Bill Smead: Read Between The Lines: Buffett Is As Bearish As He’s Ever Been

I am not attuned to this market environment and I don’t want to spoil a decent record by trying to play a game I don’t understand – Warren Buffett, Letter To Partners announcing the closing of the original Buffett Partnership, May 29, 1969

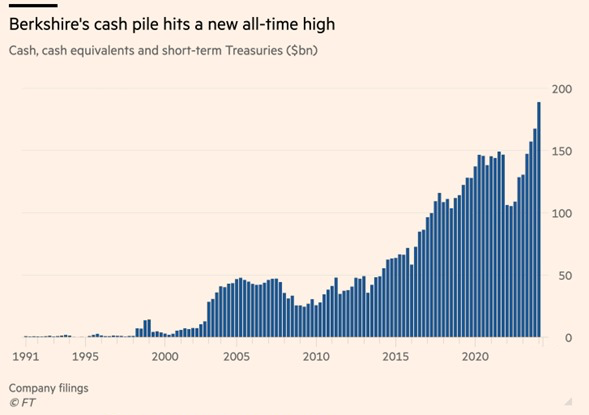

Bill Smead did a terrific interview on CNBC on Monday that I encourage everyone to watch. Smead – a true value investor and longtime Buffett disciple – said that if you read between the lines you can conclude that Buffett – who would never say so explicitly – is as bearish as he’s ever been. He cut his Apple (AAPL) stake by 13%, Berkshire’s cash position has risen to $189 billion and he sees few opportunities to deploy it, etc… Smead compared Buffett’s outlook now with the one he held towards the end of the 1960s when he also saw few opportunities and shut down his original investment partnership.

Many people will walk in and out of your life but only true friends will leave footprints on your heart – Eleanor Roosevelt

In the last part of the interview, Smead references the main difference between Buffett in 1969 and Buffet today. In 1969, Buffet was a Ben Graham-style value investor looking for quantitatively cheap stocks. Today, Buffett is a value investor looking for “wonderful companies at a fair price” not the “fair companies at a wonderful price” that he favored 45 years ago.

The man most responsible for that transformation is Charlie Munger. As Buffett himself has been quite candid about, he never would have had the success he has without the influence of his best friend (see my “Munger: The Man Behind Warren Buffett’s Rise To Greatness”, November 29, 2023). A true friend accepts you for who you are but also helps you become who you were meant to be.