The Stock Market Is Priced For Perfection, FDX -11% Premarket

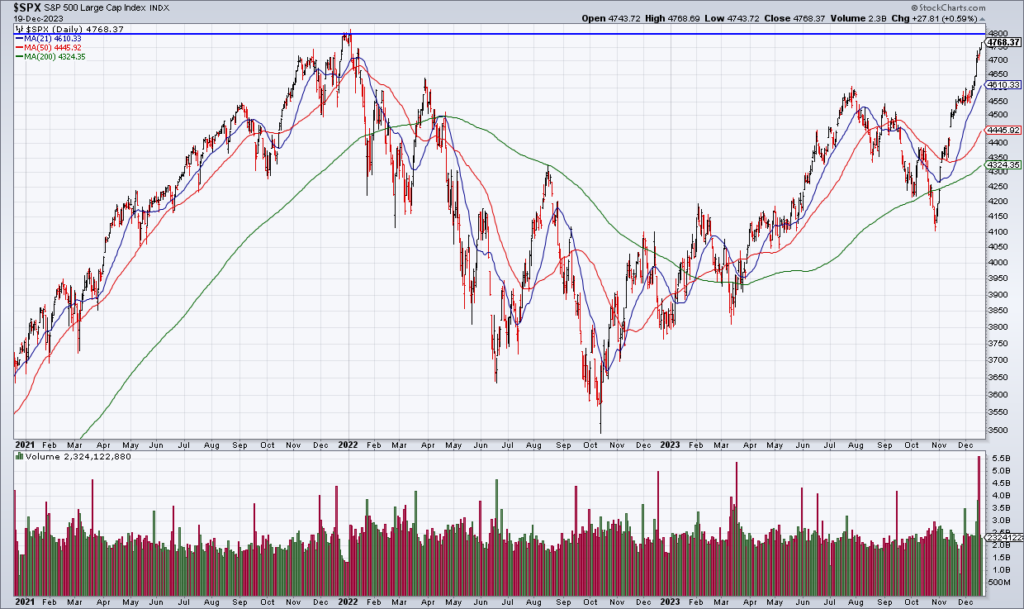

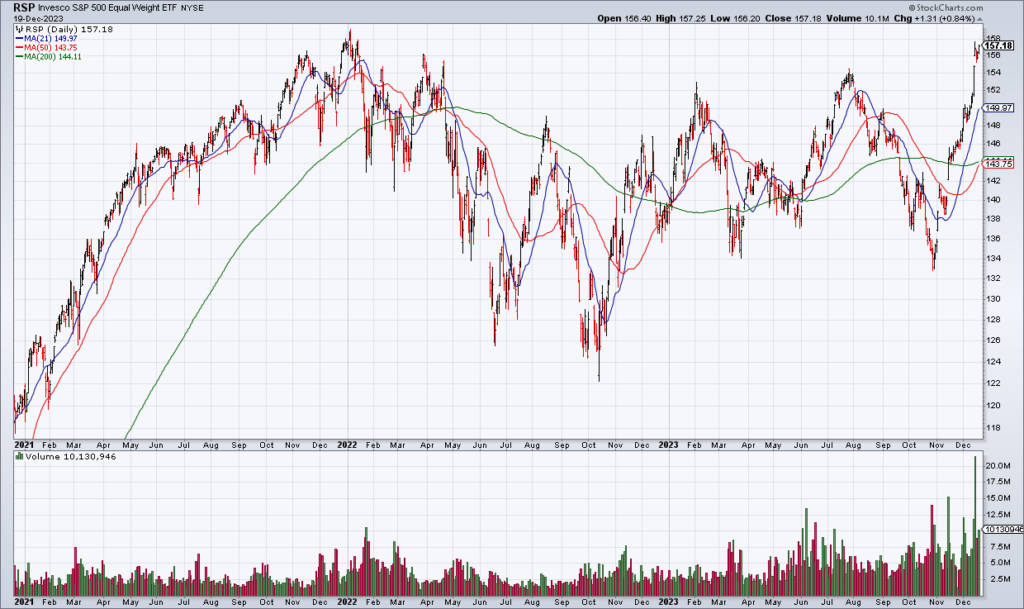

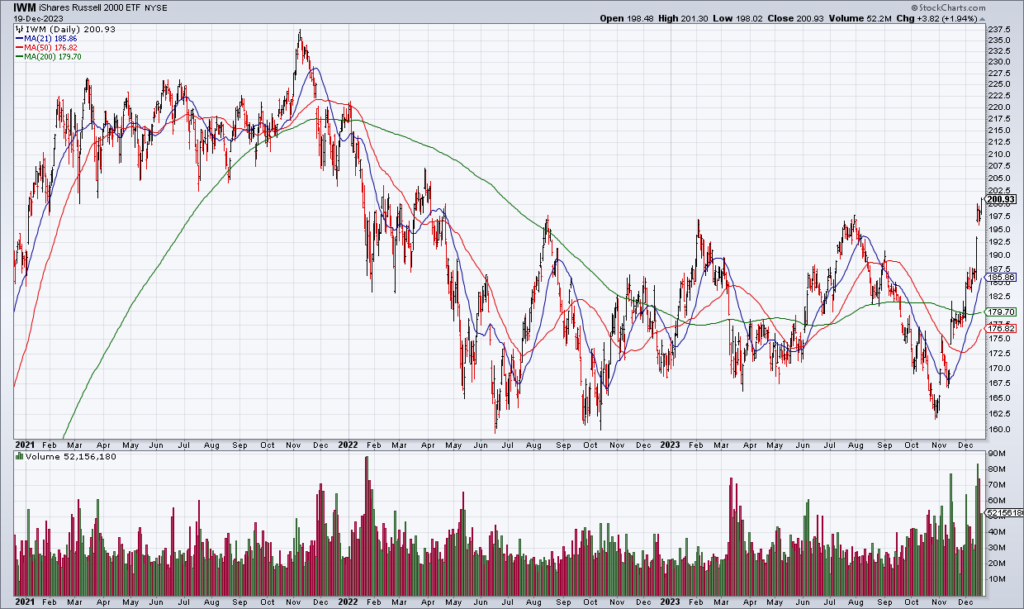

To be honest, it’s hard to find reasons to be bearish on stocks right now. The Federal Reserve essentially declared “Mission Accomplished” in its war against inflation last Wednesday. And they appear to have accomplished this without tipping the economy into recession setting up the proverbial soft landing. The Magnificent 7 masked a lot of underlying weakness in the market for most of the year, but the Equal Weight S&P (RSP) and Russell 2000 (IWM) have roared higher in recent weeks – negating that technical argument. The S&P is less than a percent away from an all time closing high. Ed Yardeni thinks the S&P will reach 5400 by the end of 2024 and 6000 by the end 2025. What could possibly go wrong?

One concern that I’ve belabored repeatedly is that all the Fed’s previous hiking is yet to make its full effect on the economy and that will be felt in 2024. Certainly the Fed Pivot reduces the likelihood of them going too far but it’s still possible that they already have. But with the moves we’ve seen in markets right now, another concern is that stocks are simply priced for perfection. That is, with everything levitating on this Goldilocks narrative, all the good news is already priced in. There’s a lot of FOMO and nobody wants to miss out or be run over by this market but this kind of best of all possible worlds environment engenders caution in my skeptical nature. Sometimes when it’s as good as it gets, that’s as good as it gets. In other words, we may be at the moment of maximum optimism.

The stock in focus Wednesday morning is Federal Express (FDX). FDX is considered by some – like former Fed Chair Alan Greenspan – an economic barometer and the stock is currently -11% in the premarket after reporting earnings Tuesday afternoon. I studied the report and it didn’t look horrible to me. Express volume was -2% on top of -12% a year ago – but the Express division has been having issues for a while now. Overall revenue was -3% and they marginally lowered FY24 revenue and EPS guidance. Bears are grasping onto this report and certainly astute bulls should be concerned. A year ago I latched onto a big negative preannouncement by FDX and assumed that it means a recession was on its way – and was wrong. So this is just a piece of the mosaic not a logically tight argument that things are falling apart. But it is a piece and it will surely get a lot of discussion today.