Gleaning Macro Insights From Earnings Reports: CPB and Inflation, PLAY and Economic Reopening, GME and The Reddit Army, May CPI

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Those of you who follow me know that I dig into a lot more earnings reports than a typical investment advisor. There are two reasons for this. First, the more stocks I know, the more options in my investment universe. Second, earnings reports frequently give me insight into the macro economy. Tonight, I’m going to analyze three recent earnings reports for the macro insights they reveal.

Let’s start with Campbell Soup (CPB) for the insight it provides into inflation and pandemic beneficiary stocks. Let’s start with the latter theme. CPB was a pandemic beneficiary. That is, during the pandemic consumers stocked up on Campbell’s packaged food products as restaurants closed their doors and consumers ate at home. As a result, CPB’s organic sales for their 1Q20 ended April 26, 2020 were +17%. However, with the pandemic waning and restaurants reopening, that benefit has turned into a headwind as CPB’s organic sales were -12% in the 1Q21 ended May 2, 2021. More broadly, stocks like Clorox (CLX) and Zoom (ZM) who benefitted from the pandemic are seeing the reverse as the economy reopens.

The other macro theme evident in CPB’s 1Q21 report was inflation. This is can best be seen in CPB’s Adjusted Gross Margin which decreased from 34.7% a year ago to 31.8%. Gross Margin is revenue minus Cost of Goods Sold which takes into account all of the costs, material, labor, etc.. that go into the actual production of a good. It does not include things like rent and salaries for corporate and administrative employees; only costs directly associated with the manufacturing of the product. Therefore, it is a pure measure of the cost of making things. The 2.9% decrease in Adjusted Gross Margin was the result of increases in the cost of everything from food ingredients, labor, freight and steel for soup cans (“Campbell Gets Scalded By Inflation” [SUBSCRIPTION REQUIRED], Aaron Back, WSJ, Thursday June 10).

Let’s move on now to Dave & Busters (PLAY) which is essentially an arcade with restaurant for adults. As a result, it is a very pure economic reopening play. PLAY helpfully reported comps compared with 2019 to give us an idea of how business is doing compared to prior to the pandemic. What they showed is that things are rapidly improving. In February, comps were -59% compared to 2019; -31% in March; and -12% in April. For their 2Q, which includes May, June and July, they guided revenues to $335 million to $350 million which is similar to the $345 million they reported in 2019. In other words for PLAY, and there’s no reason not to think something similar applies to similar types of businesses, things are now about all the way back to pre-pandemic levels. The economic reopening is upon us.

Last, let’s turn to Gamestop (GME), the favorite of Reddit’s WallStreetBets forum. GME reported Revenue +25% and a Adjusted Diluted Loss of 45 cents/share. That was not good enough for the wildly inflated stock which sold off 27.16% Thursday on 2x average volume. This will likely “put a lid on GME for a bit” the great technician Scott Redler tweeted.

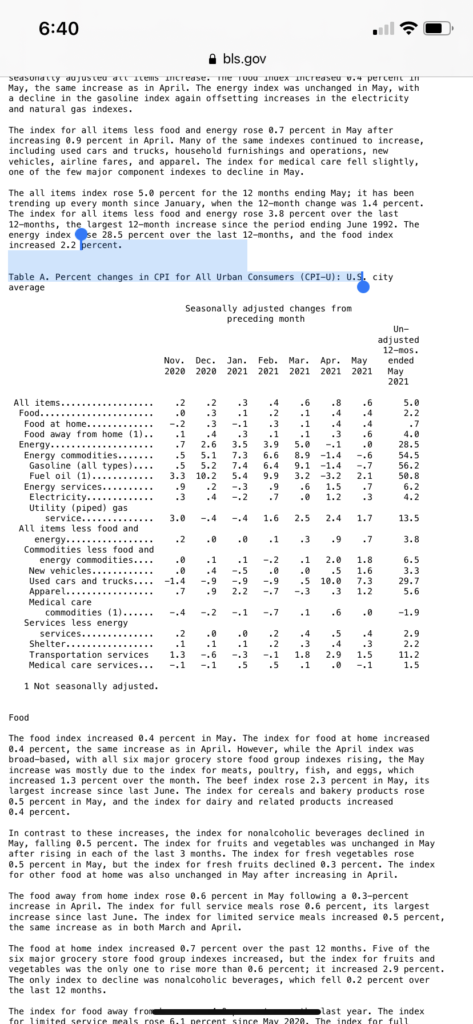

Lastly, I want to mention the May Consumer Price Index (CPI) Report which came out Thursday morning at 5:30am PST. Total inflation was +5.0% compared to a year ago and +0.6% in May. Core CPI, which excludes food and energy, was +3.8% compared to a year ago and +0.7% in May. The claim that inflation is transitory took a hit. The precious metals responded with GDX +2.50%, GDXJ +3.11%, SIL +2.82% and SILJ +3.39%. This is the very early stages of a big move in the precious metals and their miners IMO. It is by no means too late to get in.