Bear Market Premonitions

NOTE: Every week or two I wrote a Client Note for my clients. I post the notes to my blog but with a time delay usually between 1 day and 1 week. To receive the Client Notes at the same time as my clients, sign up in the box in the right hand corner of the website.

*****

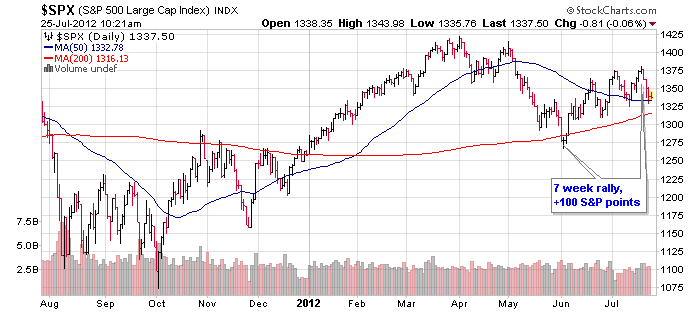

After mostly steady selling in April and May, financial markets have had a nice rally over the previous 7 weeks (Jun 4 – Jul 20). The S&P 500 rallied about 100 points over that period.

These kinds of trends and reversals are perfectly normal in financial markets. Markets move too far one way, causing a disequilibrium in supply and demand. That starts them moving the other way. Trend followers and crowd psychology add momentum. Eventually they overshoot in the opposite direction and the cycle begins again.

I hope you enjoyed this little summer rally because the nasty action since Friday suggest the reversal is at hand.

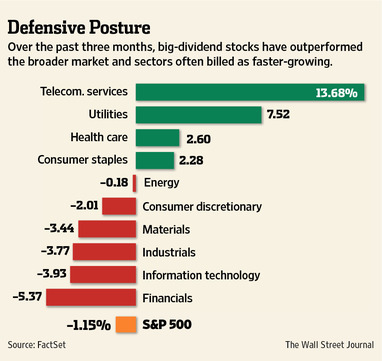

One clue that the rally would be short lived was its character. Leadership is always important. In genuine bull markets, the “sexy” stocks should lead: commodities, energy, industrials, tech, consumer discretionary and the glamour stocks of the moment. These signal an expanding economy – or at least the perception of one.

By contrast, the current 7 week joy ride was led by the defensive stocks: telecom, health care, utilities and consumer staples. These are stable, dividend paying stocks that investors seek refuge in during tough times. However, their lack of growth and imaginative possibilities limit their upside.

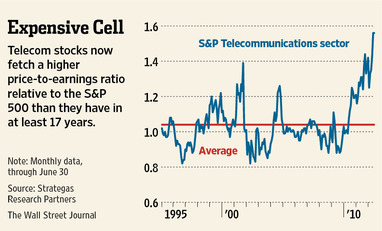

This has worked out well for us. Two and a half years ago I recommended playing the bull market in a conservative way via AT&T (T) and Verizon (VZ) in one of my most popular client notes (“Two Stocks For A Range Bound Market”, February 2010). Those stocks are up an average of about 50% since then. In addition, we collected their high dividends and income from selling covered calls during that time.

They were recently called away from us because of their outperformance the last 3 months. Both stocks are up about 20% over that period. As a result, telecom stocks are more expensive relative to the overall market than at any other time in at least the last 17 years.*

* For a nice overview of the changing character of the market over the last 3 months, I recommend an article in this morning’s Wall Street Journal from which the previous two charts were taken: “Investors Testing Limits of Defense”, Jonathan Cheng, July 23, C1.

*****

This underlying rotation in the market makes perfect sense because the global economy is showing clear signs of slowing down. In the last client note, I wrote about “The Chinese Slowdown”, including its effect on commodity based economies like Australia and Brazil. Of course, I have been covering Europe regularly.

In addition, the global slowdown is now beginning to make itself felt in corporate results. The first clear indication of this was an earnings warning two weeks ago by engine maker Cummins (CMI). The $20 billion market cap Columbus, Indiana based company surprised the market when it lowered its 2012 revenue outlook from 10% growth to flat compared with 2011. It also guided 2nd quarter revenue to $4.45 billion – compared with $4.64 billion in the year ago quarter (Cummins Press Release July 10). The announcement tanked Cummins stock and the overall market along with it.

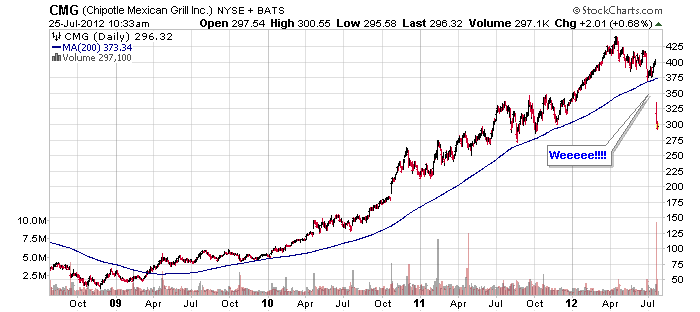

Closer to my stomach, last Thursday market darling Chipotle Mexican Grill (CMG) disappointed investors when sales came in below expectations. CFO Jack Hartung was to the point on the conference call: “We’re seeing a slowdown. I mean there is no other way around it. We were humming along nicely in the first quarter. We were humming along nicely in April, and then we saw a slowdown.” Chipotle – one of the bull market leaders up 900% from its 2008 low through early April – has more than 25% of its market cap since reporting. Its 200 DMA – which has served as support since the beginning of the bull market – was eviscerated on last Friday’s open.

Most important, Apple (AAPL) delivered a body blow to market sentiment when it disappointed yesterday. Apple has been the leader of this bull market and the one stock investors could count on no matter what. If Apple is vulnerable, what isn’t?

Everybody knows that Apple is the most important stock in the market but I should point out that Cummins and Chipotle are market leaders as well. Chipotle falls into the glamour stock category I mentioned earlier which plays an important leadership role in bull markets. Cummins is a highly owned industrial levered to global growth up more than 500% peak to trough during the bull market. The combined message of these three leading stocks cannot be ignored.

More than four months ago I wrote: “Today belongs to the short term traders trying to squeeze every last dollar out of this move. The day after tomorrow belongs to the bears” (“The Day After Tomorrow”, originally sent March 5). I have been sharpening my teeth for quite some time. Now it is time to eat.