First Republic On The Brink

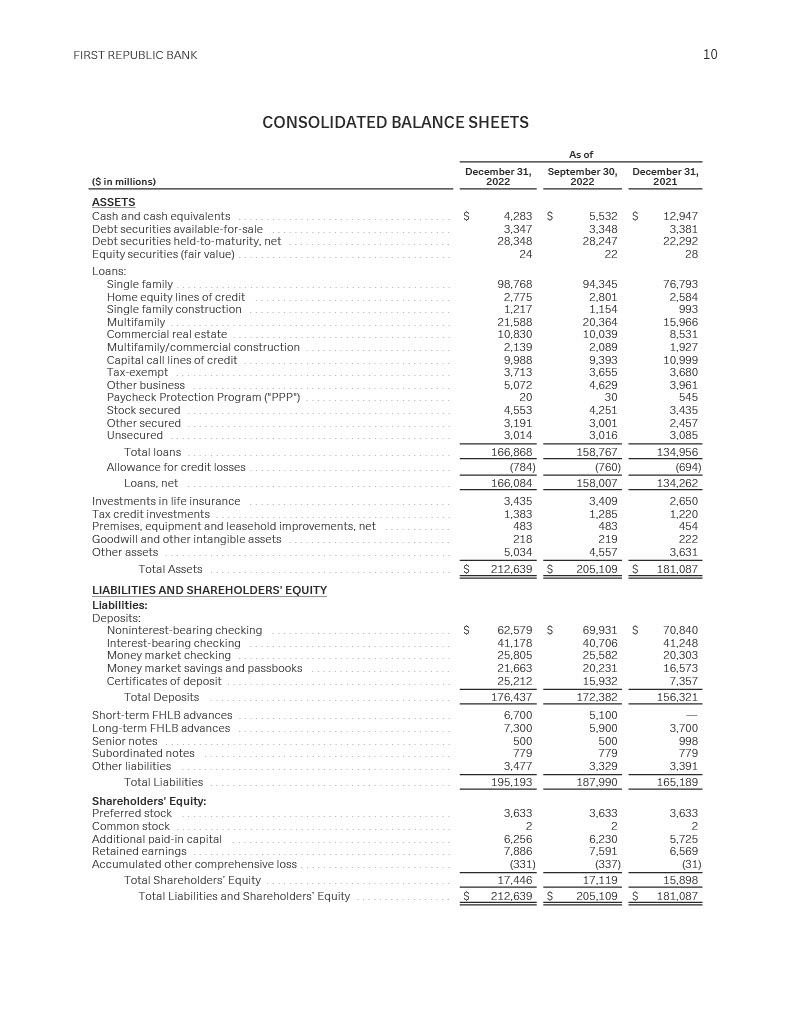

I have no doubt that First Republic (FRC) is a superior bank. At the same time, any bank under a fractional reserve model is subject to a loss of confidence by its depositors resulting in a bank run. And an article on the front page of today’s WSJ suggests that FRC is on the brink of being unable to meet redemptions – despite a $30 billion infusion by the country’s largest banks on Friday. According to the article (“First Republic Looms Large For Regulators” [SUBSCRIPTION REQUIRED], Monday March 20, A1), customers have pulled about $70 billion in deposits since the crisis originating at Silicon Valley Bank. At the top of this blog is FRC’s Balance Sheet as of 4Q22. As you can see, at that time they had $176.4 billion in deposits. In other words, customers have pulled about 40% of FRC’s deposits during the crisis. Simply put: If that continues, FRC cannot survive.