DIS Bites The Dust, Inflation Is Out Of Control

Stocks had their worst day in recent memory Wednesday with the S&P -0.82%, the NASDAQ -1.66% and the Russell -1.55%. The red ink may not let up tomorrow as Disney (DIS) – another one of the 25 most important stocks in the market – reported disappointing earnings after the close.

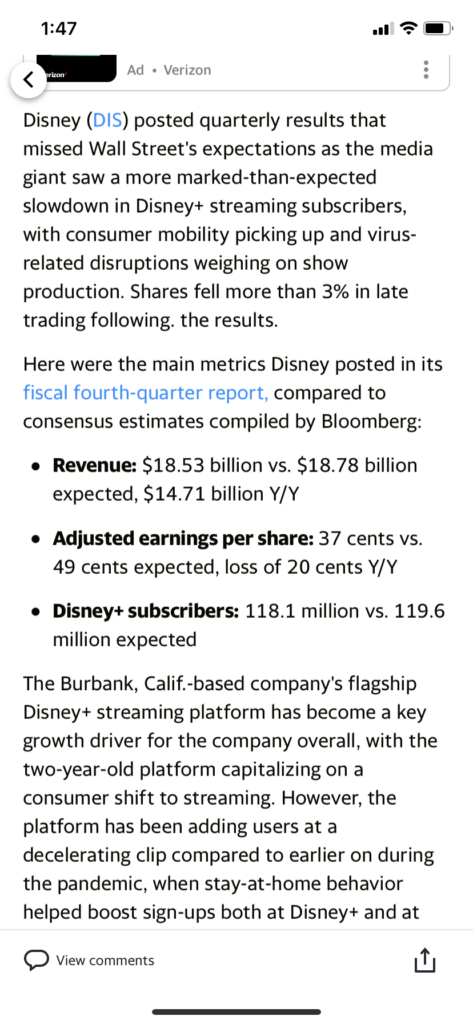

As you can see in the excerpt above, DIS missed estimates on just about every metric: Revenue, EPS and Disney+ subscribers. As a result, its stock is currently down 4.5% in the after hours to $166.50. As you can see in the chart above, DIS has only closed below $167.50 once since early December 2020 – and it bounced hard the next day. If DIS can’t hold $167.50 tomorrow, all its gains since early December 2020 will be wiped out.

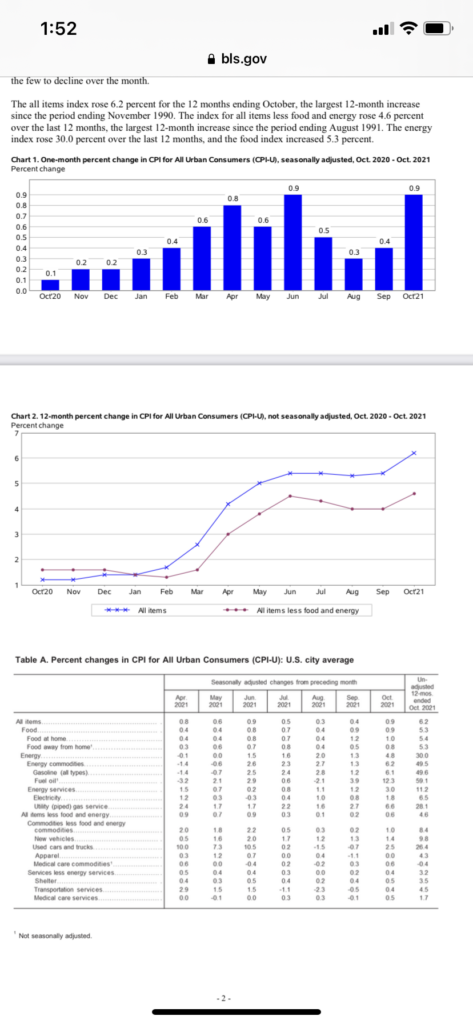

The main catalyst for Wednesday’s nasty selloff was a much hotter than expected October CPI number. Headline inflation increased 0.9% in October and 6.2% from a year ago. 0.9% annualized works out to 11.4% – and the CPI massively understates inflation. In other words, inflation is out of control and the Fed is way behind the curve.

The obvious investment for inflation is the precious metals because of their history as money. They tend to go up in dollar terms as inflation eats away at the dollar’s purchasing power. The Van Eck Gold Miners ETF (GDX) surged 1.77% Wednesday to close right on its 200 DMA. Expect it to breakout from that level soon and keep moving higher. The largest positions by far in Top Gun client accounts are the precious metals miners ETFs GDX, GDXJ, SIL and SILJ.