A Look Back At Next Year

ANOTHER BEAR MARKET RALLY: The stock market has rallied nicely the last couple of months and once again the bulls are saying the bottom is in. It isn’t. Like March and August this is another bear market rally – though that likely will not become apparent until next year.

2023 RECESSION: Recession is in the air if you’re a connoisseur of that sort of thing. Companies are starting to lay off employees. The housing market is rolling over. Rents are coming down. And corporate earnings are weakening.

NEW LOWS TO COME: As a result the stock market will make new lows in 2023.

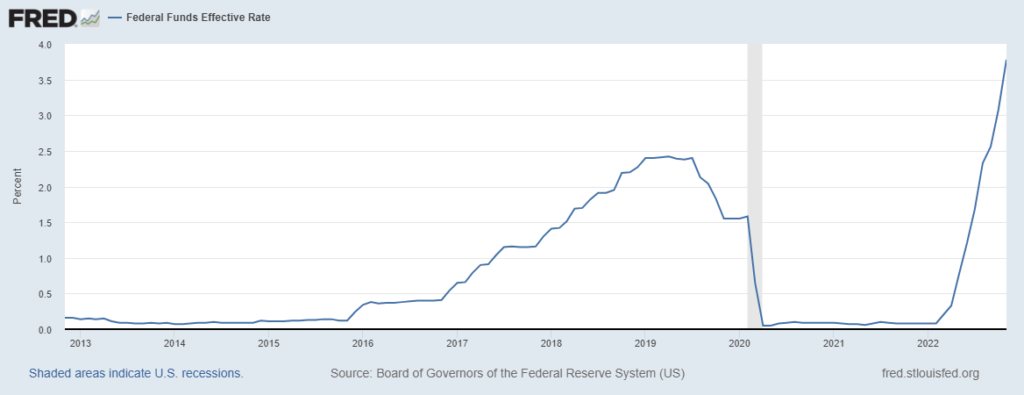

THE TERMINAL RATE IS NEAR: The Fed Pivot! How we’ve all waited and longed for it.

The Fed will raise the Fed Funds Rate 50 basis points to 4.25%-4.50% on Wed December 14th – but that may be the last rate hike of this cycle. (Perhaps they will raise another 25 basis points at the first meeting of 2023).

INFLATION: All the Fed’s rate hikes are still working their way through the system. As I said above their effects are starting to make themselves felt – and that will become obvious in 2023.

Prices are rolling over and will continue to do so. Because the Fed will be forced to terminate its rate hiking cycle soon inflation may not get down to its 2% target – but runaway inflation is off the table for now. The precious metals should continue to perform well but gold bug nirvana will remain a fantasy of permabear Cassandras.

BONDS WILL OUTPERFORM: As the economy and prices roll over the move into bonds will accelerate. Long term bonds have bottomed and moved up nicely of late – but the move is just getting started. TLT will be a monster in 2023.