Big Tech: Which Way Is It Going To Go?, My Twitter Beef With The Technicians, LULU AVGO COST & ORCL Earnings

Note: To sign up to be alerted when the morning email is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

As I wrote Thursday morning in the first section of my blog “Retest Or Failed Breakout?”, Wednesday’s correction did no technical damage except to the QQQ which is struggling to break out from its September 2nd highs. In the second section, I wrote about the “Rotation Within The QQQ” from the mega caps to the mid and small caps within the ETF in which Frank Cappelleri showed the Equal Weight NASDAQ-100 to have massively broken out from its September 2nd highs while the overall QQQ, dominated as it is by the Big 5 and a few other big tech stocks like TSLA and NVDA, is struggling to.

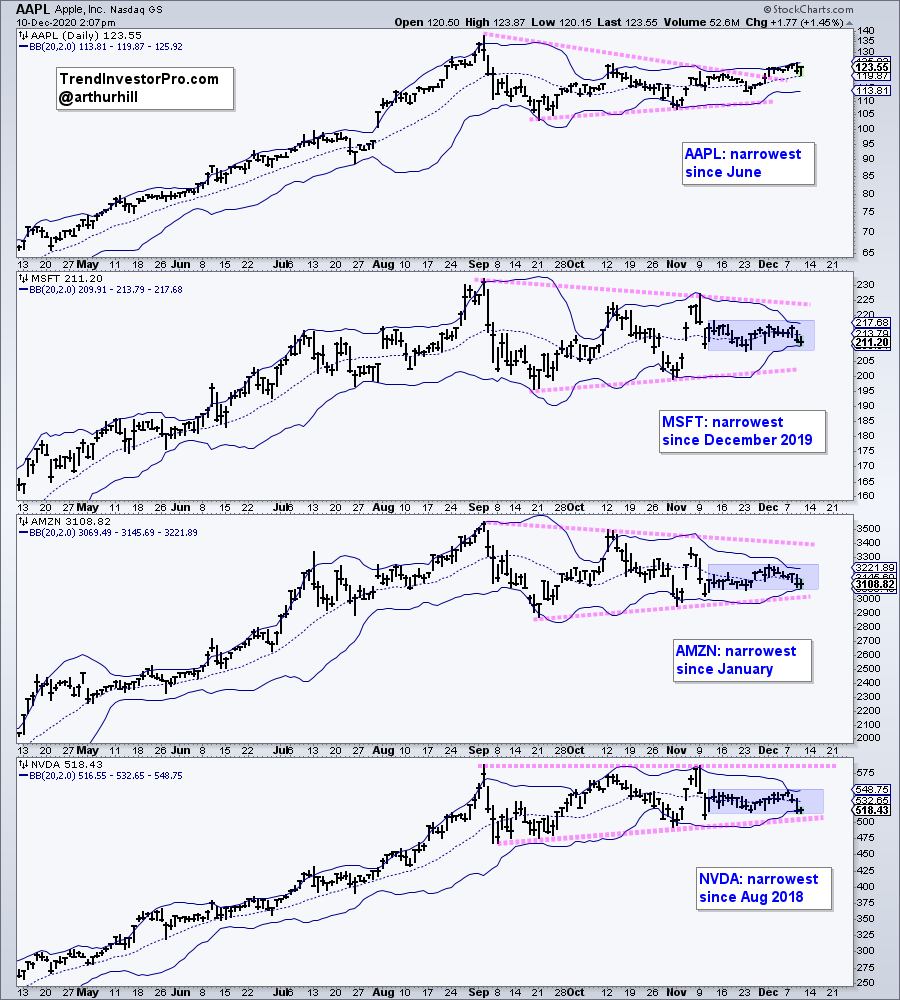

A couple of nice charts yesterday from Arthur Hill and Greg Rieben nicely illustrate Big Tech’s failure to participate in the most recent leg of the rally. Hill’s chart shows AAPL, MSFT, AMZN and NVDA trading in a range well below their September 2nd ATHs (Source: Arthur Hill Twitter, December 10, 11:08am). Rieben’s chart shows this with respect to FB (Source: Greg Rieben Twitter, December 10, 7:45am).

The only way in which a human being can make some approach to knowing the whole of a subject, is by hearing what can be said about it by persons of every variety of opinion, and studying all modes in which it can be looked at by every character of mind. No wise man ever acquired his wisdom in any mode but this; nor is it in the nature of human intellect to become wise in any other manner – JS Mill, On Liberty

As an aside, when I retweeted Rieben’s chart with the comment “Nice chart Greg Rieben but I’ll pass #Overvalued $FB”, Rieben testily replied “Undervalued, overvalued I could care less. The chart looks good that’s all I know and I’ve been long $FB for years purely as a trend follower”.

A word to the wise: Never try to engage a pure technician on anything other than price. Their belief that only price matters is held so dogmatically that any comment referencing anything else i.e.. fundamentals, valuation, etc.. is met with the intolerance of a religious fanatic. It’s a fine line between appreciating their excellent charts while recognizing the dogmatism and limitations of their perspective.

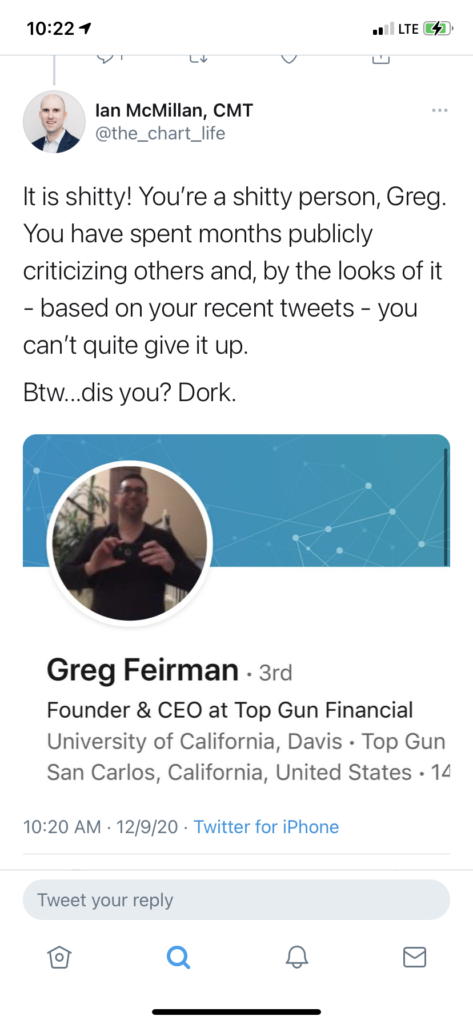

Those of you who are intimately involved with FinTwit know that I got into a nasty spat with a number of pure technicians such as Ian McMillan, Dan Russo and Aaron Jackson on Wednesday over just such philosophical issues which rippled through FinTwit. 32 year old McMillan called my work “shitty”, me a “shitty person” and posted a picture of my LinkedIn profile pic with the comment “Btw…Dis you? Dork”. All because I, wrongly it turns out, found a chart he posted in late April about a measured move breakout ridiculous at the time. I admitted I was wrong but that wasn’t good enough for McMillan who continued to hammer away at my work, character, appearance, etc.. Suffice it to say, I blocked all three and don’t plan on engaging any of them moving forward.

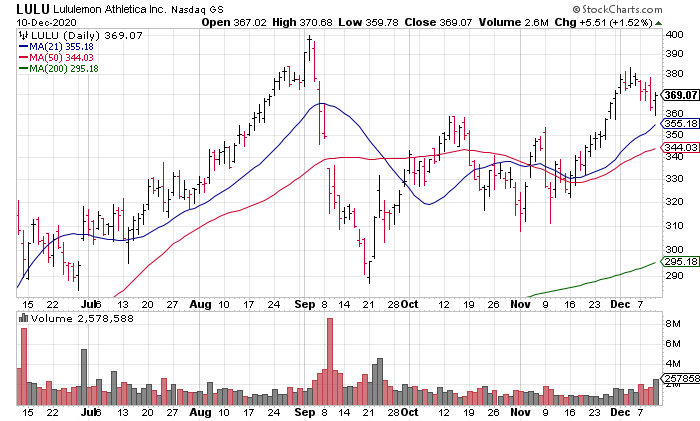

That’s enough gossip! Let’s turn to some fundamentals now in the form of Lululemon (LULU), Broadcom (AVGO), Costco (COST) and Oracle (ORCL) earnings, all of which reported yesterday afternoon. (If you’re a pure technician, I suppose now is when you tune out LOL). LULU ($48 billion market cap) reported Comps +19% and EPS +21% to $1.16 which is probably not good enough for a stock so technically extended and trading at such a lofty valuation. We’ll find out today.

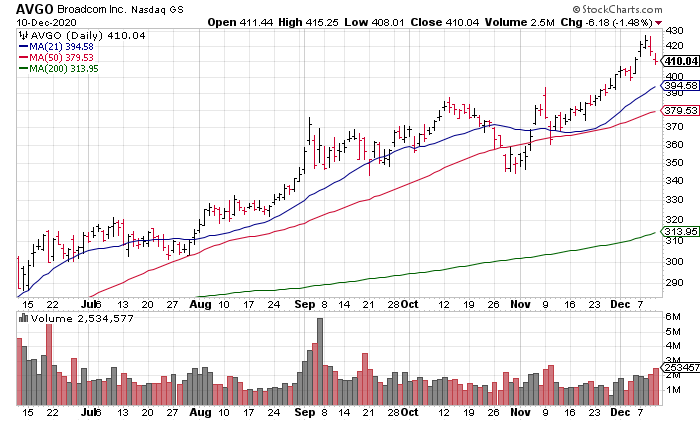

AVGO reported Revenue +12% and EPS +18% to $6.35. While AVGO’s valuation is cheaper at 18.5x their just completed fiscal year ($410.04 Thursday 12/10 Closing Price / $22.16 2020 Fiscal Year Non-GAAP EPS = 18.5x), it is still probably not good enough for a stock that is so technically extended. Again: We’ll find out today.

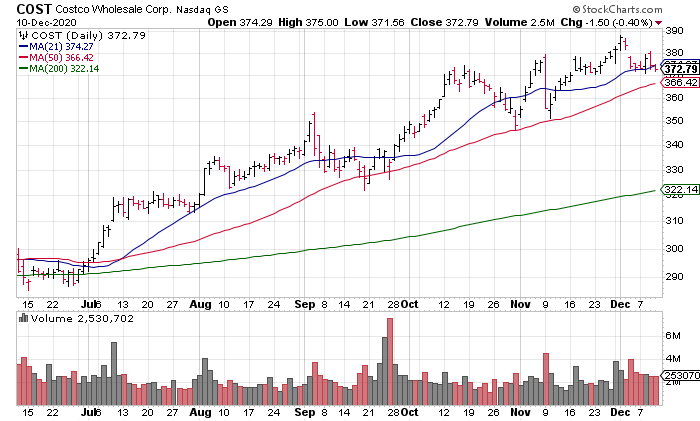

Turning to COST earnings, we have a similar problem. While the fundamentals were great with Comps +17.1% and EPS +38% to $2.62, the stock is technically extended and the valuation rich.

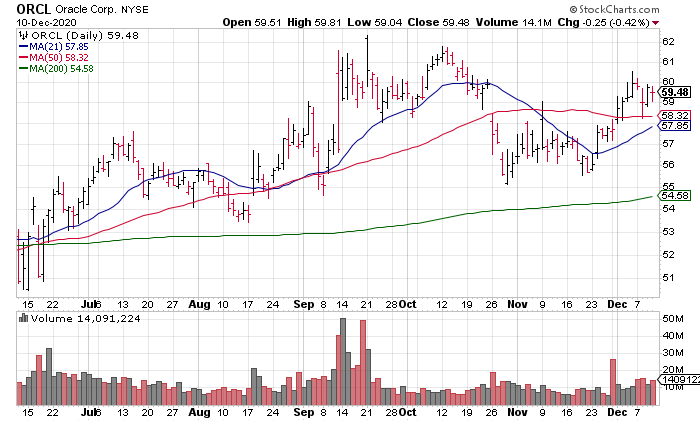

Lastly, ORCL, which is at a different, more mature, stage of its growth cycle than the previous three, reported Revenue +2% and Net Income +8.5%. The valuation is closer to fair value at 14x trailing 12 month Non-GAAP EPS, but I still think it is overvalued. Last night on Stocktwits, a member asked me for my PT and I gave $50 as my intrinsic value for the stock. We’ll see how it acts today.