A Divergence Between The NASDAQ and The S&P, The Reopen Trade Has Gotten Ahead of Itself: MAR & SPG

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

A very important divergence is taking place in markets between the tech led NASDAQ and the broader market as represented by the S&P 500. While the S&P continues to power ahead, tech and the NASDAQ are breaking down.

This bifurcated market was on illustration Monday as you can see in the above tweet of the performance of stocks in the S&P by Mansi. Big Tech, as represented by the stocks in the upper left of Mansi’s chart, got hit hard, while most Value, as represented by the stocks in the lower right of Mansi’s chart, were green on the day.

Another way of making the same point is that the iShares S&P 500 Value ETF (IVE) was essentially flat (-0.02%) on the day while the iShares S&P 500 Growth ETF (IVW) was -1.95%. The largest components of the Value ETF are stocks like Berkshire Hathaway, The Big 4 Banks (JP Morgan, Bank of America, Wells Fargo and Citigroup), Walt Disney, Johnson & Johnson and Pfizer, Verizon and AT&T and Walmart and Procter & Gamble. The largest components of the Growth ETF are the Big 5 (Apple, Microsoft, Amazon, Google, Facebook) and other big, popular tech names like Tesla, Nvidia, Paypal and Netflix.

This is not a one day thing. As you can see in the charts in the tweets by David Zarling and the Equilibrium above this divergence has been occurring basically since the beginning of 2021. This is extremely important as Tech as represented by the QQQ has led this bull market from the very beginning going all the way back to 2009 as you can see in the 20+ year chart showing the ratio of the QQQ to the SPY by the Equilibrium. It is being disguised by the strength in the S&P which contains a representative mix of stocks but should not be overlooked. Whether the S&P can continue to power ahead for too much longer without its generals is a big question mark.

The question takes on added urgency as the value led Reopen Trade appears to me to have gotten ahead of itself. This was on display in two earnings reports from Marriott (MAR) and Simon Property Group (SPG) on Monday.

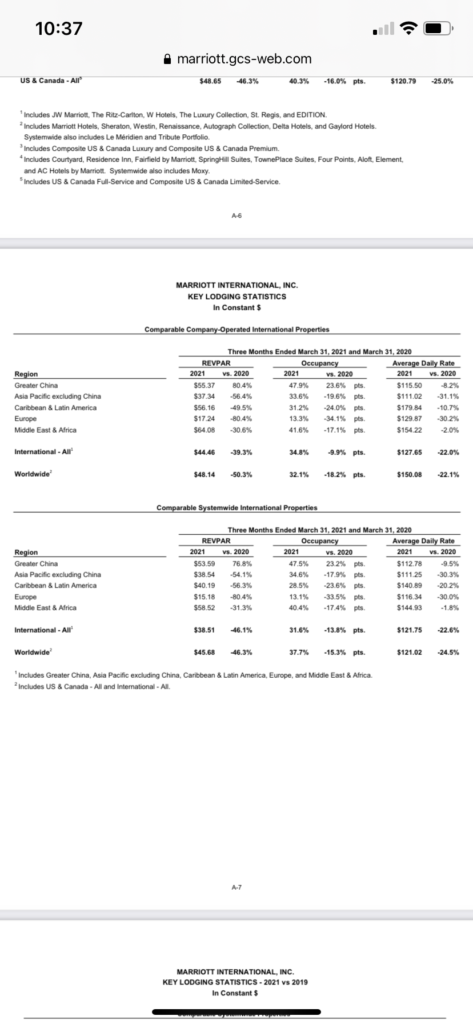

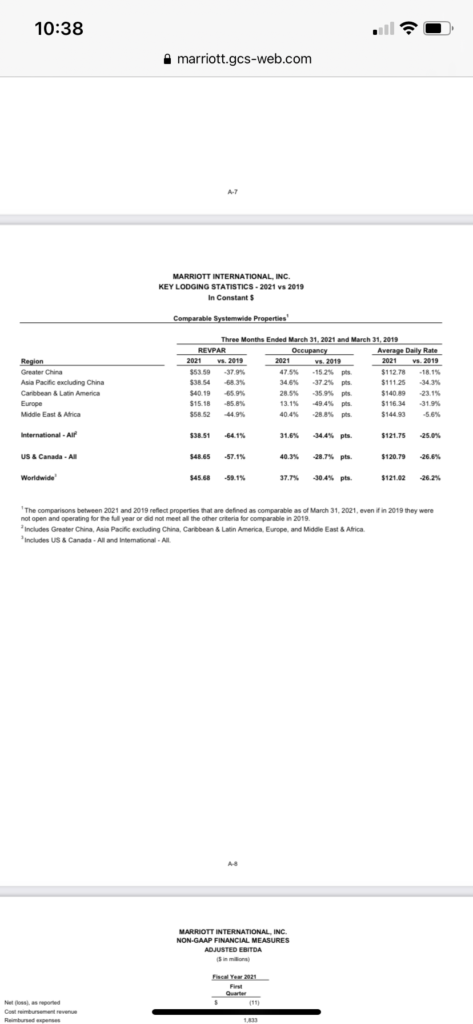

Let’s start with Marriott (MAR, Market Cap $46 Billion). With 7,662 properties and 1,429,171 rooms worldwide, Marriott is a bellwether of international travel. And what their report Monday morning showed is that international travel is very far from 1Q20 levels, much less 1Q19. Take a close look at the first table above. What it shows is that Revenue per Available Room or REVPAR, the key metric in the hotel industry, for 1Q21 was -46.3% compared to 1Q20. Occupancy was -15.3% and Average Room Rate -24.5%. Take a look at the second table above and you can see that things are even worse when compared to 1Q19. REVPAR was -59.1% consisting of a 30.4% decline in Occupancy and a 26.4% decrease in Average Room Rate. However, if you look at the stock chart, the stock is essentially already back to its February 2020 highs! In other words, MAR stock is running way ahead of its fundamentals and trading mostly on narrative.

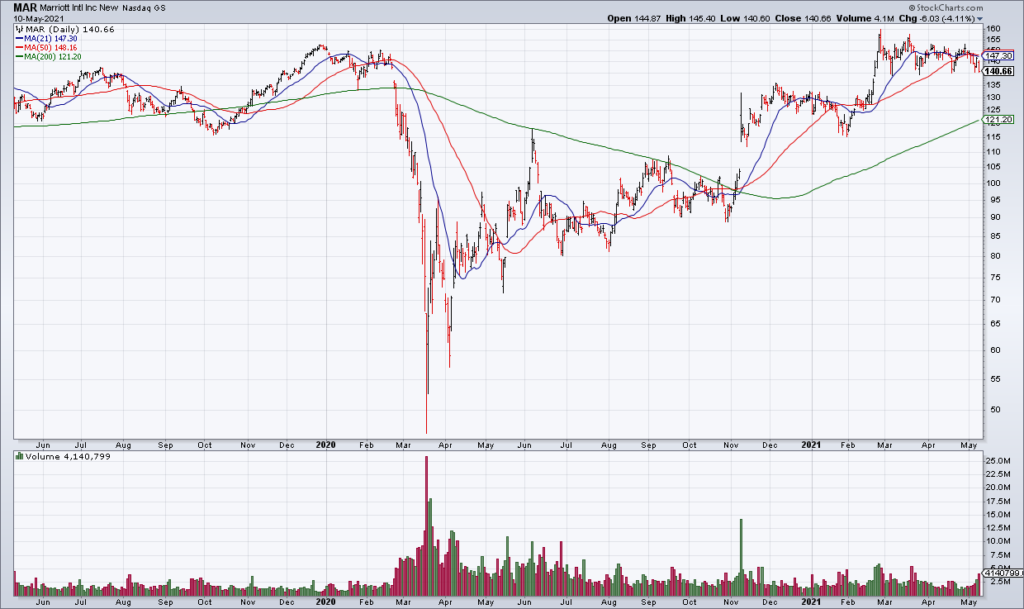

The same kind of thing, though perhaps not to the same degree, applies to mall operator Simon Property Group (SPG, Market Cap $48 Billion). With 167 malls and outlets totaling 141.1 million square feet in the United States and more internationally, SPG is a bellwether of brick and mortar shopping. While improving, revenue was -8.4% and Funds From Operation (FFO), the key metric for REITs, -10.8% compared to 1Q20. SPG did not provide a comparison to 1Q19 so I gathered the data and did the calculations myself. Revenue was -14.7% and FFO -18.4% compared to 1Q19. While things appear to be closer to the previous peak for SPG than MAR, a look at the stock chart shows that this is already essentially completely priced in. Again, while to a lesser degree, SPG stock is running ahead of its fundamentals and trading on narrative.

When you combine the breakdown in Tech, which has led this bull market since 2009, with the fact that the value led Reopen Trade appears to be ahead of the fundamentals and trading to a great extent on narrative, the bull market seems to be on quite shaky ground to my skeptical eyes.