High On Pot Stocks, Penny Stock Volume Explodes, Russell 40% Above Its 200 DMA, TWTR LYFT Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

While Monday was all about Tesla (TSLA) buying Bitcoin causing it to surge to new highs, Tuesday was a slow day for the major indexes (S&P -0.11% NASDAQ +0.14% Russell +0.40%) but not for the marijuana stocks!

The leading marijuana stock ETF, the ETFMG Alernative Harvest ETF (MJ), was +13.42% on the day on 3x average three month volume. It has now essentially tripled in three months.

The moves in some of the individual names are even more extreme. Tilray (TLRY) was +40.74% yesterday on 4.5x average three month volume. It is up 413% YTD. Aphria (APHA) was +25.13% on 3.5x average 3 month volume and is +337% YTD.

While volume in the major ETFs (SPY, QQQ, IWM) was anemic Tuesday, penny stock volume exploded.

The leading Russell 2000 index of small cap stocks is now about 40% above its 200 DMA – the most extended in its history. Sometimes you see this level of technical extension for individual stocks but I’ve never seen it for a major index.

Kiddie Technician Ian McMillan was pumped writing: “They will write about this in the history books one day for future generations to study the greatness we are witnessing.”

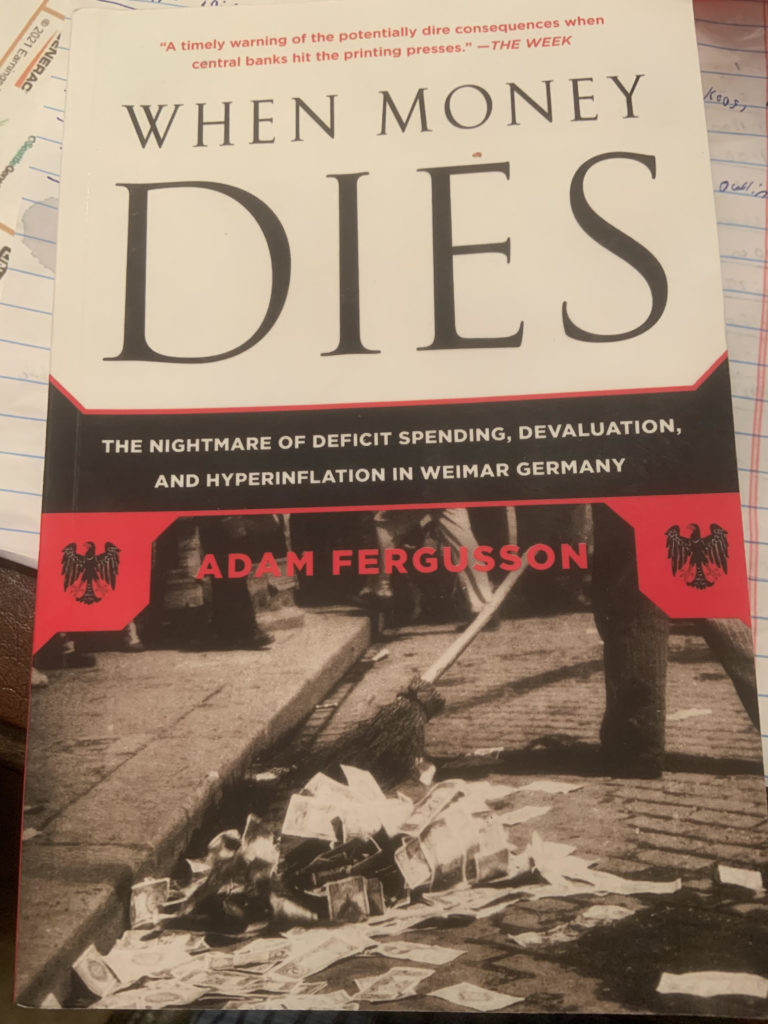

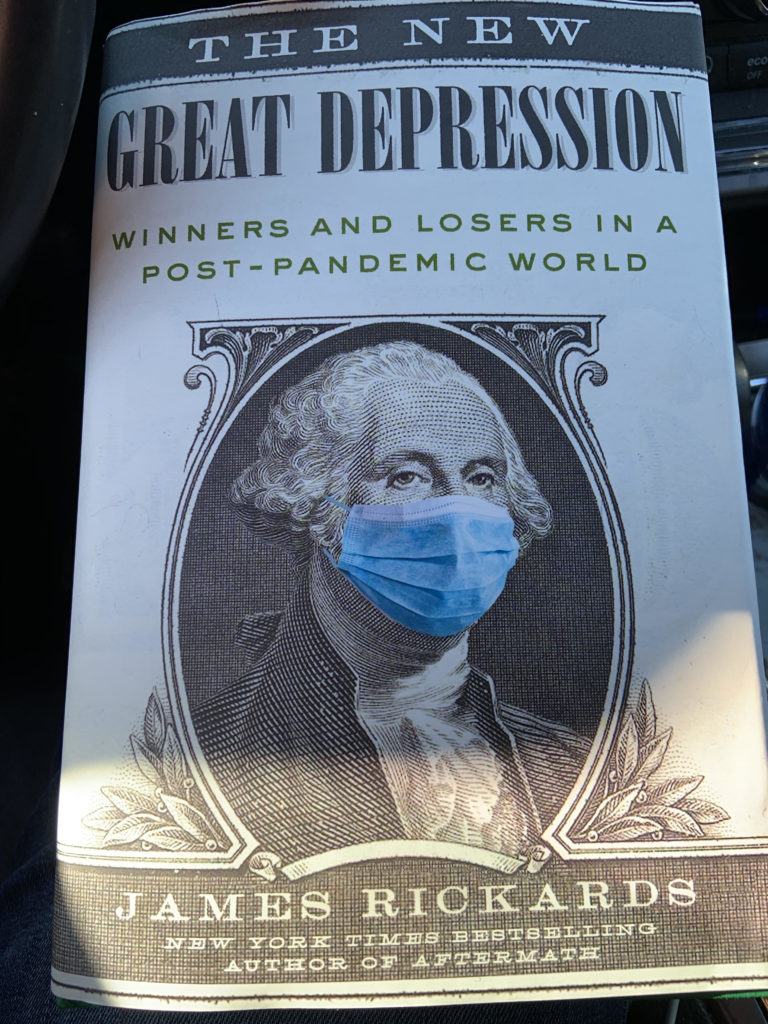

Books will be written about what’s happening right now but the exact opposite ones the kid thinks.

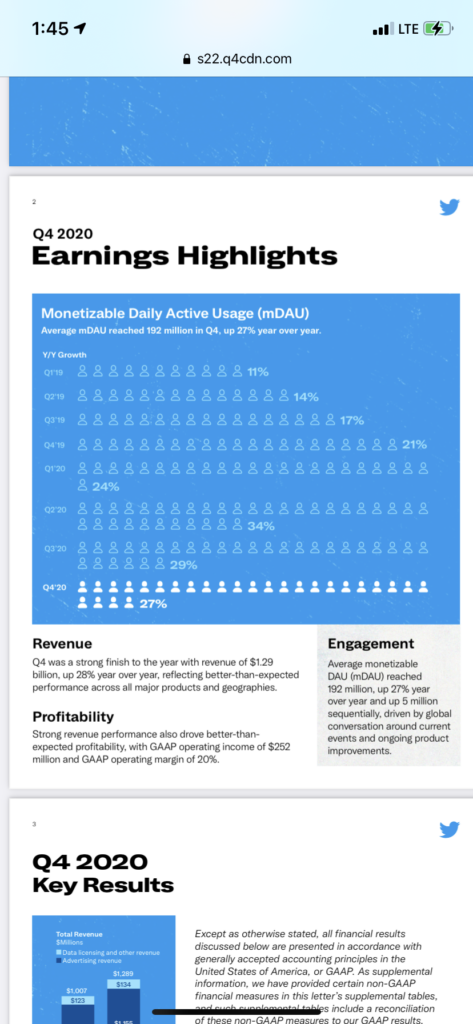

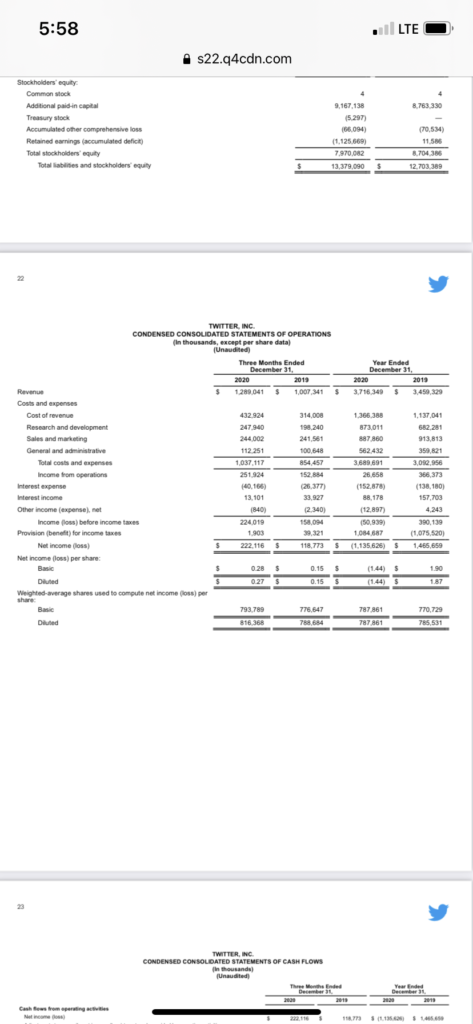

Before concluding, let’s reconnect with reality and review Twitter (TWTR) and Lyft (LYFT) 4Q earnings reports. Starting with TWTR, it reported a stellar quarter with mDAUs +27%, Revenue +28% and Net Income +87%. While already trading at 7 year highs, shares are up more than 7% in the premarket.

The problem with TWTR is valuation. Even if use enterprise value (EV) instead of market cap to give it credit for its $4 billion net cash position and cherry pick quarters using this blowout 4Q20 and the first three quarters of 2019 which were not impacted by the pandemic like the first three of 2020 were, EV to Adjusted Diluted EPS is 115x and EV to Sales 11x at yesterday’s closing price.

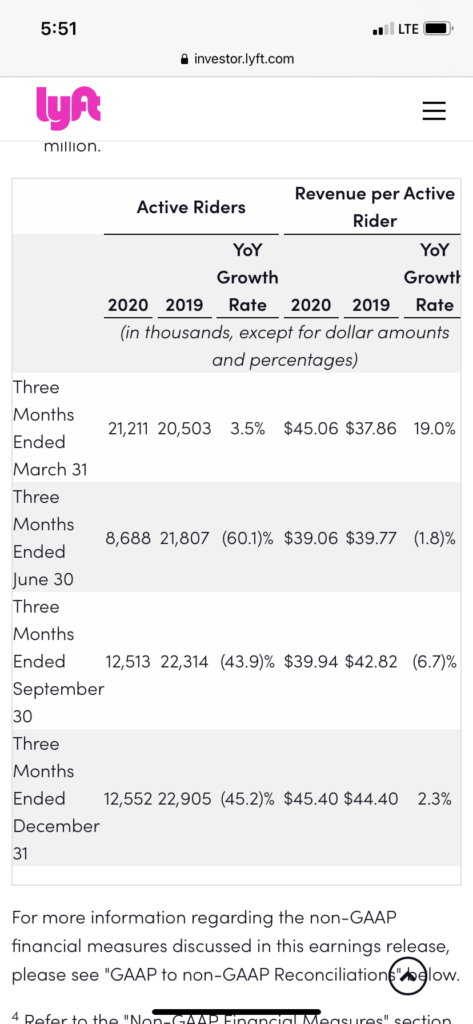

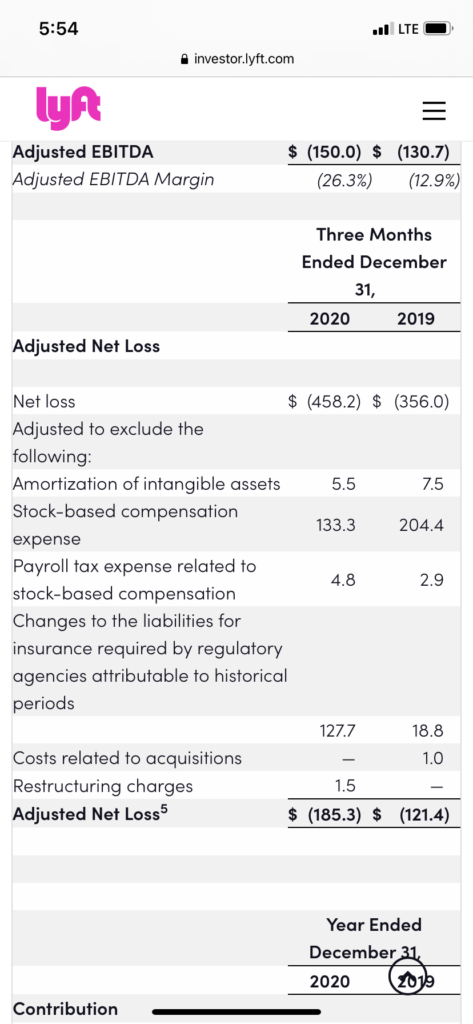

LYFT is in a different category of stocks from the tech and internet companies with great fundamentals but extreme valuations. It’s in the category of brick and mortar, reopen stocks with horrible fundamentals and extreme valuations! Active Riders were -45.2% in 4Q20 while Adjusted Net Loss swelled to $185 million from $121 million a year ago. Not a problem! CFO Brian Roberts was quoted in the press release as saying “we should experience a growth inflection beginning in the second quarter that strengthens in the second half of the year”. If you say so! Shares are up more than 11% in the premarket representing the “triumph of hope over experience”.