The Return Of Higher For Longer, DLTR: A Tale Of Two Economies

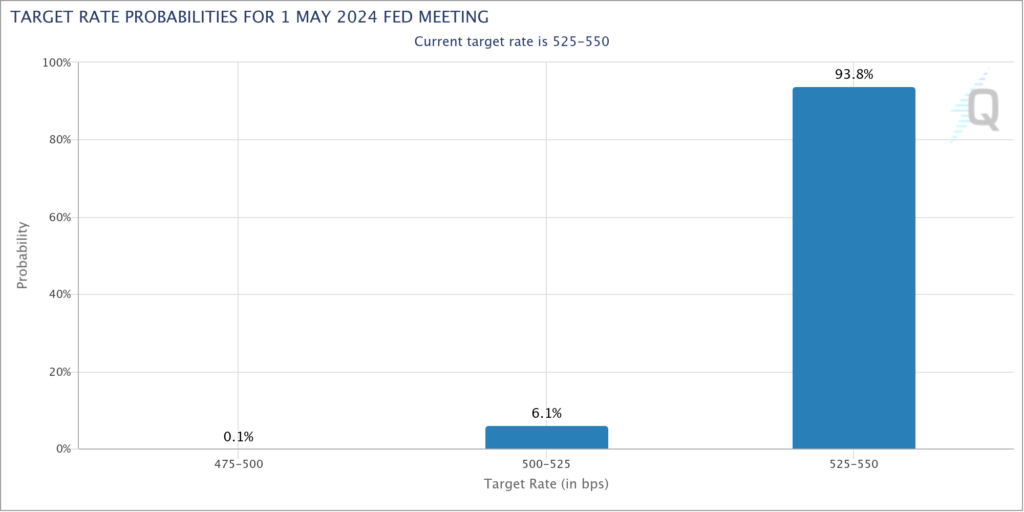

As markets have digested the slightly hotter than expected February CPI on Tuesday morning, the idea of sticky inflation has started to take hold and the debate about the timing of the first rate cut pushed back to June. A week ago the probability of a May cut was 25% but now it’s only 6%.

You’d think this would be bearish for stocks but the market has held up well in the wake of the report. Aaron Back sized things up nicely in this morning’s WSJ arguing that it’s possible to have a strong economy and stock market in a higher rate environment (“Higher-for-Longer Rates Have A Silver Lining” [SUBSCRIPTION REQUIRED]). I’m positioned the other way – but I’ve been wrong.

At the same time that the stock market levitates, the lower class is struggling as evidenced by Wednesday’s earnings report from Dollar Tree (DLTR) and comments from McDonald’s (MCD) CFO at an investor conference. DLTR is composed of the Dollar Tree and Family Dollar chains. Dollar Tree stores are mostly in suburban areas and cater to a more middle class clientele. The problem is Family dollar whose stores are more concentrated in urban locations and caters to a lower class population. 4Q comps were +6.3% at Dollar Tree but declined 1.2% at Family Dollar. As a result, DLTR is going to close about 1,000 Family Dollar locations (see Will Feuer, “Dollar Chains To Close 1,000 Stores” [SUBSCRIPTION REQUIRED], WSJ B1, 3/14). DLTR shares fell 14% on heavy volume Wednesday. Rival Dollar General (DG) – which also caters to a lower class clientele – seems to be doing just fine however, guiding 2024 comps to +2.0% to +2.7% in its 4Q23 earnings report earlier this morning.