Playing The Bubble: 1 – Bianco: The Bull Case, 2 – Aaron Jackson: NOT The Bull Case, 3 – Cathie Wood on CNBC Fast Money Re: PLTR, 4 – SHOP Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

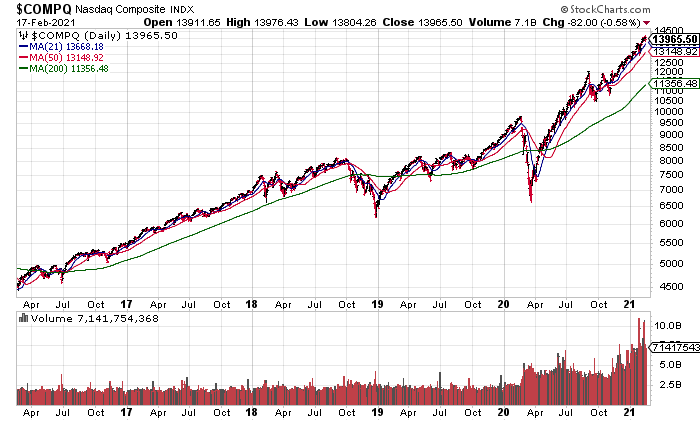

Jim Bianco was on CNBC’s Trading Nation yesterday with Seema Mody and nicely laid out the bull case. Bianco says “It’s a mania” but that doesn’t mean it won’t keep going higher in the short term. For example, in the late 1990s then Fed Chair Alan Greenspan called the market “irrationally exuberant” in December 1996 but the NASDAQ didn’t top until more than three years later in March 2000. We’re somewhere in that phase according to Bianco.

Bianco also mentions that it’s hard to keep the money you make in mania/bubble because bubbles pop. He is also concerned about rising interest rates and inflation in the second half of the year from all the monetary and fiscal stimulus.

In other words, this is a bubble, this is “the triumph of liquidity over fundamentals” to use Citigroup’s Matt King’s felicitous phrase, but it can, and likely will, keep going higher, at least in the short to medium term, according to Bianco.

Kiddie Technician Aaron Jackson is also bullish but for the wrong reason: Like his hero Cathie Wood, he is a True Believer in this market:

Cathie Wood and ARK are this bull market’s superstar research firm. The research and worldview is enlightening, refreshing and inspiring.

There are larger secular trends supporting the ARK thesis:

There’s exponential growth in information. Remember the Covid vaccine? We had the information just lying around and it took a couple of days to analyze the virus and cook up a vaccine with completely new technology. You better believe that isn’t the only useful information we have lying around waiting for useful application.

Human capital is being unleashed in a manner that is incomprehensible. Not only is information growing exponentially, it’s flowing exponentially. That means access to ideas and opportunity for people in rural areas of developed nations. That means literacy exploding in un-developed countries. That leads to more people having more ideas and solving problems and finding new ones, which leads to more new companies in new industries across the world at a faster and faster rate.

It’s a cycle that’s going to take decades if not generations to fully play out.

(From Aaron Jackson, “The Cathie Wood Report”, Monday February 15)

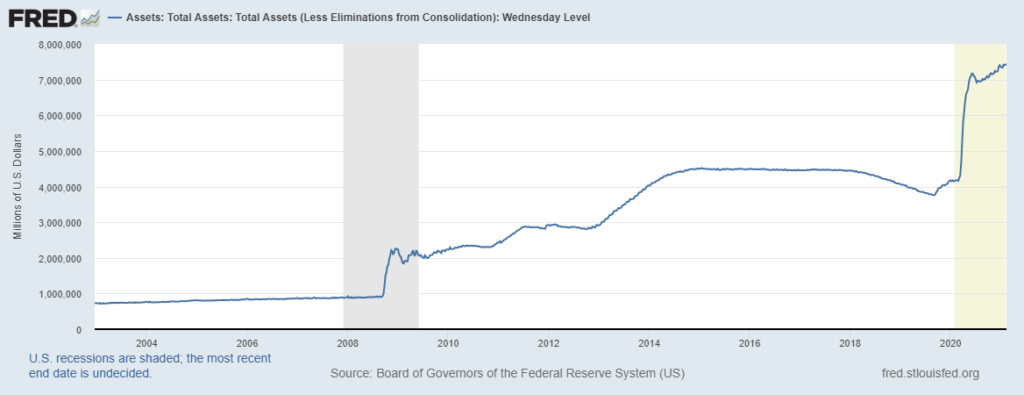

While it is true that innovation drives economic growth, that is NOT what is driving financial markets right now. Markets have gone parabolic since COVID. Did innovation all of a sudden explode at that time? Of course not. While Jackson’s point about information exploding and becoming more accessible is correct, that has been true for decades. The reason the market has gone parabolic the last 11 months is because the Fed injected $3 trillion into financial markets from mid-March through early June. That this is the case can be seen by comparing a chart of the NASDAQ with a chart of the Fed’s Balance Sheet.

Conventiently, Wood was on CNBCs Fast Money Halftime yesterday talking about her investment philosophy and Palantir (PLTR) in particular. PLTR is a data analytics software firm with an emphasis on counterterrorism software for the government that also has a division focused on private companies. It’s an interesting company and a holding of Wood’s firm which she added to in the wake of their poorly received earnings report Tuesday morning.

Now, PLTR seems like a very innovative firm doing good work. The problem is that the stock is already priced like a success when it’s still barely profitable and in the early stages of its growth cycle. Even after being hammered Tuesday and Wednesday, it has a $48 billion market cap with only $1.1 billion in revenues in 2020. On Tuesday morning, they guided 2021 revenue growth to greater than 30%. So let’s say 2021 revenue is $1.5 billion. The forward Price to Sales ratio is 32x! So, while I’m all for innovation, I want to pay a fair price for a young, early stage, high risk company, not a price that already prices in an uncertain success as PLTR does. But as far as Cathie Wood is concerned, no price is too high to pay for innovation.

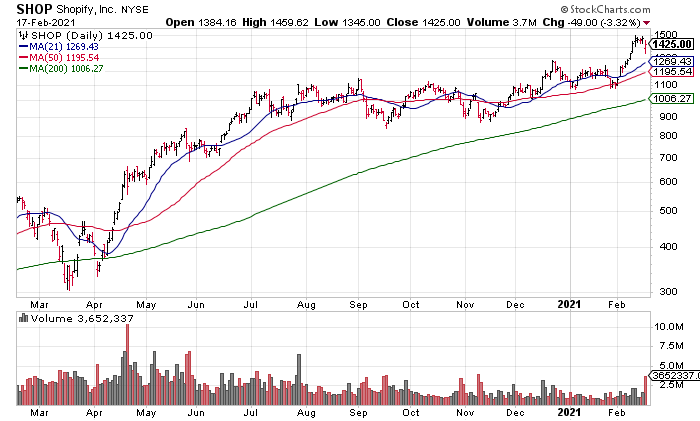

We saw something similar to PLTR on Tuesday play out yesterday (Wednesday) with another Cathie Wood favorite, Shopify (SHOP). SHOP reported a superb 4Q20: Revenue was +94% and they even turned a nice profit with Adjusted Diluted EPS of $1.58. However, SHOP got hit 3.32% on almost 3x three month average volume because great results were already priced in.

SHOP still trades at 59x 2020 revenue – even when subtracting its $6 billion in net cash from its market cap. Like I tweeted yesterday afternoon, I love SHOP’s mission of empowering small businesses. My problem is paying this kind of price for a business at this early stage in its growth cycle. With success already priced in, unless SHOP is the next AAPL or AMZN, the stock can only disappoint from here over the longer term.

In conclusion, if you’re going to speculate in this market – which I have no problem with – understand what’s going on so you don’t give back all your profits. Understand with Jim Bianco that this is a mania that will end badly. Don’t be a True Believer like Aaron Jackson and Cathie Wood who will hold through the bust, giving back all of their gains. If you understand this, you may be able to make a lot of money in a short time right now and hold onto the bulk of your gains. But this will end badly and nobody knows when.