Defense Stocks Are A Buy, Technical Weakness

You’d think defense stocks would have performed better given all the geopolitical conflict over the last two years. But – as Jon Sindreu wrote in his excellent column in this morning’s WSJ (“What Defense Shares Say About A More Violent World” [SUBSCRIPTION REQUIRED]) – investors still don’t seem convinced that we are entering a new period of heightened geopolitical risk. As Sindreu writes, shares are flashing amber not red. I think that’s a mistake and it creates a buying opportunity for those who think the same way.

Russia-Ukraine, Israel-Palestine, China-Taiwan. It seems clear the the world is becoming increasingly dangerous and the way to play that is by owning defense stocks. Lockheed Martin (LMT) reported a decent quarter this morning with revenue +2% and EPS -1%. They also reaffirmed their 2023 outlook including EPS of $27.00-$27.20. Shares are down marginally in the premarket and I’ll take the opportunity to add to my position. Northrop Grumman (NOC) – my other defense play – reports earnings next Thursday morning and I’ll add to it this morning as well.

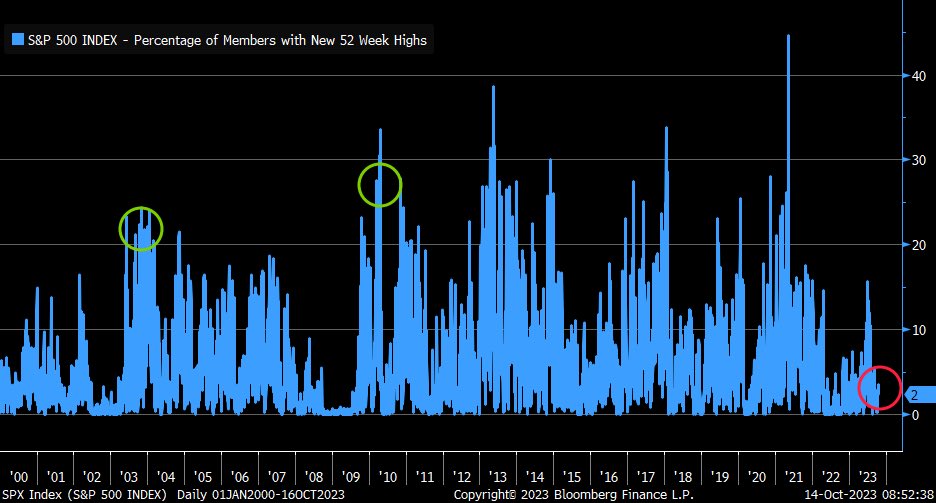

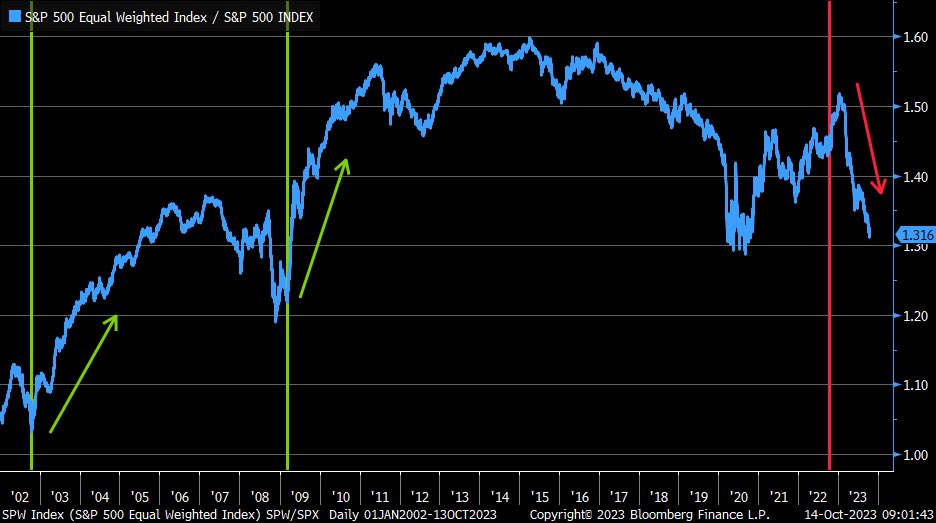

I’d certainly rather own defense stocks – and defensive stocks in general – than play offense. I’ve written extensively about my macro reasons for being bearish but technically the market is showing clear signs of weakness as well. Schwab’s Chief Investment Strategist Liz Ann Sonders tweeted some excellent charts yesterday morning that bring this home. Sonders pointed out some technical differences in market strength between the current market and the new bull market rallies of 2003 and 2009. A year into those new bull markets – it’s been a year since the market bottomed in October 2022 – more than 20% of S&P stocks were making new 52-week highs. Currently that number is 2%. In addition, the equal weight S&P was significantly outperforming the market weight S&P a year into those new bull markets. The reverse is the case this time around as the Magnificent 7 carry the market while everything else is rolling over. I stand by my assertion from two weeks ago that “The Market Is About To Break”.