Beneath The Surface Most Stocks Are Struggling

Tuesday was another typical day:

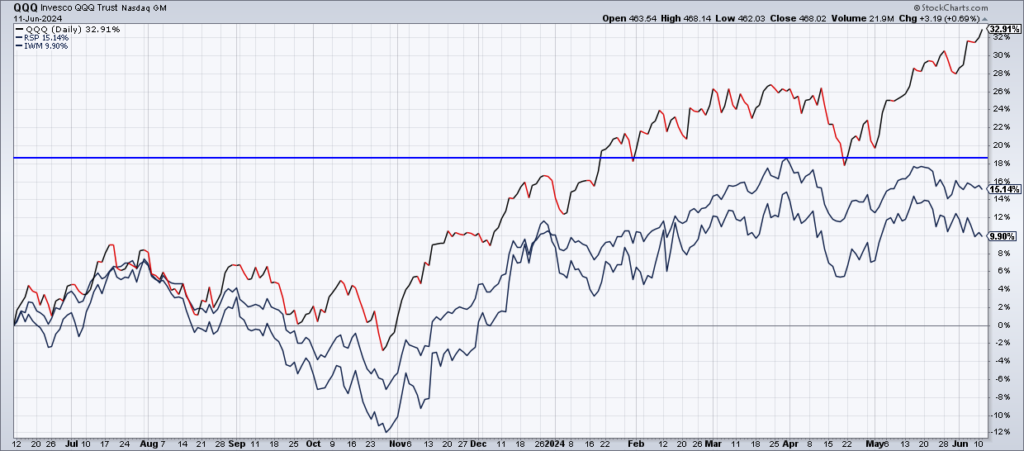

QQQ: +0.69%

S&P: +0.27%

S&P Equal Weight (RSP): -0.41%

Small Caps (IWM): -0.34%

While the bulls won the day at the index level, beneath the surface most stocks are going down. On the NYSE and NASDAQ, 2,997 stocks advanced while 4,010 declined.

What am I getting at? The Magnificent 7 – due their enormous size – are pulling the market cap weighted indexes higher while beneath the surface most stocks are going down or sideways. Over the last year, QQQ is +32.91% while the Equal Weight S&P is up less than half that (+15.14%). And if you look closely, you can see that RSP is actually negative since the beginning of April.

Performance chasing investors – of course – are piling into the winners i.e. The Magnificent 7. That is making those stocks more and more expensive. For example, one of the bull arguments for Nvidia (NVDA) was that it was actually getting cheaper as it went higher. But it’s hard to argue that it’s cheap anyore at 45x the average analyst’s estimate of $2.71 EPS this year.

In other words, this whole market rests on a few large, popular and increasingly overvalued stocks. When the music stops, there’s going to be a rush for the exits. I don’t think it will be too long…..