Blowout Big Tech Earnings: AAPL, MSFT, GOOG/GOOGL, FB

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

This week is the biggest earnings week of the season. All of the Big 5 (APPL, AMZN, MSFT, GOOG/GOOGL, FB) have/are reporting as well as many other important companies. In this morning’s blog, I’m going to focus in on the incredible earnings posted by Apple (AAPL), Microsoft (MSFT), Google (GOOG/GOOGL) and Facebook (FB). (Amazon (AMZN) reports this afternoon and I’d expect similar blowout results based on what we’ve seen). To get as clear a look as possible at the strength of Big Tech’s earnings, I think the best strategy is to compare them with 1Q19 to avoid any distortions resulting from the impact of COVID which started to impact the global economy in 1Q20.

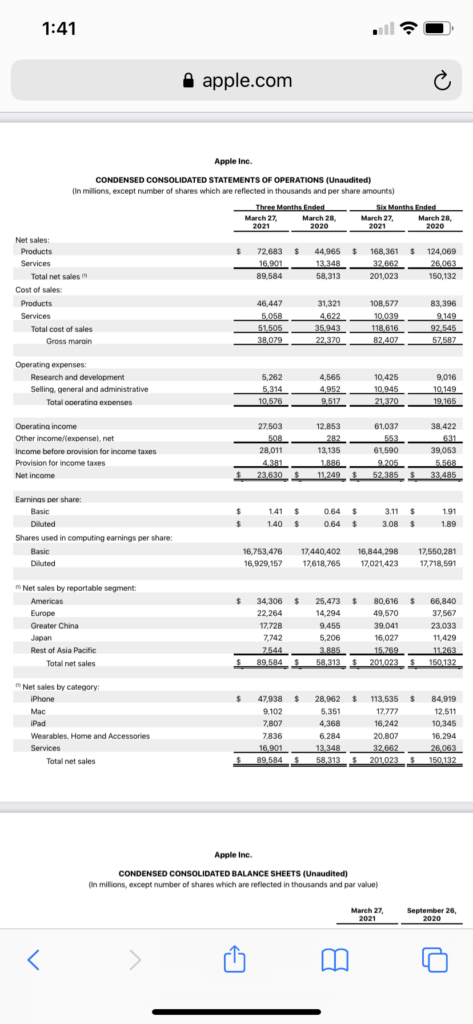

Let’s start with the most important stock in the market, Apple (AAPL). With a market cap of $2.27 trillion at yesterday’s (Wed 4/28) close, movements in AAPL have an outsized impact on the market cap weighted S&P 500 and NASDAQ. AAPL reported a monster quarter with Revenue of $89.6 billion and Net Income of $23.6 billion or $1.40/share. Those numbers are +54%, +104% and+128% compared to 1Q19. (EPS growth is notably higher than Net Income growth because AAPL has bought back almost 2 billion shares since 1Q19).

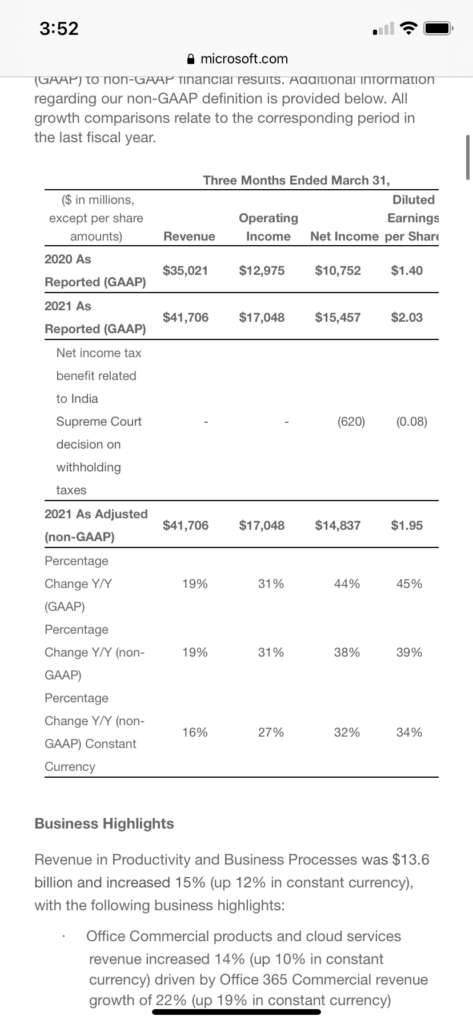

Let’s move on to Microsoft (MSFT). With a market cap of $1.93 trillion, MSFT packs quite the punch. While its earnings from Tuesday afternoon (4/27) were not well received with the stock down about 3% yesterday, the numbers appeared phenomenal to me. Revenue of $41.7 billion and Diluted EPS of $1.95 were +36% and +71% compared to 1Q19.

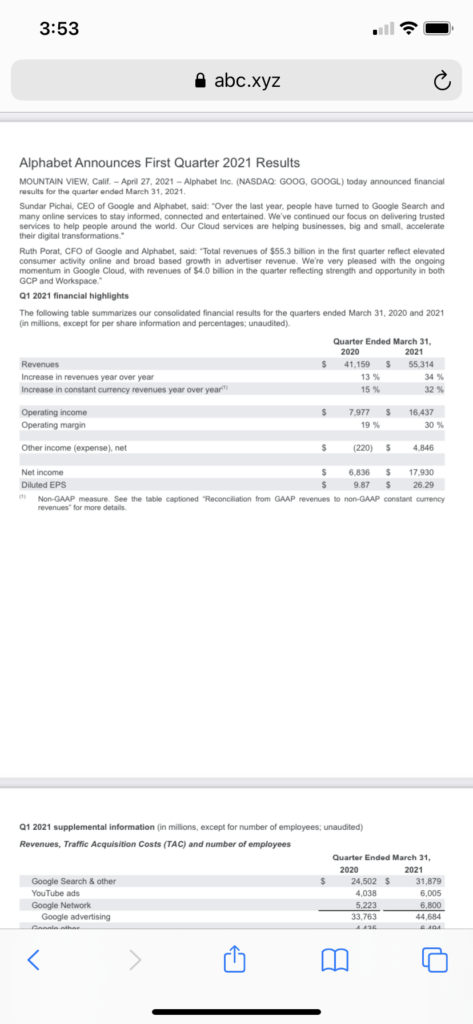

Next up: Google (GOOG/GOOGL – I refuse to call it Alphabet!). With a market cap of $1.6 trillion GOOG/GOOGL is obviously a major player. Revenue of $55.3 billion and EPS of $26.29 were +52% and +121% compared to 1Q19.

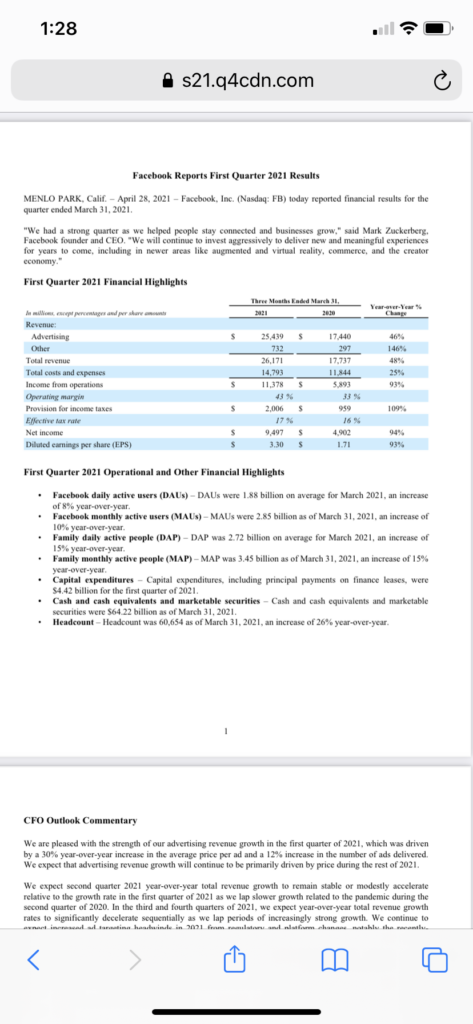

Last, let’s take a look at the baby Facebook (FB) with a market cap of only $885 billion. FB did not disappoint with Revenue of $26.2 billion and Diluted EPS of $3.30 – +74% and +75% compared to 1Q19.

On the back of AAPL and FB’s blowout earnings yesterday afternoon, the Futures are roaring this morning with NASDAQ Futures up more than 1% and S&P Futures almost 0.70%.