Calling Powell’s Bluff, AAPL Earnings On Deck, MTCH: You Don’t Love Me Anymore? Playing For A PYPL Pop

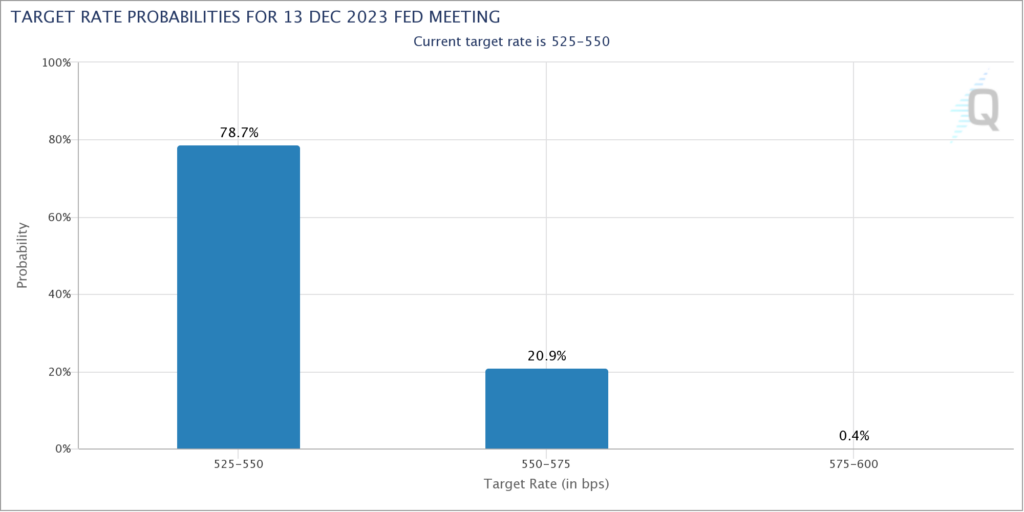

In about three hours, the Fed will release its interest rate decision and statement followed by Powell’s press conference. While it’s almost a lock that the Fed will hold interest rates steady, it seems likely that the statement and Powell will lean hawkish. However, the market is now pricing in only a 21% chance that the Fed will hike again in December and bonds are rallying hard today. In other words, the market is calling Powell’s bluff. The Fed is likely done raising rates for this cycle.

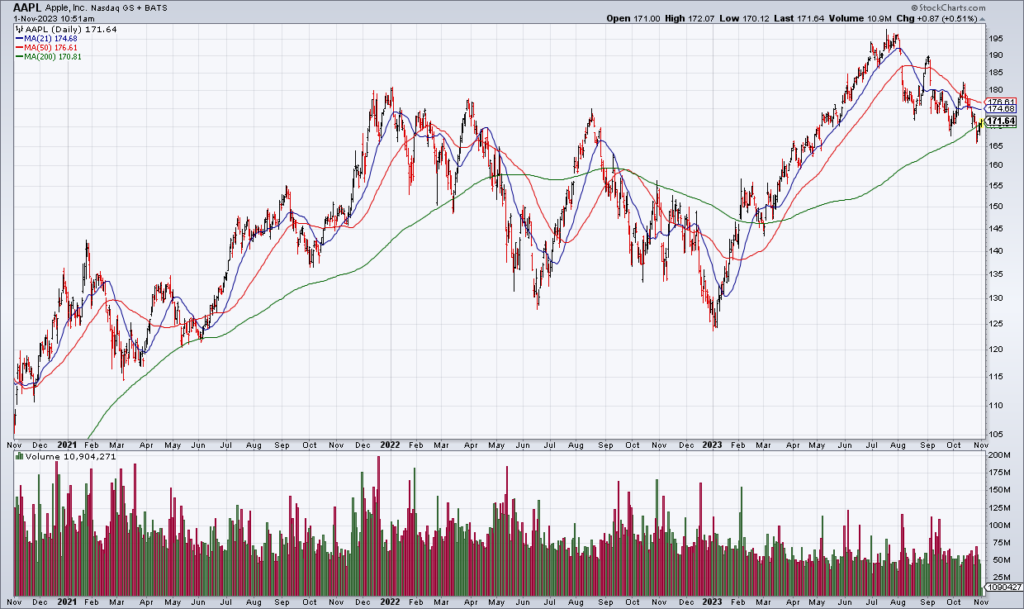

Next up after the Fed is Apple (AAPL) earnings on Thursday afternoon. Everybody knows that AAPL is the biggest and most important stock in the world but its performance has been unusually poor since its last earnings report. Investors don’t appear very optimistic about the iPhone15 which was launched in late September. This quarter will only include a week of iPhone15 sales so it’s the next one that will be telling: “Apple’s Q1 results typically dictate the strength of an iPhone cycle”, Bernstein’s Toni Sacconaghi wrote in a note last week (quoted in Dan Gallagher “Apple’s Dark Cloud Might Linger” [SUBSCRIPTION REQUIRED]). Investors will be keying in on anything AAPL says about iPhone 15 sales in October.

The WSJ’s Dan Gallagher argued in his column this morning that even a strong report on the iPhone front may not be enough given concerns about AAPL’s long term outlook in China and worries about the lucrative payments AAPL receives from Google to make its search engine the default option on its devices. The US government believes this gives Google an unfair advantage.

Personally, I believe AAPL is a mature value stock that still trades with the valuation of a growth stock and is due to be revalued accordingly (“AAPL Is Not A Growth Stock Anymore But It’s Still Priced Like One”, April 28, 2022). AAPL is Top Gun’s largest single stock short position.

Match (MTCH) – the owner of dating apps Tinder and Hinge – reported earnings yesterday afternoon and the stock – already down huge over the last year – is being hit hard again today. The biggest problem is that Tinder is now mature with paying subscribers have peaked at 11.1 million a year ago and declining to 10.4 million in the most recent quarter. On the other hand, Hinge – a relationship oriented app as opposed to Tinder’s reputation of being for hookups – is growing nicely. MTCH just started breaking out Hinge’s paying subscriber number a couple quarters ago and it currently stands at 1.3 million. There is probably some value here but I continue to swipe left for the moment.

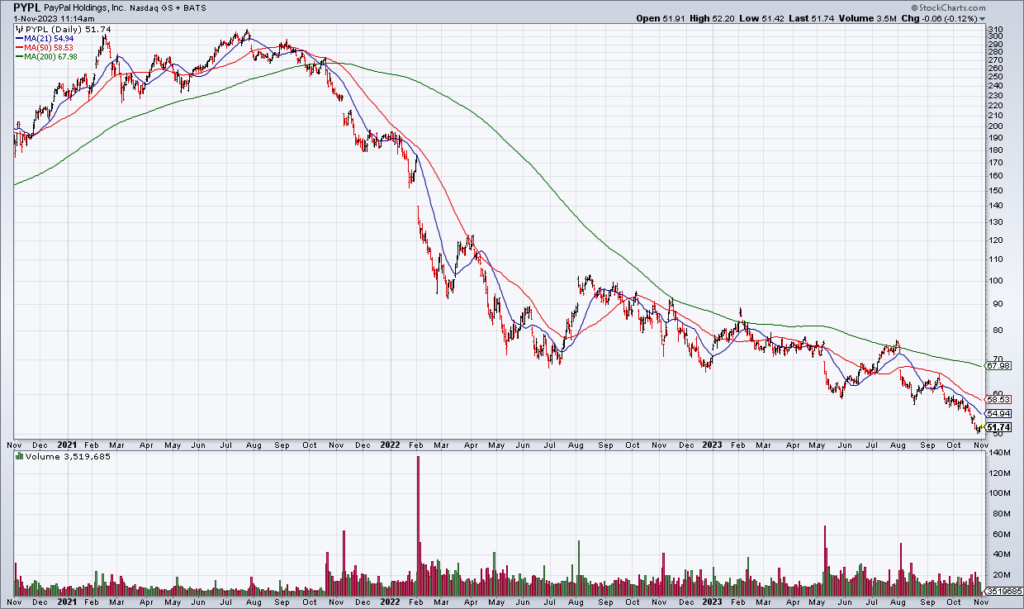

Lastly, PayPal (PYPL) reports earnings after the close and anything decent could result in a significant relief rally. The stock is way oversold (“PYPL Is Ready”, July 30) and offers tremendous value (“PYPL: Tremendous Value”, May 8). In addition to a large position in the stock, I bought some PYPL Nov3 $55 Calls just now for $1.

Disclosure: Top Gun is short AAPL and long PYPL.