strong March Jobs Report, the odds of a Fed pause in June increased to 51% from 34% yesterday. The longer the Fed pauses at this level, the more likely high rates push the economy into recession (see “Fed Rate Hiking Cycles And Recessions: A History Lesson”, Thursday April 4). There are only two Fed meetings after June 12 before the Presidential Election on Tuesday November 5. While the Fed claims not to be influenced by politics, it doesn’t want to appear political. Therefore, some analysts think they will pause on July 31 and September 18, increasing the importance of their June decision. The next important data point bearing on the Fed is the March CPI next Wednesday (April 10) at 8:30am EST.

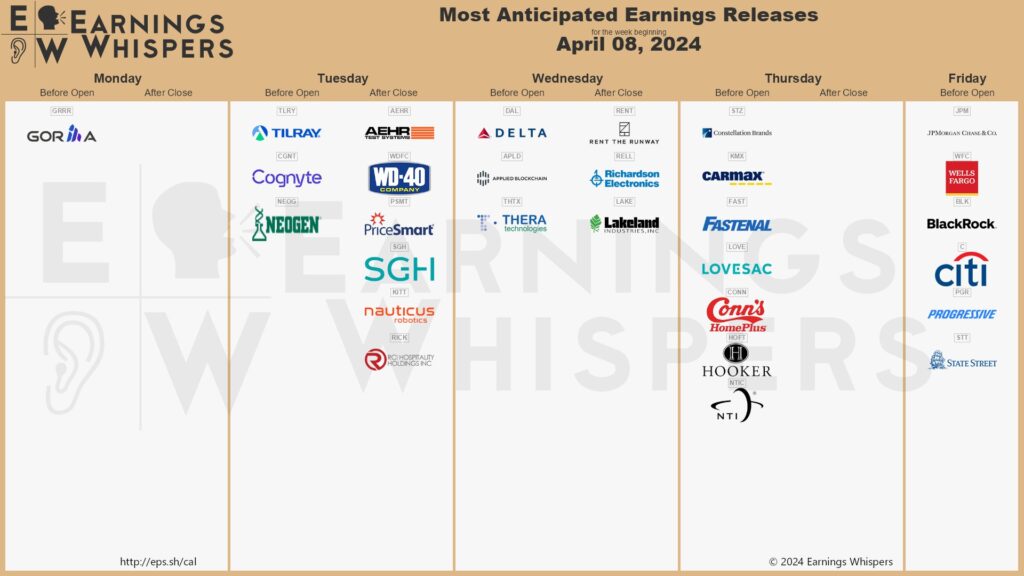

Lastly, 1Q24 earnings season gets underway next Friday (April 12) with three of the big commercial banks. Things really get going the following week.