“Digestion” Week, 10 Year Yield Jumps 15 Basis Points, Bitcoin $55k, Micro Cap Insanity

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

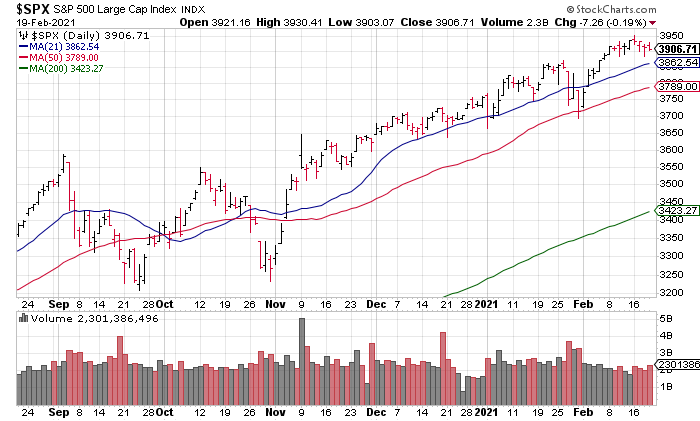

Friday February 19, 2021 marked the one year anniversary of the pre-coronavirus peak. After peaking at 3,386 on February 19, 2020, the awakening to the coronavirus pandemic sent the S&P down 34% in a one month period to 2,370 on March 23, 2020. Incredibly, in the midst of the worst pandemic since The Spanish Flu 100 years ago, the S&P closed yesterday 15% higher than the year ago peak.

Getting more micro, last week was what the great short term trader and technician Scott Redler characterized as a “digestion” week. The S&P dropped 0.71% but no technical damage was does. The market was essentially “digesting” its previous gains and, presumptively since the trend is up, setting the stage for the next move higher.

However, Arthur Hill pointed out a divergence beneath the surface of the QQQ yesterday. While the QQQ has moved higher in 2021, participation has decreased as represented by the number of components above their 50 DMAs. Currently at 69%, a move below 50% would likely signal the onset of a major correction according to Hill (Arthur Hill, “A Medium-term Breadth Indicator Waves The Caution Flag”, February 19, 2021).

The biggest story of the week was the 15 basis point jump in yield on the 10 Year Treasury. While bullish for banks who borrow short and lend long and thus profit from the increasing spread between short and long term interest rates, rising interest rates are a negative overall for our highly indebted economy by increasing interest costs across governments, businesses and households. So while the XLF made All Time Highs last week, this is something that bears watching.

The second biggest story of the week was Bitcoin surging through $55k! It’s been an incredible move though professional traders like Scott Redler are taking some profits here.

The move in Bitcoin already shows you the speculative nature of the current environment but it doesn’t compare to the action in some of the micro cap stocks. The WSJ’s James Mackintosh wrote an article Friday that blew my mind (James Mackintosh, “Tiny-Company Boom Makes Markets Look Silly”, February 19, 2021 [SUBSCRIPTION REQUIRED]):

Stocks come and go, but every year a few tiny companies get promoted to the small-capitalization indexes. Some eventually make it all the way to the S&P 500.

What they don’t do is go in the space of 18 months from being a penny stock with a market value of $39 million to be worth more than a dozen S&P companies, yet, that is exactly what FuelCell Energy (FCEL) has done.

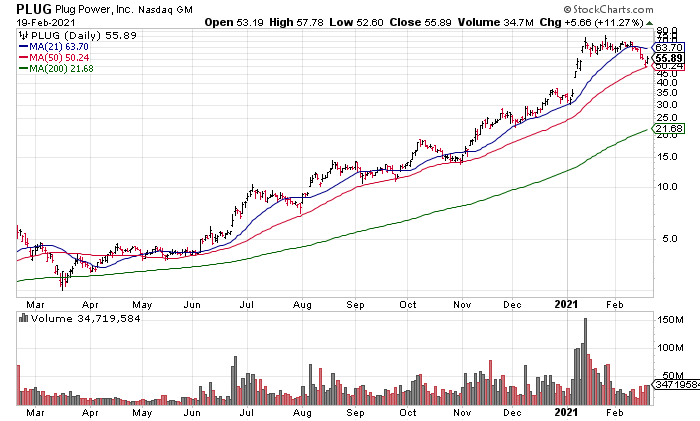

Plug Power (PLUG) [was] up 973% last year and another 48% this year to make the fuel cell developer big to be in the top half of the S&P, worth about the same as State Street Corp. or Kroger Co.

I just took a quick look at PLUG’s fundamentals and this move has nothing to do with them. With a current market cap around $34 billion, PLUG had revenues of $216 million for the first 9 months of 2020 and lost 4 cents/share pro forma in 3Q20 (Source: PLUG 3Q20 Letter To Shareholders).

Mackintosh names seven stocks that have made these insane moves of late and I can pretty much guarantee you that fundamentals play little role in the story of the rest of them either. I doubt we will ever see a market like this again.