Beneath The Surface: PYPL Breaks Down

Monday’s trading session was a yawner with the S&P +0.09%, the NASDAQ +0.07% and the Russell +0.23%. Tomorrow is likely to be different as the real action was after the close when PayPal (PYPL) reported 3Q earnings.

A $268 billion fintech darling, PYPL is one of the 25 most important stocks in the market IMO. A bad report was expected as PYPL was 26% off its late July highs heading into the number but the report was even worse than expected.

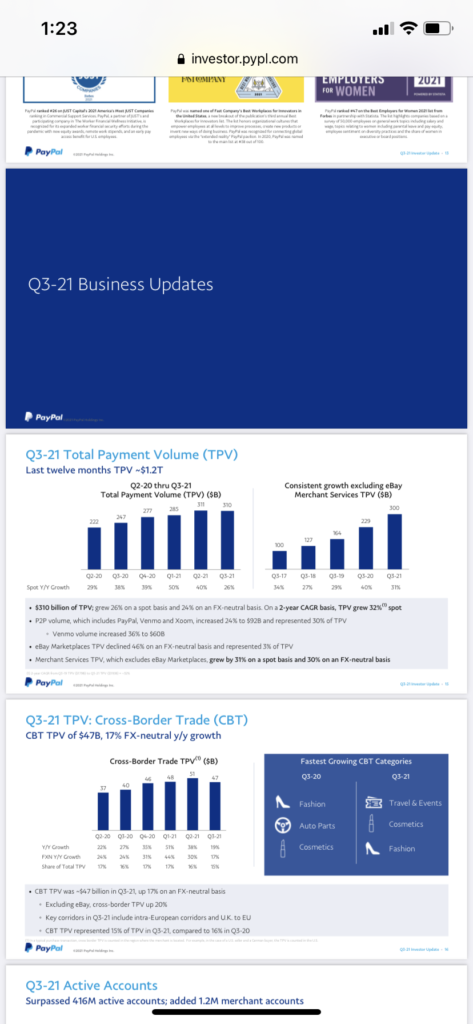

Total Payment Volume (TPV) – the key number that measures the dollar amount of transactions across PYPL’s online platforms – shockingly declined in the 3Q to $310 billion from $311 billion in 2Q21. As a result, revenue and EPS of $6.18 billion and $1.11 were also stagnant compared with 2Q21 ($6.24 billion and $1.15, respectively).

PYPL is a growth stock priced like one at 50x 2021 EPS guidance. Flat metrics like these don’t cut it. The stock – already beaten down as previously mentioned – is poised to take out the $220 support line in the chart above Tuesday and join the ranks of Snapchat (SNAP) and Peloton (PTON) as a broken stock.

This is just another example of the carnage beneath the surface that Mega Cap Tech is masking. When the stock market Gods come for it, the party will be over. It won’t be long…