CRM: Operating Margin Therapy

Salesforce (CRM) reported 4Q22 earnings after the close and the stock is currently +16% in the after hours. That works out to an increase of more than $25 billion in the company’s market cap. Why?

Everybody has been focusing on slowing revenue growth in the tech space and CRM is not immune from that as they are guiding to only 10% growth in 2023. That’s not why the stock is popping. Nor is it that they’re increasing their share buyback to $20 billion.

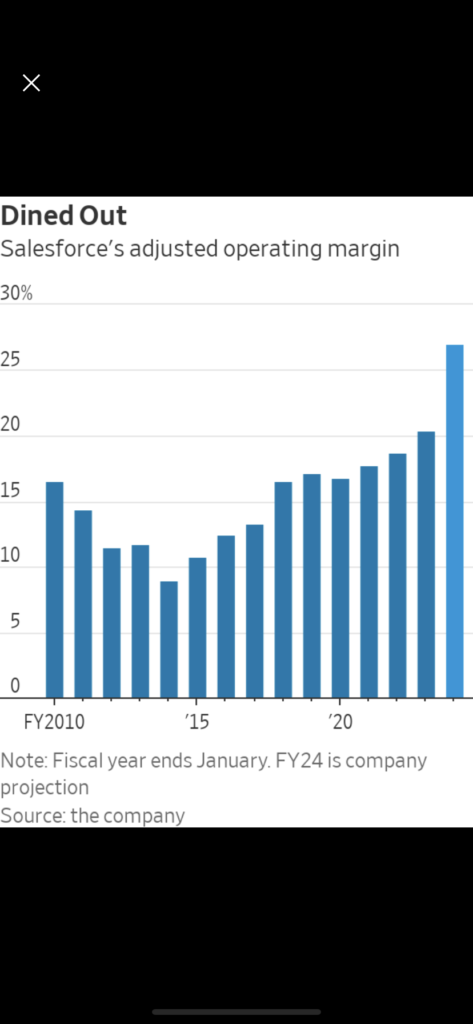

The reason the stock is popping is that CRM is guiding to 27% operating margins in 2023 – up from 22.5% in 2022. That’s going to result in a huge increase in profitability to $7.12-$7.14 compared to $5.24 in 2022. In other words, CRM is expecting EPS to increase 36% on only 10% revenue growth.

How are they doing this? Cost cuts. According to The Wall Street Journal’s Dan Gallagher [SUBSCRIPTION REQUIRED], the company is cutting ties with a 75-acre wellness retreat in Northern California and scaling back on specialty baristas at its San Francisco headquarters – though apparently they are still paying Mathew McConaughey $10 million a year to be a creative consultant.