Be OMO Not FOMO, The Resumption Of The Bear Market, NFLX Is Extremely Overvalued

I wouldn’t be taking as big of a risk because of valuations. It’s terrifying how narrow the rally has been. You need growth to surprise to the upside. If not, high multiples can get compressed, and that can happen quickly. Investors will run for the exits – Julie Biel, Chief Market Strategist, Kayne Anderson Rudnick (quoted in Paul LaMonica, “FOMO Is Dead. Welcome to the ‘OMO’ Stock Market” [SUBSCRIPTION REQUIRED], Barron’s, The Trader Column, Saturday 4/13

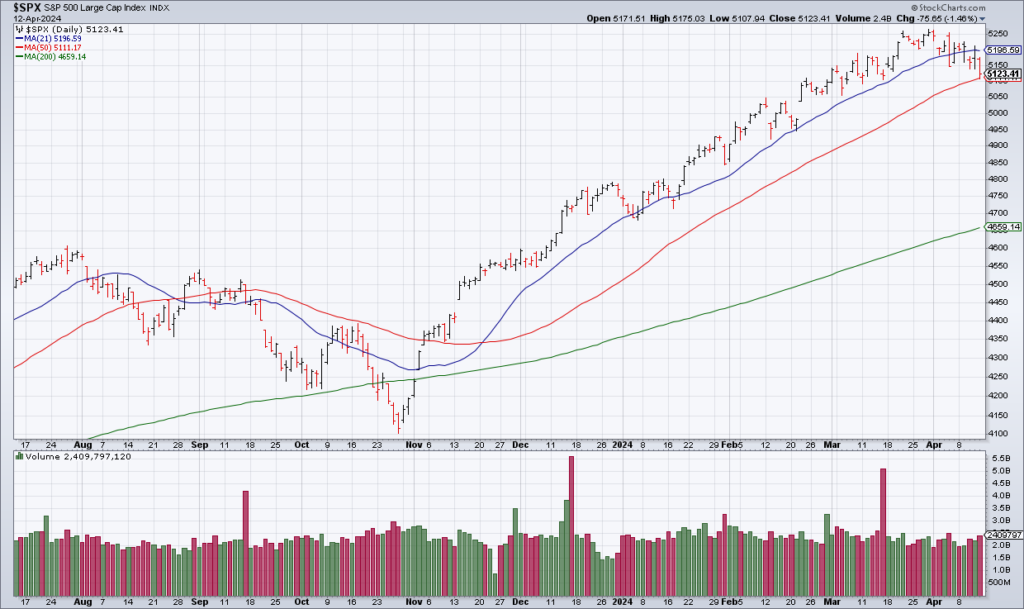

The S&P has had a terrific run over the last six months, adding ~1,000 points or nearly 25%. Investors can be forgiven for feeling FOMO: Fear Of Missing Out. But those days are over. You’re better off OMO going forward: Okay Missing Out – an acronym from Kayne Anderson Rudnick’s Chief Market Strategist Julie Biel.

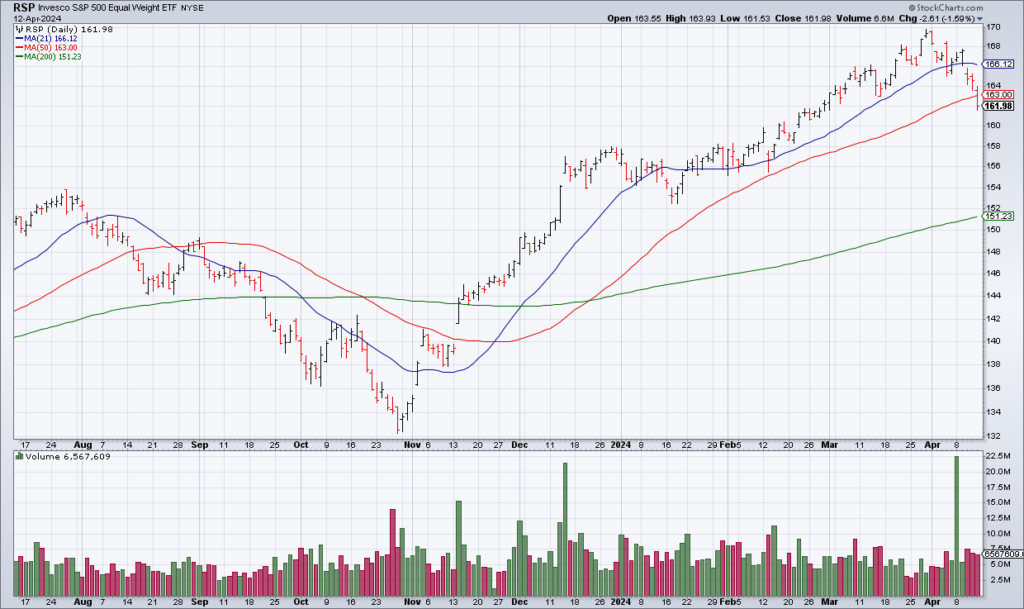

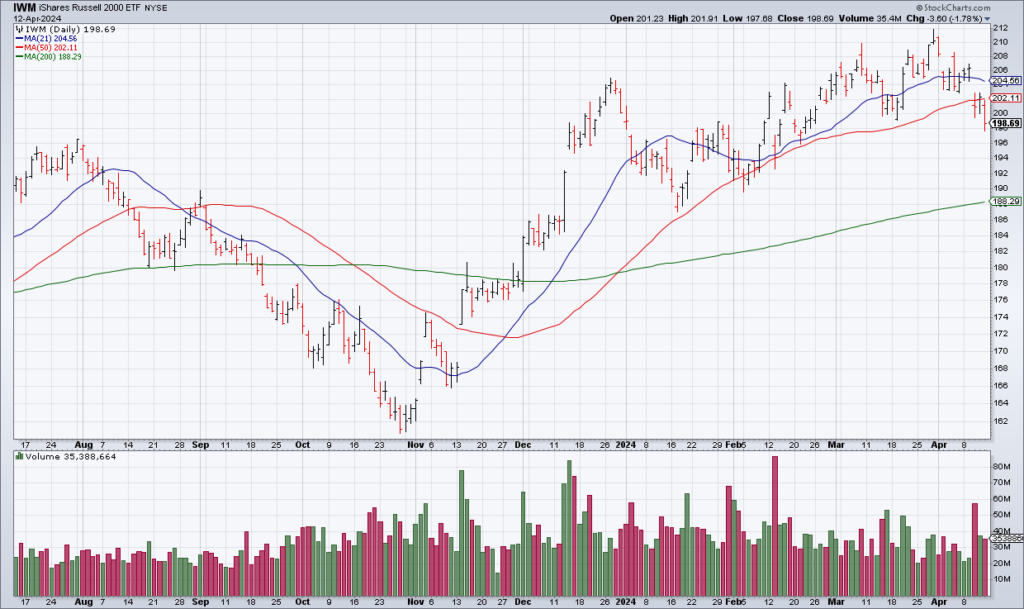

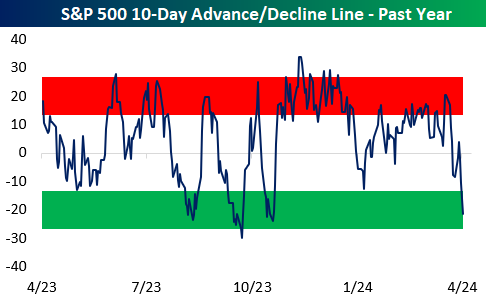

That’s because the market is starting to roll over. While the S&P lost only 1.56% last week and found support at its 50 DMA Friday, things were worse beneath the surface. The Equal Weight S&P (RSP) lost 2.65% and its 50 DMA. The Russell 2000 (IWM) lost 2.82% and its 50 DMA as well. So much for the much heralded increase in participation. All of a sudden, most stocks in the S&P are going down day after day as can been in the chart of the S&P 10 Day Advance/Decline Line above by BeSpoke.

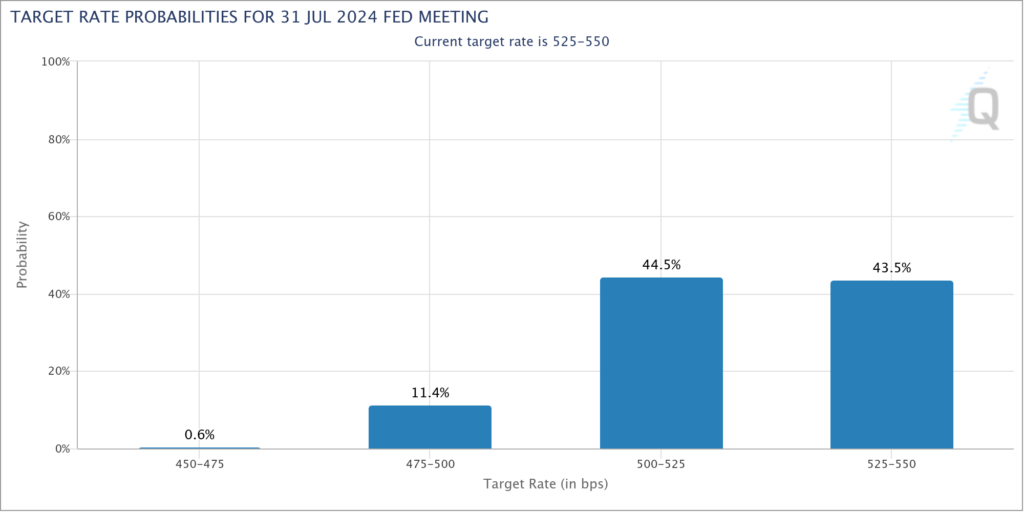

The hotter than expected March CPI Report Wednesday morning has pushed the first rate cut debate back to July from June as you can see in the Fed Futures Probability chart above. The risk is that the Fed stays too tight for too long, pushing the economy into recession. The historical evidence strongly suggests that’s exactly what’s going to happen. Combined with the recent action in the market, my sense is that the bear market is on the cusp of being resumed.

One stock that I’d strongly recommend taking profits in is Netflix (NFLX). The stock is up almost 80% over the last six months as they have cracked down on password sharing resulting in large increases in new subscribers the last two quarters. However, The stock is extremely overvalued at more than 40x my estimate for 2024 EPS. I like the NFLX Jan2025 $500 Puts which can be had for ~$25. NFLX reports 1Q24 earnings Thursday afternoon.