DOCU Disaster: Catch This Falling Knife

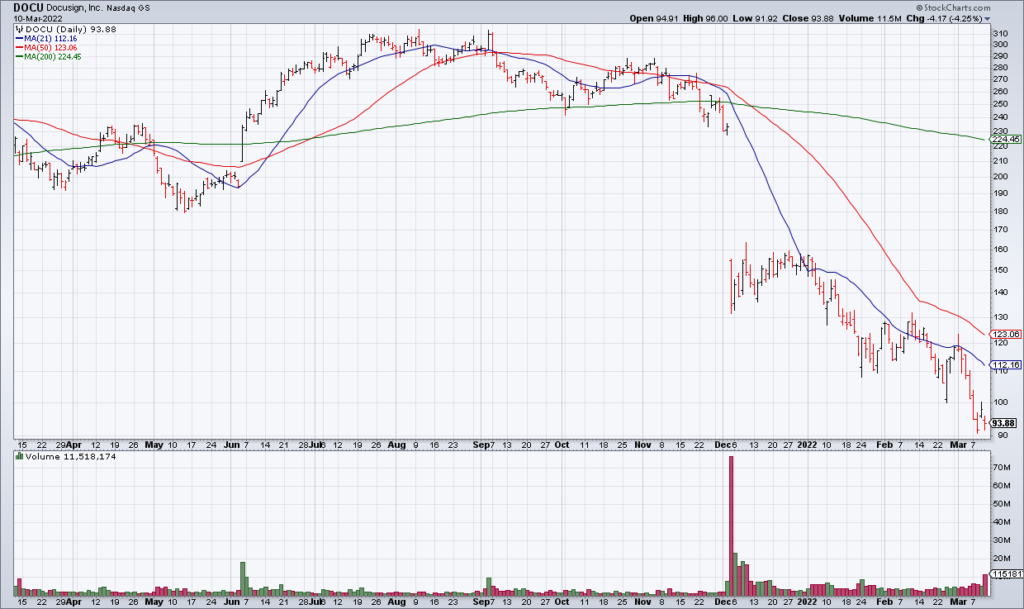

There are a lot of poorly performing stocks since the November 22 top in the NASDAQ but few can compete with Docusign (DOCU). DOCU lost almost half its value after its previous earnings report in December and is poised to lose another 20% this morning after its most recent. Even Ark’s Cathie Wood – well known to double down on her positions into big selloffs – bailed on DOCU in January. With all the bad news priced in and no one left to sell, however, it’s time to catch this falling knife.

Thursday afternoon DOCU reported 4Q21 earnings and provided guidance for 2022. 4Q21 revenue of $581 million was +35% and EPS of 47 cents +30% compared to a year ago. The problem is guidance. DOCU guided 2022 revenue to $2,470 million to $2,482 million which represents only 17.5% growth at the midpoint. Worse, it guided operating margin to 16%-18% compared to 20% in 2021 which means that EPS will essentially be flat year over year at the midpoint. When a high flying growth company forecasts no earnings growth that’s a problem.

Nevertheless, the shift to ecommerce is in secular growth and DOCU’s cloud contract software figures to be as well. We’ve all probably signed a lease or contract using Docusign by now and it seems inevitable that this will become more and more common. Yes: DOCU was a pandemic beneficiary and business was certainly pulled forward. But it’s also a secular growth story. At 6x forward revenue and 40x forward EPS, DOCU is now attractively valued for the long term.

The Wall Street cliche is to never catch a falling knife. That’s fine because DOCU isn’t a falling a knife; it’s a falling piano.