Extreme Speculative Behavior and Valuation, Historic Insider Selling, PG As A Contrarian Play

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

The single most dependable feature of the late stages of the great bubbles of history has been really crazy investor behavior, especially on the part of individuals – Jeremy Grantham, “Waiting For The Last Dance”, January 5, 2021

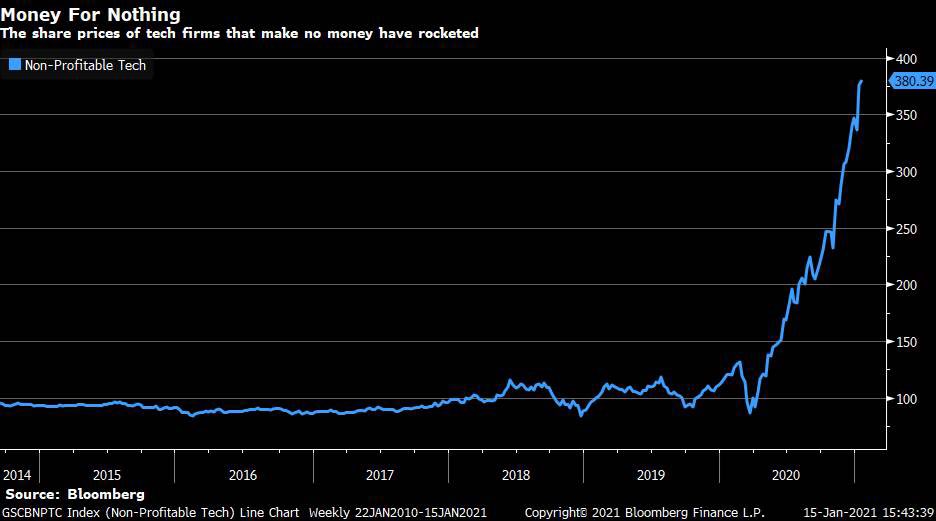

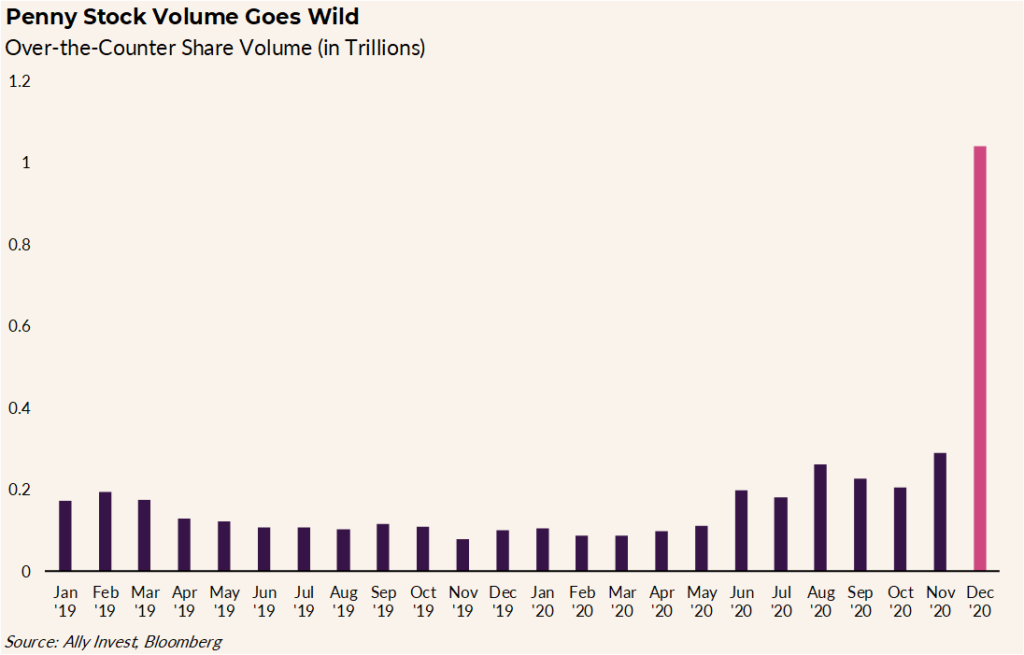

Individual investors are going crazy Jeremy Grantham. An index of unprofitable tech stocks has surged almost 300% since March after being flat for at least six years and are also wading into penny stocks like never before with penny stock volume exceeding 1 trillion shares in December 2020 (Chart Sources: Callum Thomas Twitter, January 23, 2021).

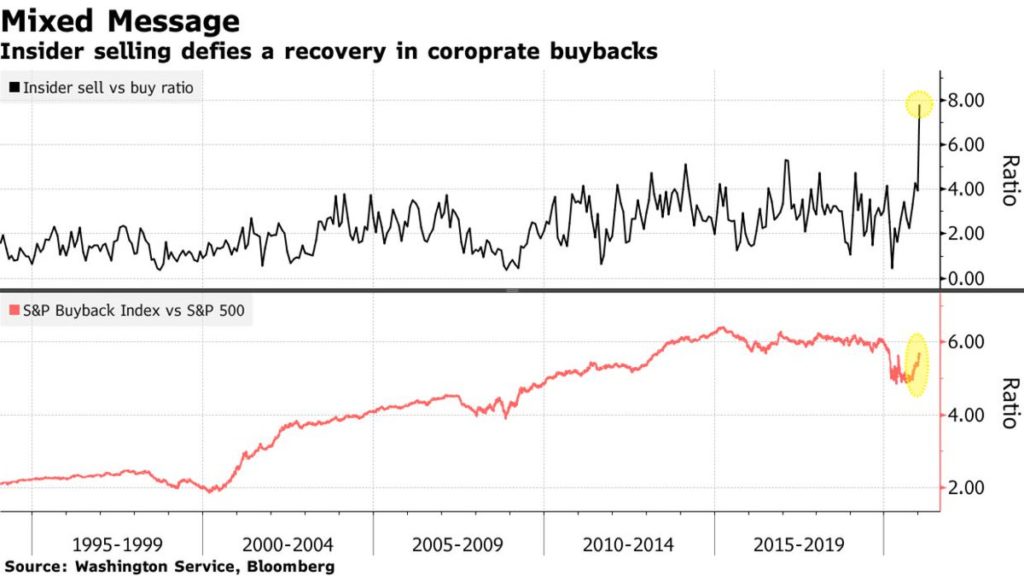

While individual investors, in general the least informed of investors or “the dumb money”, are wading into the most speculative areas of the market, corporate insiders for S&P companies, those who know the most about their companies and generally considered “the smart money”, are selling shares at the highest ratio in at least 25 years (Chart Source: Callum Thomas Twitter, January 23, 2021).

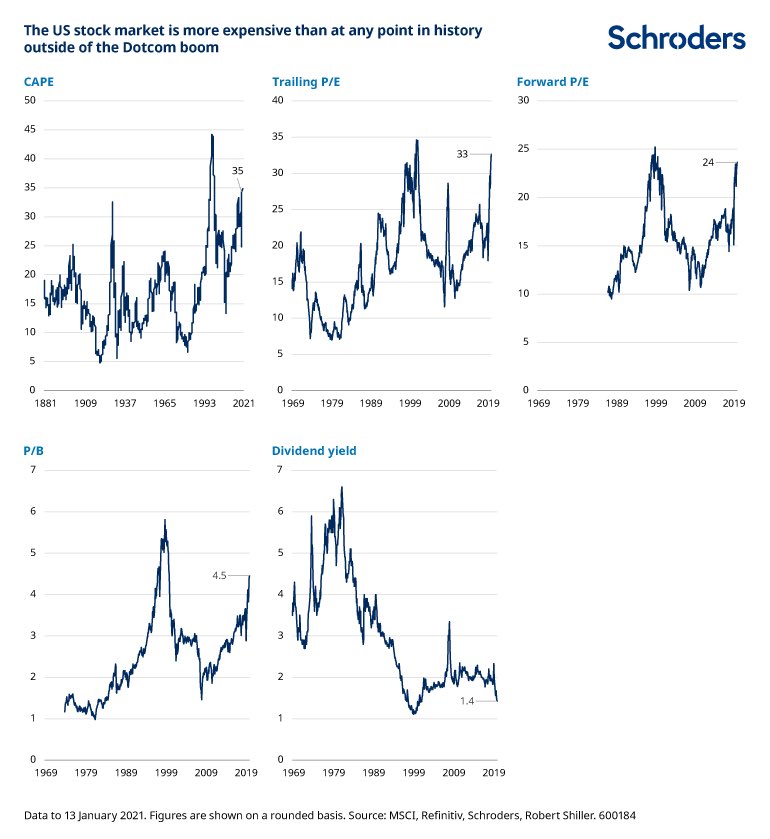

Meanwhile valuations are the highest they’ve been since the peak of the Dot Com Bubble (Chart Source: Callum Thomas Twitter, January 23, 2021).

I’ve covered this stuff ad nauseum but I continue to hammer it home: This is a massive bubble. When you buy 90% of stocks now, you are paying prices that have an expected negative long term return. You’re simply playing The Greater Fool Theory: Buying high in the hopes of selling even higher to a greater fool before the music stops. I don’t have a problem with anyone who does that – as long as they understand what they are doing. Otherwise, if you believe these prices fairly reflect corporate fundamentals, you’re likely to be the one holding the bag when the music does stop. And it will stop, most likely soon.

Note that I said 90% of stocks. You can still find value. You just have to look very hard. Top Gun owns 5 stocks and 4 precious metal miner ETFs for clients right now. I’m looking for defensive stocks that sell “necessities” for which demand is “inelastic”. That is, the stuff that people buy in good times and bad – because bad times are coming once this bubble pops. And, as always, I’m looking for higher quality companies at a fair price (It’s better to buy a wonderful company at a fair price than a fair company at a wonderful price – Warren Buffett, 1989 Letter to Shareholders).

The definition of defensive and high quality is Procter & Gamble (PG, market capitalization $340 billion). Their portfolio of brands like Tide, Crest, Old Spice and Gillette is unparalleled. Not only are these brands the leaders in their categories, they are all “necessities”: laundry detergent, toothpaste, anti-perspirant and razors/shaving cream. The problem with PG historically has always been valuation. It almost always trades at a significant premium to its peers.

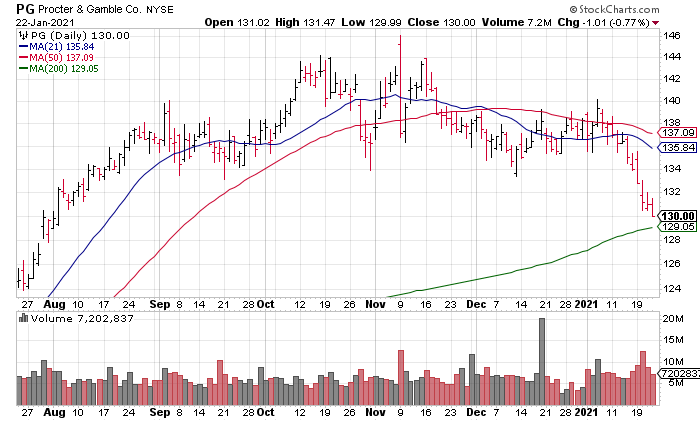

However, as investors lose interest in boring stocks like PG as they move into the more speculative areas of the market, they have sold off PG shares hard during the first three weeks of 2021.

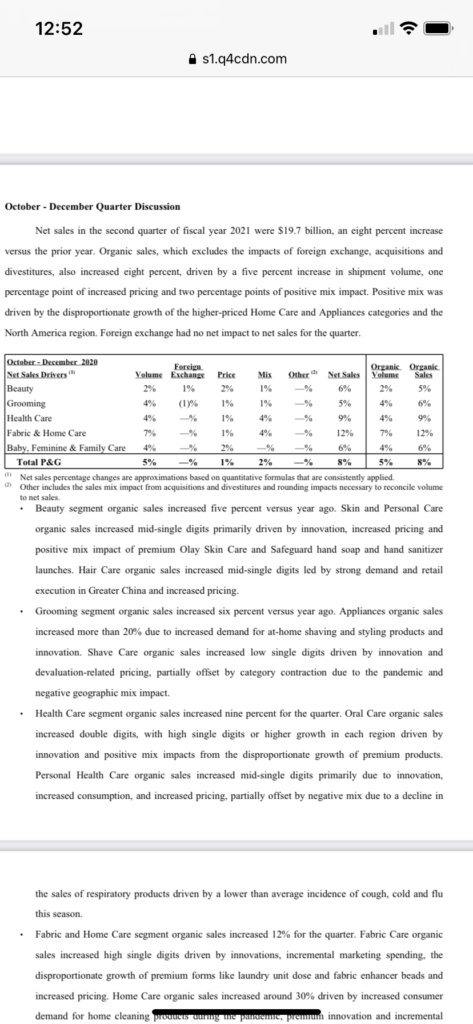

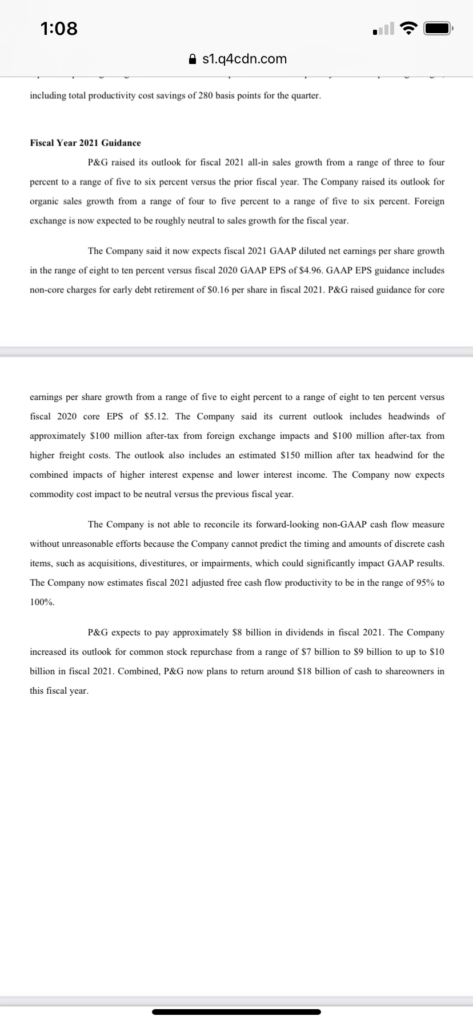

This has created an opportunity for contrarian, value conscious investors like myself to pick up one of the best companies in the world at a reasonable price. PG reported earnings last Wednesday and their fundamentals are stellar. Organic Sales were +8% leading to a 15% increase in Core EPS to $1.64. They also raised fiscal year 2021 Core EPS guidance from a 5-8% increase from fiscal year 2020 Core EPS of $5.12 to an 8-10% increase. At the midpoint that works out to $5.58 giving PG a 23x forward multiple ($130 Friday 1/22 Closing Price / $5.58 = 23x). PG also pays a 2.43% dividend.

While 23x is by no means cheap, that’s about as cheap as you’re going to get PG, especially in this market. In addition, the stock is only about $1 above its 200 DMA which may act as support and thus represent a good entry. I’ll be watching the stock closely this week for an opportunity to pick up shares.