Inflation And Reopening Take A Bite Out Of CHWY

Online pet retailer Chewy (CHWY) reported 4Q21 earnings after the close Tuesday. In this blog, I’m going to analyze those results because I think they shed light on some important macro trends.

The first macro trend is economic reopening. During the pandemic – with people working from home – many people adopted pets and CHWY’s business boomed. CHWY’s revenue increased 47% in 2020. However – as the economy reopens – that trend is reversing. CHWY’s revenue growth slowed to 24% to in 2021 and they guided 2022 revenue growth to 15%-17%.

The second macro trend is inflation. CHWY’s gross margin was above 27% for 4Q20 through 2Q21. However that fell to 25.4% in 4Q21. CHWY’s adjusted EBITDA margin got hit even harder. It peaked at 3.6% in 1Q21 but fell off dramatically in 4Q21 to -1.2%. That’s the first time CHWY lost money on that basis since 4Q19.

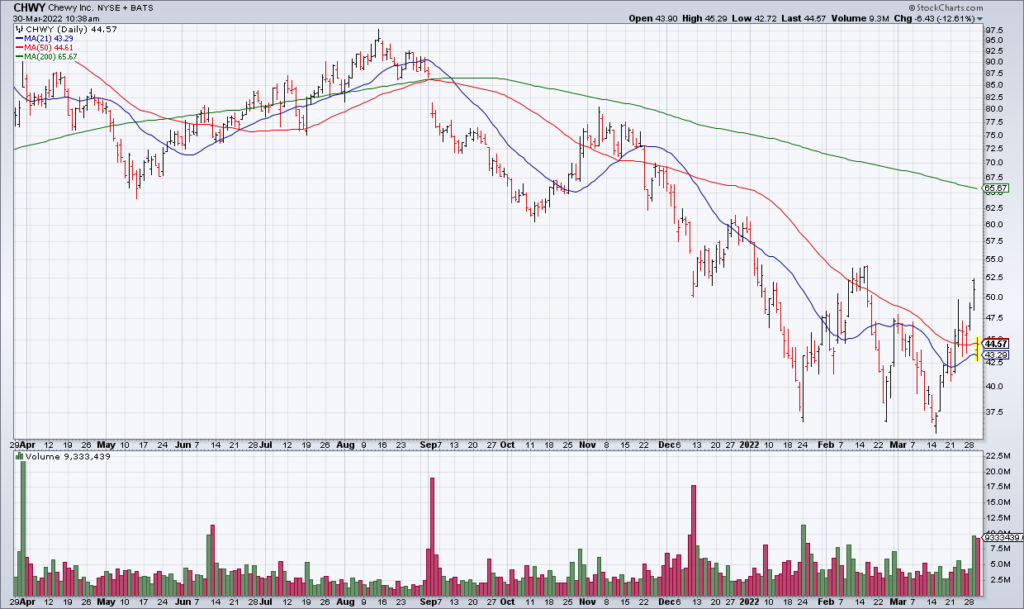

I want to be clear that I’m not picking on CHWY. I think the pet business is a secular growth story as young people are staying single longer and having less kids. In effect, they are substituting pets for children. But near term, CHWY is facing macro headwinds from economic reopening and inflation. In addition, rising interest rates hurt CHWY because it is an early stage growth company whose intrinsic value is entirely in future earnings. As I’ve discussed many times, higher interest rates increase the discount rate used to value future earnings, decreasing their present value. As a result of these macro headwinds, CHWY’s business is getting hit and its stock is down 13% today at the moment.