Analyzing BAC, GS and NFLX Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Yesterday was the most important earnings day so far and of the week so I think it’s useful to take a deep dive into each of the major reports (BAC, GS & NFLX) to see what we can learn.

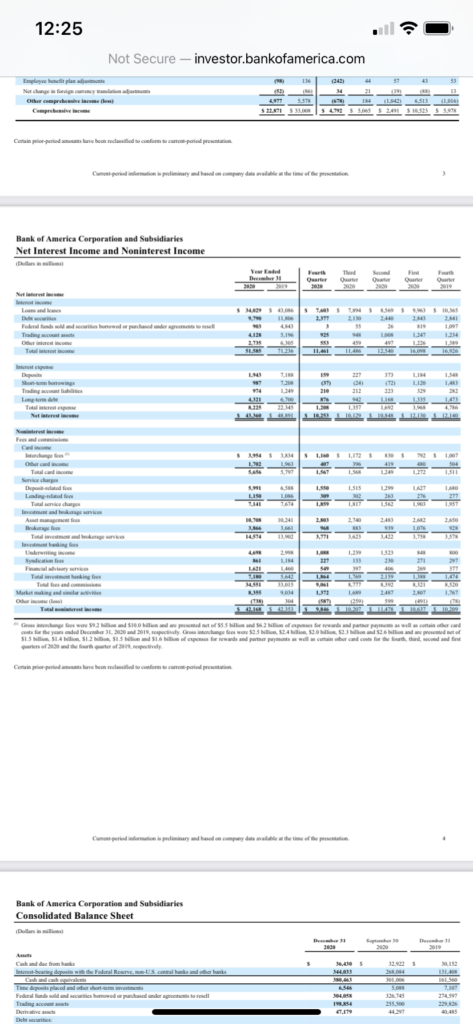

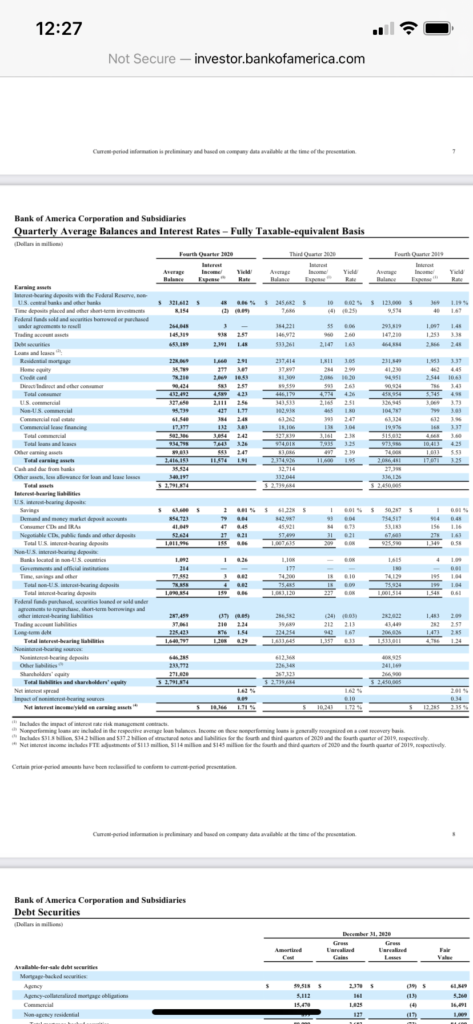

Let’s start with Bank of America (BAC, Market Capitalization $288 billion) which reported Tuesday morning. The first thing that stands out to me is the 16% decline in Net Interest Income, the core source of bank profitability. Why did Net Interest Income drop? Net Interest Income dropped because Net Interest Margin dropped from 2.01% in 4Q19 to 1.62% in 4Q20. Why did Net Interest Margin drop? Because, despite increasing deposits by 23% or $237 billion, their higher yielding loan book actually declined by 4% to $934.8 billion. In other words, they’re making less of a spread on the money they’re borrowing and the money that they’re lending. This resulted in a 23% decline in Net Income from $6.748 billion to $5.208 billion. BAC shares were down 0.73% on significantly above average volume Tuesday.

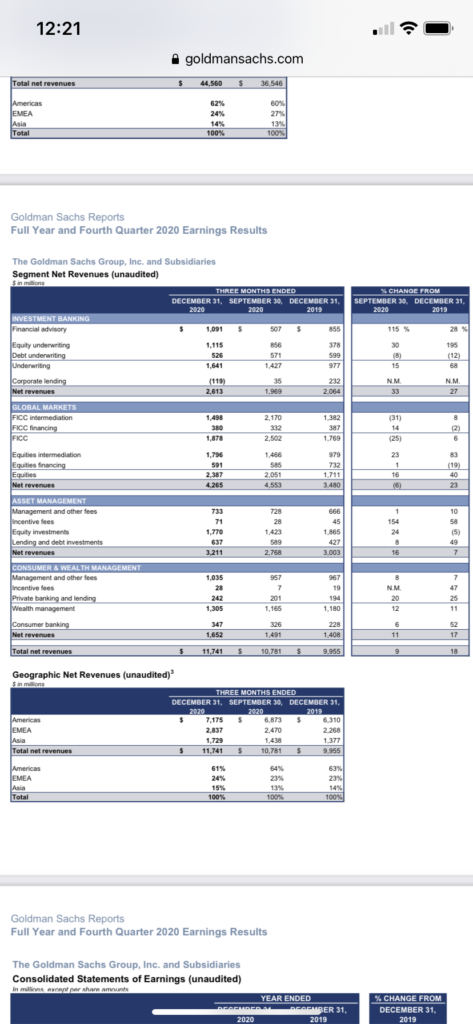

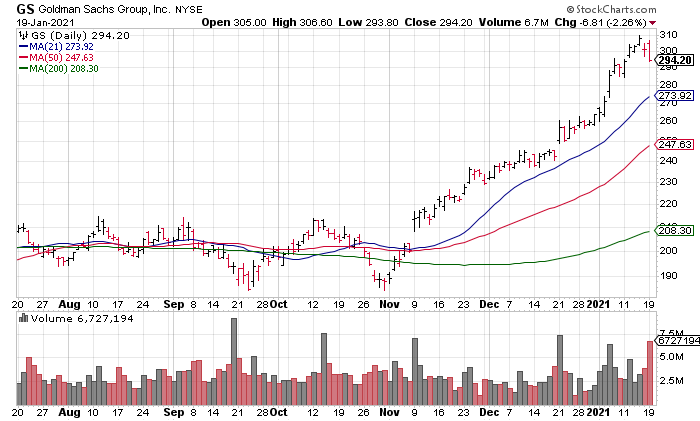

Let’s turn now to Goldman Sachs (GS, Market Capitalization $106 billion). GS had a brilliant quarter with Revenue +18% and EPS +158%. Every segment of GS’s business was firing on all cylinders: Investing Banking Revenue +27%, Global Markets Revenue +23%, Asset Management Revenue +7% and Consumer and Wealth Management Revenue +17%. EPS increased to $12.08 from $4.69 a year ago. Nevertheless, GS shares sold off 2.26% on greater than 2x average volume. Clearly, the recent surge in the stock had already priced in the great quarter.

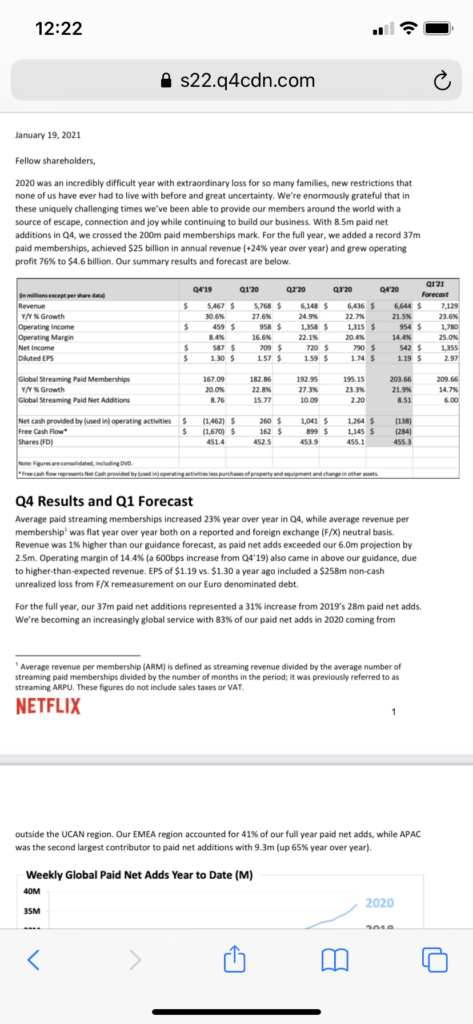

Lastly, let’s take a look at Netflix (NFLX, Market Capitalization $256 billion) which reported after the close (NOTE: I’m using the after hours closing price of $562.40 to calculate NFLX’s market capitalization). NFLX also reported a solid quarter adding 8.51 million paid subscribers resulting in Revenue +21.5% and Operating Income +108%. 1Q21 Guidance also looked good at Paid Subscriber Additions of 6.0 million and a huge increase in Operating Margin to 25.0% resulting in a big increase in EPS. Shares surged more than 12% in the after hours. However, my concern here is valuation. If you take NFLX’s $256 billion market cap and divide it by the $4.6 billion in Operating Income they earned in 2020 minus the 21% corporate income tax rate ($3.6 billion), you get 71x. That’s a multiple I’m not willing to pay despite the business’s stellar fundamentals.

In sum, BAC, like the other big 3 (JPM C WFC) that reported last Friday morning, is seeing deposits skyrocket but having a hard time deploying the cash in high yielding loans resulting in a decline in Net Interest Margin and Net Interest Income, the core source of bank profitability. While GS and NFLX both reported excellent quarters, the former sold off yesterday after the 50% plus move in its stock price since the start of November while the latter is set to test its All Time Closing High of $556.55 from September 1, 2020 today despite a soaring valuation. None of these stocks strikes me as a buy here due primarily to fundamentals (BAC), technicals (GS – too extended) and valuation (NFLX).