Market Preview Week Of Jan 30-Feb 3: The Fed And Big Tech Earnings

Get your beauty sleep this weekend because next week is poised to be epic. In addition to a Fed Decision on Wednesday, we have Big Tech earnings.

The market ramped up last week with the S&P breaking out above its 200 Day Moving Average (DMA) – the most widely watched indicator in Technical Analysis. Many investors believe you should be long when the market is above its 200 DMA and bearish when it is below it. And we are on the verge of a Golden Cross in which the 50 DMA breaks through the 200 DMA from below. If this occurs, the technicians will go from extremely bullish to euphoric. (Of course, if the rally fails, they will just say it was a “false breakout”. How are you to invest based on such a methodology?).

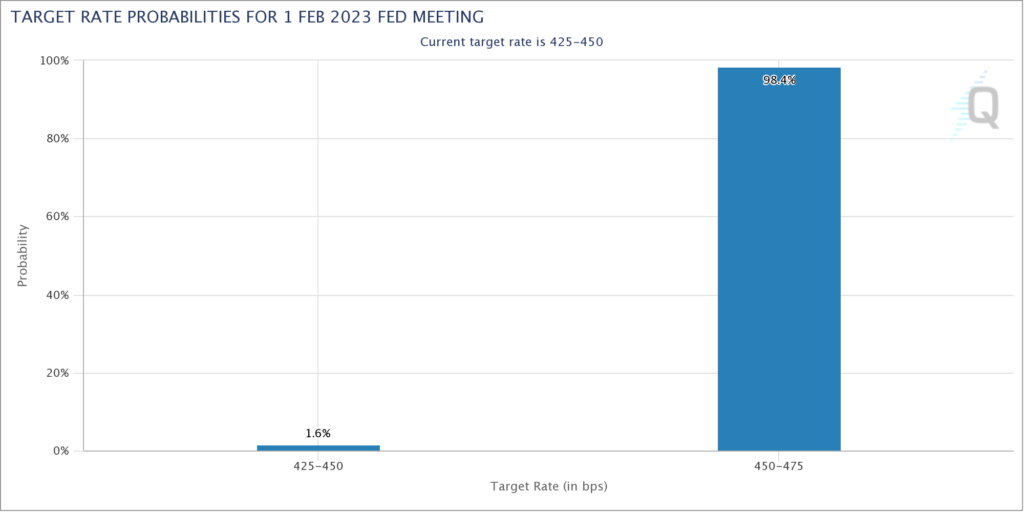

Personally I’m leaning bearish heading into next week because – while the Fed will raise 25 basis points on Wednesday – Fed Chair Powell may well throw cold water on the market in his post statement press conference. He’s likely to be hawkish – expect to hear “higher for longer” – as he doesn’t want stocks to ease financial conditions too much.

In addition, Big Tech has run up into earnings creating a higher bar. For example, META – which reports Wednesday afternoon – is up about 70% in the last three months. Their report better be good or else the stock is at risk of rolling over.

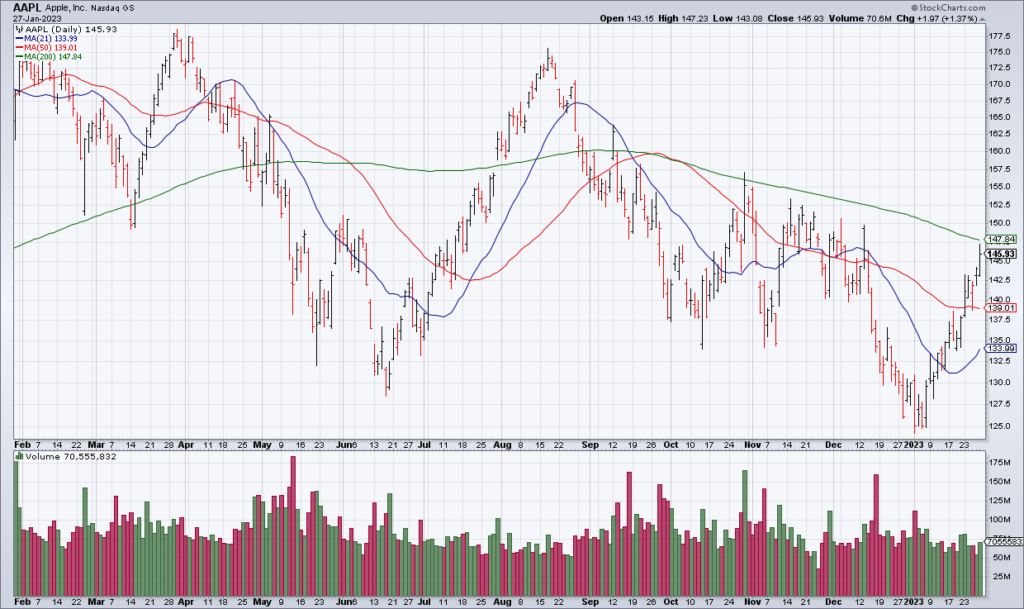

On Thursday afternoon, AAPL AMZN and GOOG/GOOGL all report 4Q22 earnings. Those three stocks represent nearly $5 trillion in market capitalization and dominate the performance of the major indexes because of their size. Get your popcorn ready.