ABNB Is Just The Latest Important Stock To Get Hit On Earnings This Week

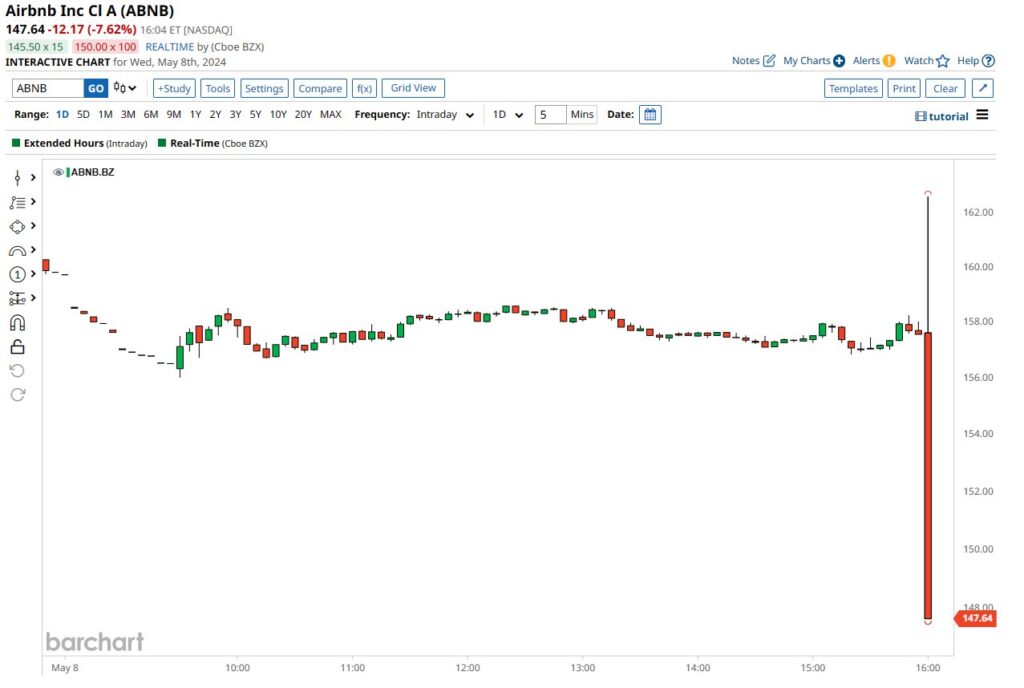

Air BnB (ABNB) reported 1Q24 earnings Wednesday afternoon and is currently set to get hit hard in Thursday’s session. Weak 2Q24 guidance of revenue +8% to +10% and Adjusted EBITDA of flat to up appears to be the culprit.

But ABNB is just the latest to get hit in response to earnings this week. First it was Palantir (PLTR) and Disney (DIS) on Tuesday. Then it was Shopify (SHOP) and Uber (UBER) on Wednesday.

To paraphrase Orwell, some stocks are more equal than others. The Magnificent 7 – which make up nearly 30% of the market cap of the S&P – dominate the S&P’s performance and the market cap weighted index will not break down until they do.

But – after them – there are a number of important, second tier companies like the ones mentioned above that are breaking down. As of Wednesday’s close, here is the market cap of the five above mentioned important but second tier stocks, plus Starbucks (SBUX) which got hit hard last week:

ABNB: $103 billion

PLTR: $53 billion

SHOP: $81.5 billion

UBER: $138 billion

DIS: $193 billion

SBUX: $84 billion

While the performance of these stocks is dwarfed by the much larger Magnificent 7, they show that beneath the surface of the major indexes we are witnessing some serious carnage. My bet is that sooner rather than later that will make itself felt in the major indexes themselves.