Breaking All The Rules: Long FB & PYPL Into Earnings

I just purchased 2% positions each in hated Facebook (FB) and Paypal (PYPL) heading into their 1Q22 earnings reports this afternoon. This is the kind of trade that loses me Twitter followers because it goes against a number of Wall Street cliches. The first cliche is: Don’t catch a falling knife. The second is: Don’t speculate on earnings. My response is that FB and PYPL aren’t falling knives; they’re falling pianos. In all seriousness though, sometimes you can make a lot of money by being willing to do something almost nobody else is. (You can lose too of course).

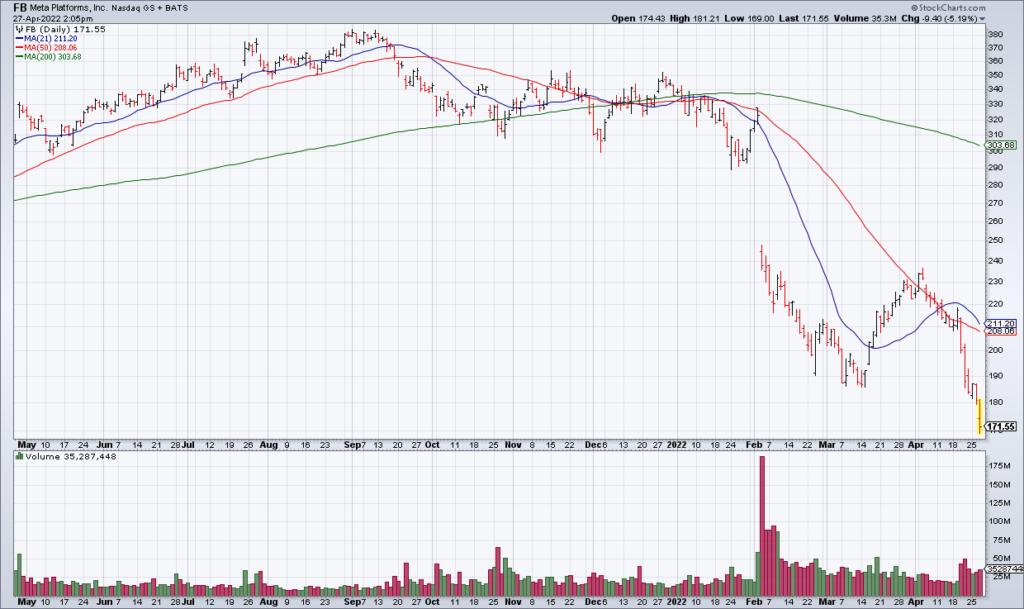

Let’s start with FB. FB’s 4Q21 earnings report was a debacle. They guided 1Q22 revenue growth to a disappointing 3%-11% and reiterated that full year 2022 expenses will be significantly higher at $90-$95 billion compared to $71 billion in 2021. Shares have been slaughtered in the three months since the report.

How can I possibly make the case for FB then? Because it’s so bad that it’s good. FB is still a great company that will be around for a long time and make a lot of money. With everyone already out, I’m willing to step in because the supply and demand dynamics are such that anything decent should result in a nice post earnings pop.

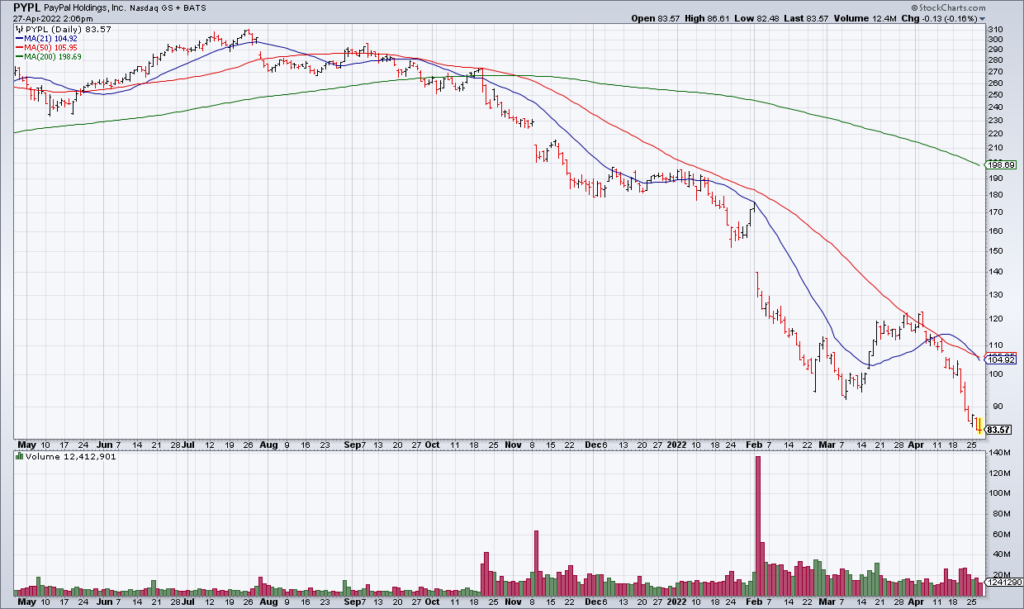

The same kind of analysis applies to PYPL. In its 4Q21 earnings report PYPL guided 2022 revenue growth to 15%-17% but essentially flat EPS of $4.60-$4.75 compared to $4.60 in 2021. For whatever reason they expect their operating margin to be only 23% in 2022 compared to 25% in 2021. Growth investors hate it when growth stocks stop growing and PYPL has been taken to the woodshed over the last three months. Once again, however, it’s so bad that it might be good. Like FB, PYPL is a great company that will be around for a long time and make a lot of money. Any whiff of a reprieve and shares are ripe for a relief rally.