A ‘Perfect Week’, The Most Expensive Market In History, No Profits, No Fear, No Shorts, The Bull Market Since 2009, Feb 5, 1637

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

The seeds are being laid for an economic apocalypse – Top Gun Financial, “The Next Bubble”, October 29, 2008 – the day the Fed cut the Fed Funds Rate from 1.5% to 1%

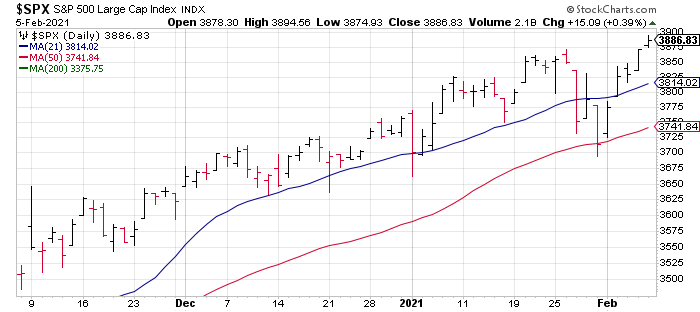

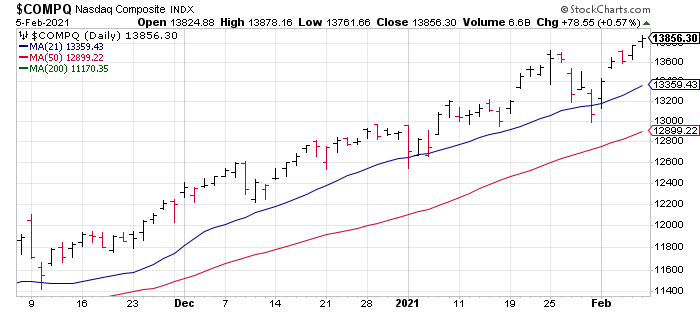

The S&P recorded a “perfect week” last week in which it was up all five days and closed the week at an ATH (the term comes from Bespoke Investment Group). The NASDAQ just missed by being down 0.02% on Wednesday. Here are the weekly returns for the major indexes: S&P +4.66% NASDAQ +6.00% Russell +7.67%. Investment Nirvana!

While the market won’t stop going up, reasons for concern continue to multiply. For one, based on the Price to Sales ratio of the S&P, this is the most expensive market in history (Chart Source: Liz Ann Sonders Twitter, February 5, 4:09am PST).

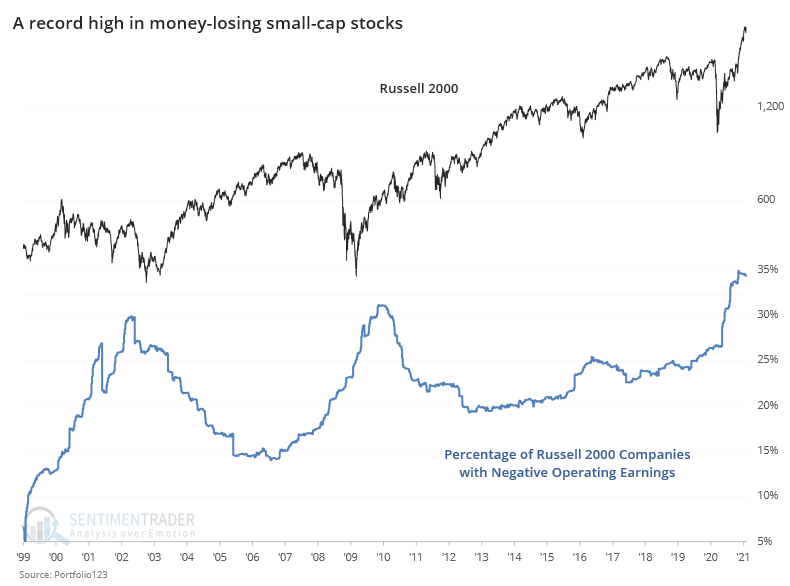

In addition, almost 35% of the companies in the soaring Russell 2000 have negative operating earnings over the last 12 months. No Profits, No Problem! (Chart Source: Sentimentrader, “Weekly Wrap For Feb 5 – More mania as internals decline”, February 5).

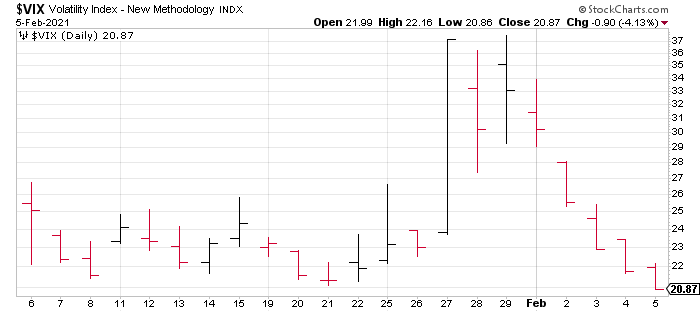

Further, the market has no fear with the VIX dropping 43.9% over the last seven trading sessions – the second most since 1990 according to Charlie Bilello.

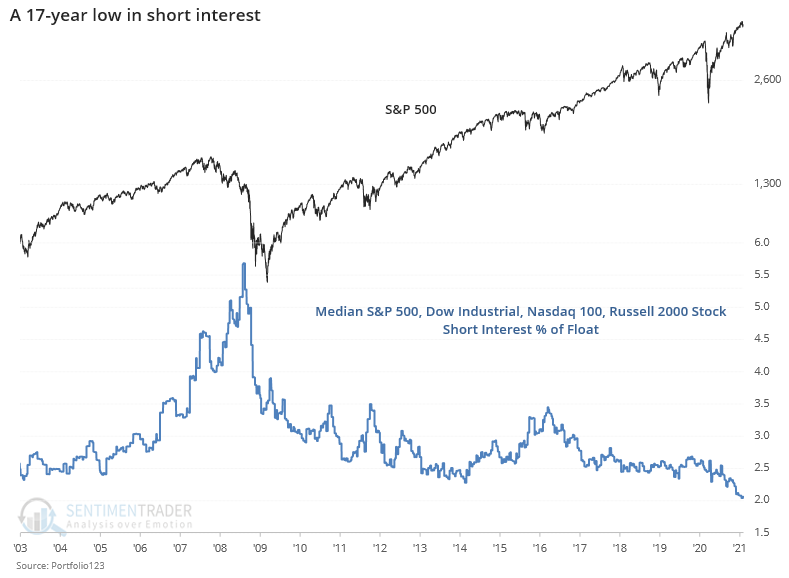

Short sellers have given up pushing the median short interest % on stocks in the S&P, DJIA, NASDAQ-100 and Russell 2000 to a 17 year low just above 2% (Chart Source: Sentimentrader, “Weekly Wrap Feb 5 – More mania as internals decline”, February 5).

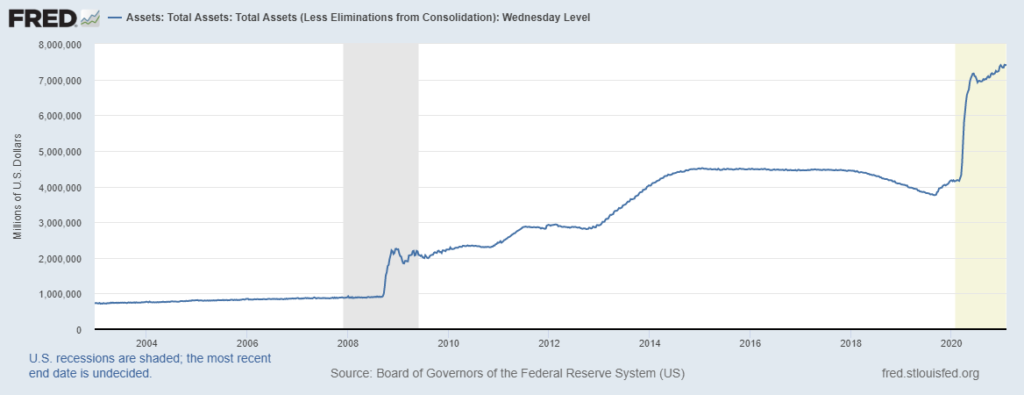

Taking the long view, the S&P has now risen from a bear market closing low of 677 on March 9, 2009 to yesterday’s close of 3,887 – a 474% increase or 15.8% annualized over the 11 years and 11 months. The whole thing has been driven primarily by The Fed’s new policy of Quantitative Easing, not real economic growth, and this has created the biggest bubble in economic history.

I’ll conclude with this excerpt from Mike Dash’s 1999 Tulipomania:

The bulb dealers had come to Alkmaar to attend an unprecedented auction. The guardians of the little orphanage in the town had come into the possession of one of the most valuable collections of tulips in the whole of the Netherlands. Caring more for the flowers’ value than for their beauty, they were selling off the bulbs for the benefit of some of the children in their care. So shortly after dawn broke, gray and chill, the traders began to make their way to the saleroom in the Nieuwe Schutters-Doelen – the headquarters of Alkmaar’s civic guard, an ornate and garbled building in the center of the town.

It was a large room, but they filled it. The bidding started briskly and soon became frantic. Single bulbs were knocked down for 200 guilders, then 400, 600, 1,000, and more. Four of the hundred or so lots were sold for in excess of 2,000 guilders apiece. And when at last the final tulip had been sold and all the money tallied, the auction proved to have raised a total of 90,000 guilders, which was, quite literally, a fortune in those days.

The date was February 5, 1637, the day flower fever reached such a pitch of frenzy in the United Provinces that once-worthless bulbs truly threatened to supplant precious metals as objects of desire (2-3)