A Housing Double Dip?

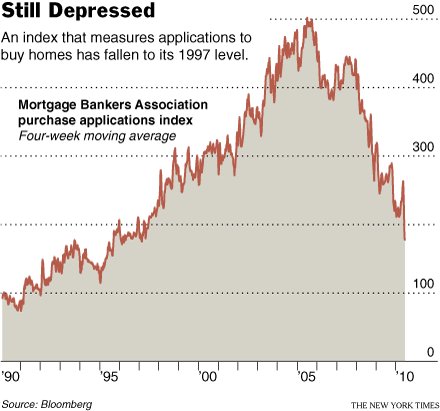

Everyone expected the housing market to suffer at least a temporary hangover after the government’s $8,000 tax credit expired, but not necessarily this much. Preliminary data from around the country indicates that the housing market began swooning last month immediately after the credit was no longer available. In some places, sales dropped more than 20 percent from May 2009, when the worst of the financial crisis had subsided.

– “Housing Market Slows As Buyers Get Picky”, David Streitfeld, The New York Times, June 17, A1

Also pertaining to a potential double dip, homebuilder sentiment dipped 5 points to 17 in June and Toll Brothers (TOL) yesterday said that activity has slowed the last three weeks.

Also see: “NYT: Spurt Of Home Buying As End Of Tax Credit Looms”, Top Gun FP, March 30, 2010. Key quote from that article:

If you have a short-run program to stimulate demand, it’s always tricky to figure out how you gently remove it without going off a precipice.

– James Poterba, Economics Professor, M.I.T.

“Top Gun FP Client Note: The Lesson Of Cash For Clunkers”, Top Gun FP, October 6, 2009