Inflation, The End of the Bond Bull Market and The Second Great Depression

For the first time in 40 years we have real inflation in the US and the implications are enormous. It means the end of the 40 year bond bull market, a stock market crash and The Second Great Depression.

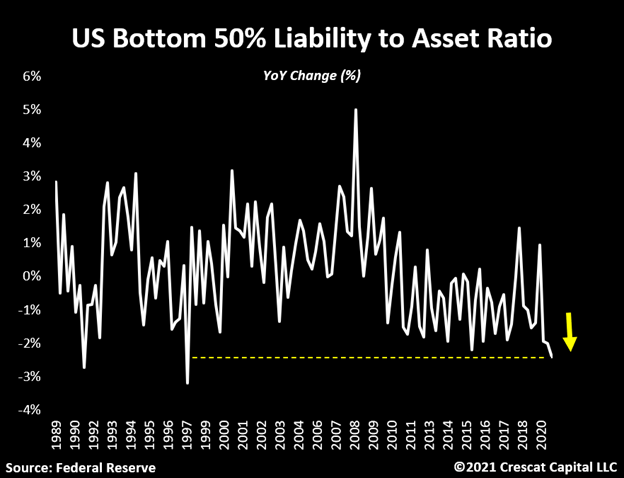

In their May Research Letter, Crescat Capital nicely outlined “The 3 Pillars of Inflation”. The first pillar is what they call demand pull. Due to all the fiscal stimulus since COVID, the balance sheets of the bottom 50% are in great shape: “The total liability to asset ratio for the lower class is not only in a long-term downward trend, but it is now at its best condition in almost two decades”. All this money in their pockets will drive spending creating inflation from the demand side.

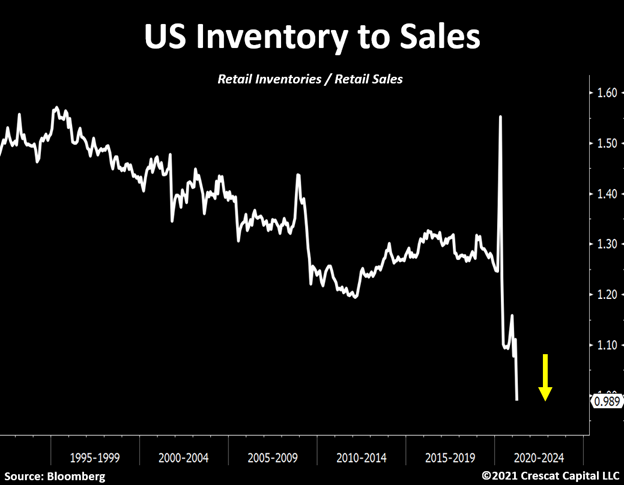

The second pillar of inflation is what Crescat calls cost push. All of this demand is putting stress on the supply chain resulting in bottlenecks and raw material inflation for businesses. As I have recently written about, businesses such as Federal Express, Carmax and Nike are having trouble meeting the demand for their products and services. The retail inventory to sales ratio is at record lows.

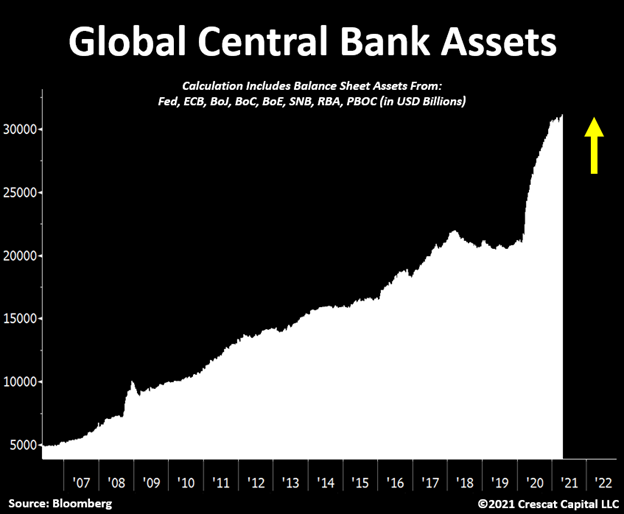

The third pillar of inflation Crescat calls monetary debasement. As we all know, global central banks have been creating money out of thin air to buy financial assets (called “Quantitative Easing”) since 2008 but that process has gone parabolic since COVID.

The combination of all this fiscal and monetary stimulus is turbocharging what Keynes called aggregate demand. All that demand is putting tremendous stress on the global supply chain resulting in bottlenecks and raw material inflation. The inflation we are now experiencing is not transitory and it’s going to get worse.

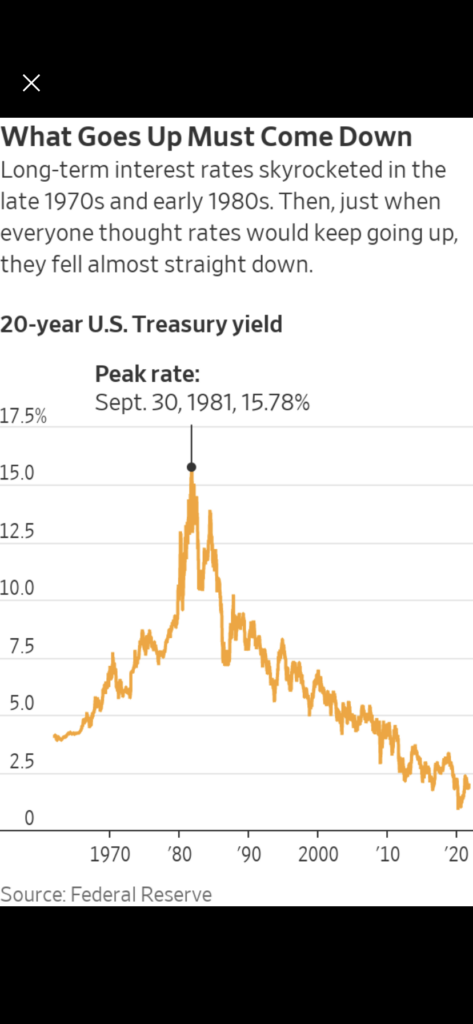

It’s Economics 101 that interest rates incorporate a component for inflation. That’s because it makes no sense to lend money at a rate lower than inflation. Doing so would mean a negative real return. Therefore, all this inflation will cause interest rates to rise, ending the 40 year bond bull market.

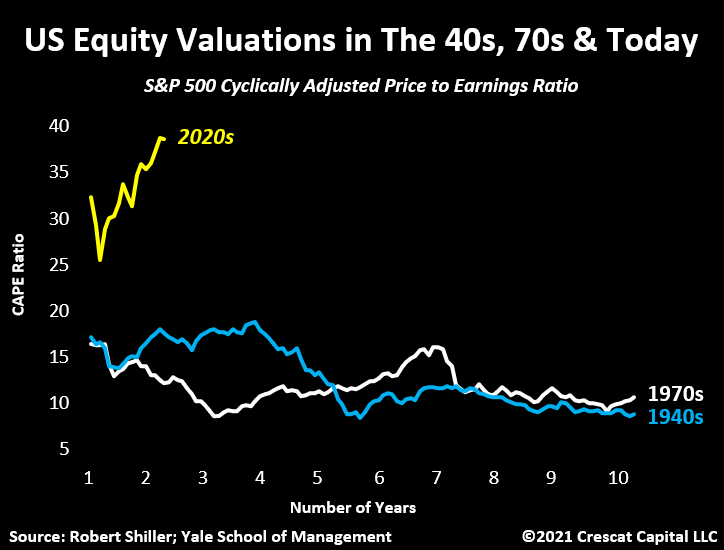

Interest rates are a big deal for stocks because they effect intrinsic values through the discount rate used to value future earnings. The higher the discount rate, the lower the present value of future earnings. This especially hurts growth stocks, like technology, where a lot of the value lies in future earnings. Combine rising interest rates with record high valuations and you have the recipe for a stock market crash.

Like in 1929, the stock market crash will infect the real economy leading to The Second Great Depression. Given the “financialization” of our economy, that is the growing size of financial markets relative to the real economy, the contagion is unavoidable.