Impressive Breadth, Seasonality, TSLA, Monetary + Fiscal Policy = Supply Bottlenecks & Massive Inflation, CLF & MOS Earnings

Monday’s trading session was bullish and the trend remains up regardless of the fundamentals. The most positive development was the broadening out of market strength. Last week was all about mega cap tech pulling up a thin market. Today the mega caps took a break while smaller stocks rallied.

For example, the S&P 100 ETF (OEF) was actually marginally down (-0.01%) while the S&P Equal Weight ETF (RSP) had a strong day (+0.80%). The Russell 2000 (ETF: IWM) was the star, up 2.59%. As a result, breadth was impressive with 5,988 advancers versus 1,988 decliners on the NYSE + NASDAQ.

While I got shaken out of my “trading sardines” during the intraday reversal from about 1:15pm to 2:15pm EST, the market rallied hard to finish the session and I won’t hesitate to get back in at tomorrow’s open if the market doesn’t gap up too much.

Seasonality, Seasonality, Seasonality: I don’t know if I can take hearing anymore about how positive seasonality is from now through year end. Nevertheless, it is and everybody knows it and is positioning accordingly.

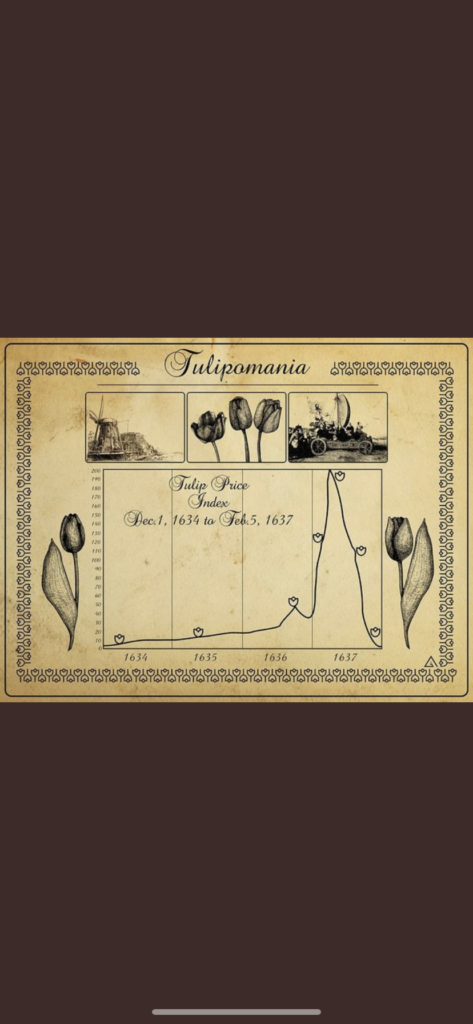

The action in Tesla (TSLA) continues to be insane with the stock up another 8.49% on almost 3x average volume Monday. The stock is +33% the last six sessions, adding $336 billion in market cap over that span. The catalyst was news last Monday morning that Hertz was buying 100k Teslas for $4.2 billion but it turns out there isn’t even a signed contract! It’s one thing for a small cap to go up that much that fast. It’s unprecedented for a $1+ trillion company to do so. Obviously this is a bubble and will end badly – but nobody knows when.

The combination of all this fiscal and monetary stimulus is turbocharging what Keynes called aggregate demand. All that demand is putting tremendous stress on the global supply chain resulting in bottlenecks and raw material inflation. The inflation we are now experiencing is not transitory and it’s going to get worse – “Inflation, The End of the Bond Bull Market and The Second Great Depression”, Top Gun Financial, October 4, 2021

While it’s all fun and games in the stock market at the moment, a storm is brewing in the real economy that will eventually topple it. The side effects of the massive amounts of monetary and fiscal stimulus the government has injected into financial markets and the economy are just starting to show themselves in the form of supply chain bottlenecks and inflation.

I believe that early next year they will start wreaking havoc with corporate earnings via demand destruction for discretionary items as consumers get squeezed by rising prices for necessities as well as margin compression for companies without pricing power. In my opinion, the market has no idea of the earnings recession that is just over the horizon. (On top of that, I recently discussed how rising interest rates will hit stock valuations as well in “Inflation, The End of the Bond Bull Market and The Second Great Depression” (10/4)).

That inflation is ripping is evident in the earnings results of commodity producers. A couple weeks ago, steel maker Cleveland Cliffs (CLF) reported a ridiculous quarter: Revenues are anticipated to be up more than ten times to $21 billion in 2021 compared to $2 billion in 2019.

This afternoon fertilizer producer Mosaic (MOS) reported a tremendous quarter as well as demand for agricultural commodities explodes: 3Q results were the strongest in more than a decade said CEO Joc O’Rourke.

For now, the stock market is a party reminiscent of 1929 and 2000. But we all know what the hangover was like.