Bulls Back In Charge, AMZN GOOG/GOOGL CMG Earnings, GME Saga Winds Down

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

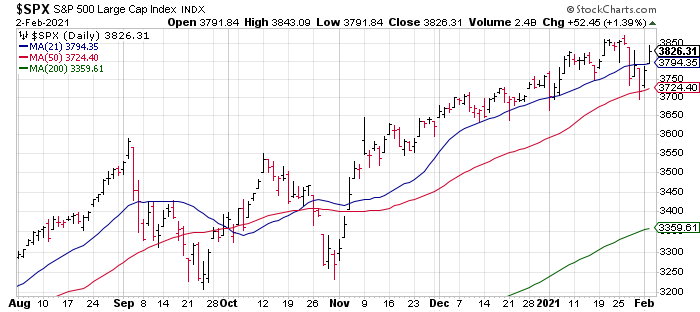

Incredibly, after just two sessions this week the bulls have taken back 80% of last Tuesday through Friday’s selloff and, with the S&P back above its 21 DMA, are back in charge.

The only caveat is that volume on the bounce has been much lighter than the historic volume we saw last week. NYSE + NASDAQ volume was about 12.7 billion shares on Tuesday and 12.4 billion shares on Monday. As I’ve written previously, volume adds conviction to a move IMO and so this lighter volume raises the possibility of a dead cat bounce. However, if the bulls keep pushing prices higher, especially to new ATHs which we are within 1% of, that negates this observation.

Yesterday was the biggest earnings day of the week with Amazon (AMZN, market cap $1.73 trillion) and Alphabet (GOOG/GOOGL, $1.41 trillion (using the current premarket price)) reporting in the afternoon.

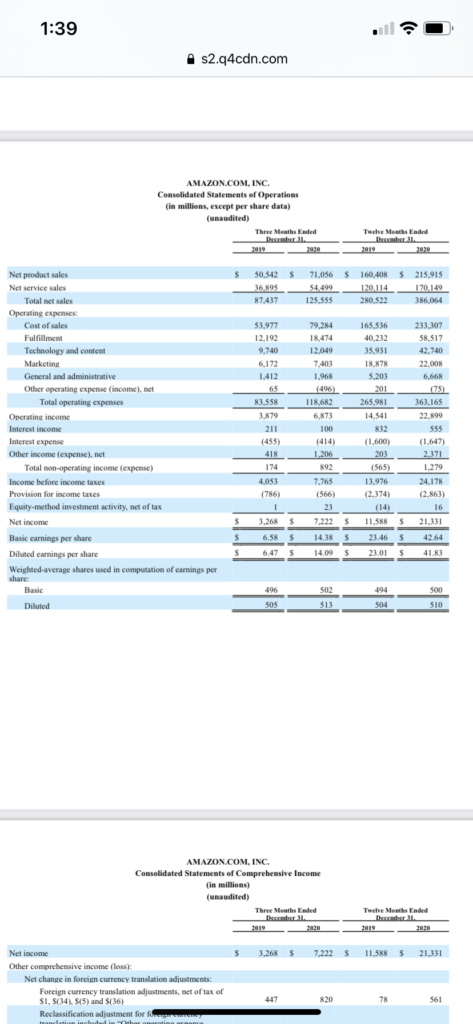

AMZN reported a superb quarter with Revenue +44% and Diluted EPS +118%. However, Jeff Bezos announced that he will be stepping down from the CEO role and the stock is only marginally up in the premarket.

The numbers speak for themselves: AMZN’s fundamentals are superb. The problem here is valuation with shares trading for almost 80x trailing earnings even after giving them credit for their net cash position.

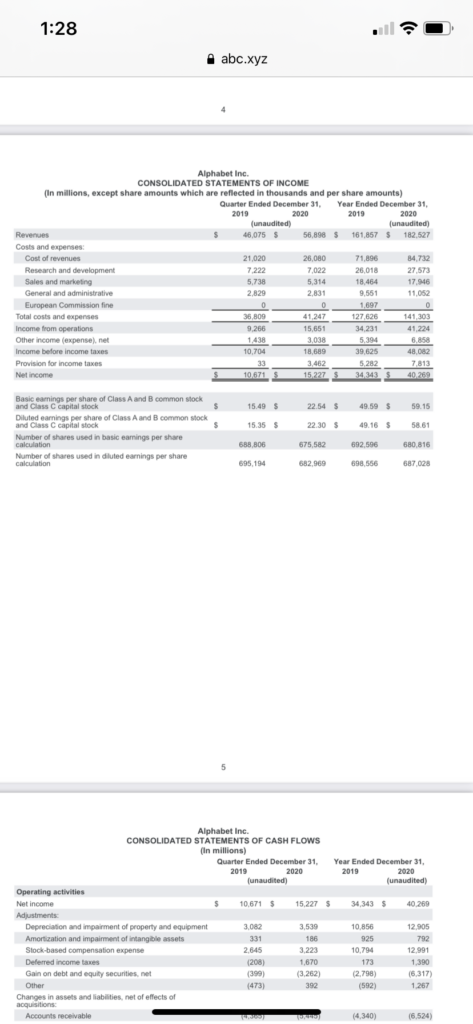

The same sort of analysis applies to GOOG/GOOGL. The quarter sparkled with Revenue +23% and Diluted EPS +45%.

The problem here again is valuation with shares trading at more than 33x trailing earnings even after giving them credit for the net cash on their balance sheet. And so while I think you can continue to ride these two as momentum trades in the short term, I don’t think long term returns will be good from these valuation levels.

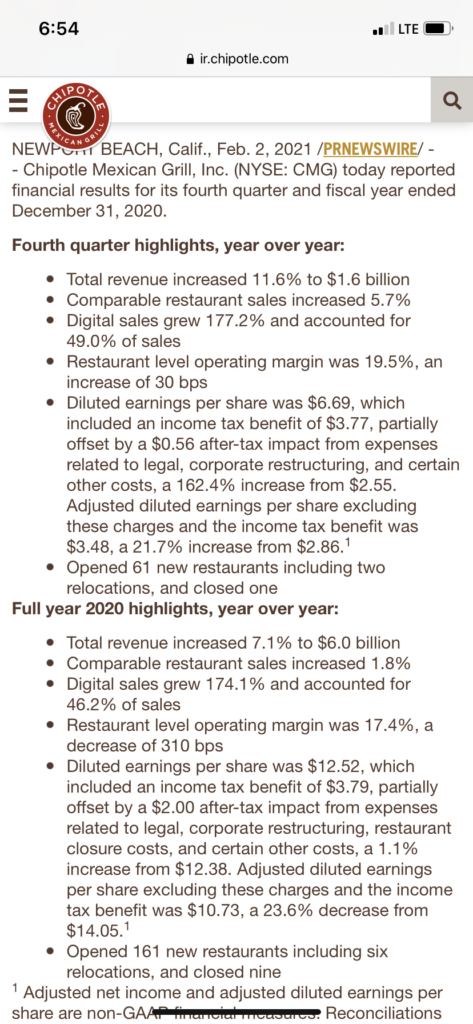

Also reporting yesterday afternoon was the beloved burrito chain Chipotle (CMG, $42 billion market cap (using the current premarket price)). The report was mediocre IMO with Comps +5.7% and Adjusted Diluted EPS +22%.

Normally, that might be good enough but not with the runup and valuation CMG sports. Shares were +28% from November 3, 2020 through yesterday’s close (Tuesday February 2, 2021) and trade at 136x trailing earnings even when giving them credit for the net cash on their balance sheet. That is a ridiculous valuation for a company at this stage in its growth cycle.

Lastly, it appears that yesterday put an end to the GME saga that has dominated headlines for the last week as shares were down 60% ($135) to $90. That is still too high but that kind of move will likely take most of the bulls’ spirit. We always knew this was going to end badly. It was just a question of how absurd things would get (Chart Source: 2kaykim Twitter, February 2, 4:00pm PST).