Investors Are All In With A Weak Hand

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

I could’ve been a contender. Forgive me my nostalgia but everybody who knows me hears this story at one point or another. For those of you who don’t know, I’m a professional caliber poker player with 15 years of experience. This March, right before everything shutdown due to COVID, I played in the $5250 Bay 101 Shooting Star Texas Hold ‘Em No Limit poker tournament in San Jose, CA. On Day 1, I played with well known pros like Loni Harwood and James Carroll.

The tournament drew about 300 players and I was sitting with a solid 50 BB stack in the BB with 39 players left in the middle of Day 2 when Chino Rheem raised. Darren Elias, the former #1 player in the world according to the Global Poker Index (GPI), raised from the SB ((Both Chino and Darren are Top 10 World Poker Tour Players of the Decade according to Tournament Director Matt Savage (Source: Matt Savage, “Darren Elias Is The World Poker Tour Player of the Decade”, January 8, 2020)). I looked down at QQ.

Chino is hyper aggressive so Darren could very easily be re-raising light i.e. with a less than premium hand. Even if he wasn’t, there were many value hands in his range I could beat like 1010 JJ and AQ. It was a no brainer: Go All In. I shoved, Chino folded, Darren called with an equivalent stack and AK and there was monster pile of chips in the middle when an Ace came on the flop. My dream of winning my home tournament, the most prestigious in the Bay Area, would have to wait for another year. Fortunately, my friend Pat Lyons, WPT and WSOP Champion and Bay Area Poker Legend, was there to console me and confirm that I’d made the right play (For an excellent piece on Pat’s larger than life personality, see Jeff Walsh “From Banned to WSOP Bracelet: The Return of “World Famous” Pat Lyons”, July 24, 2020).

The stock market is euphoric right now. A lot of people are extrapolating fro the recent past and going, ‘Wow, the market’s gone up a lot and I think it’ll go up more.’ We’ve seen this play out before, and it doesn’t end well – James Angel, Professor of Finance, Georgetown University (quoted in “Margin Debt Reaches a Record”, Michael Wursthorn, WSJ C1, Monday December 28 [SUBSCRIPTION REQUIRED]).

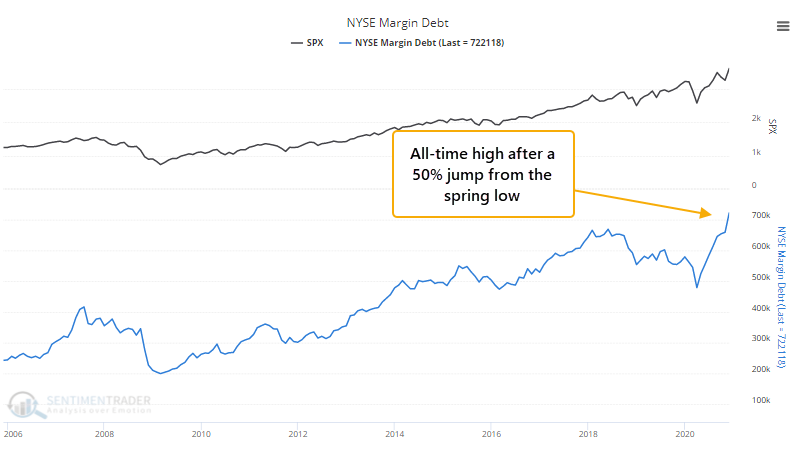

I tell this story now because investors are All-In and they don’t have anything like QQ. One measure of investor sentiment is Margin Debt which hit an all time high in November of $722 billion (Chart Sources: “Margin debt, and other leverage, hits record high”, Sentimentrader, December 28).

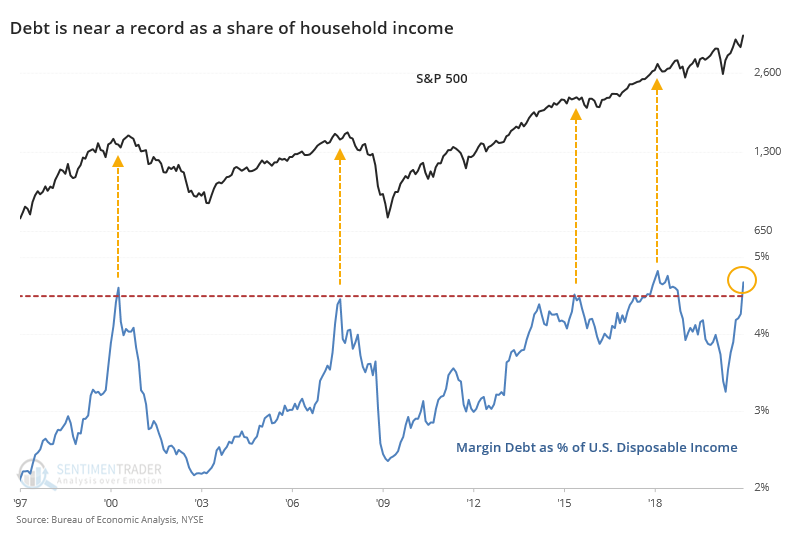

This can be looked at from a number of angles. First, let’s look at Margin Debt as a % of Disposable Income. 4.5% seems to be the threshold here correlating with market tops.

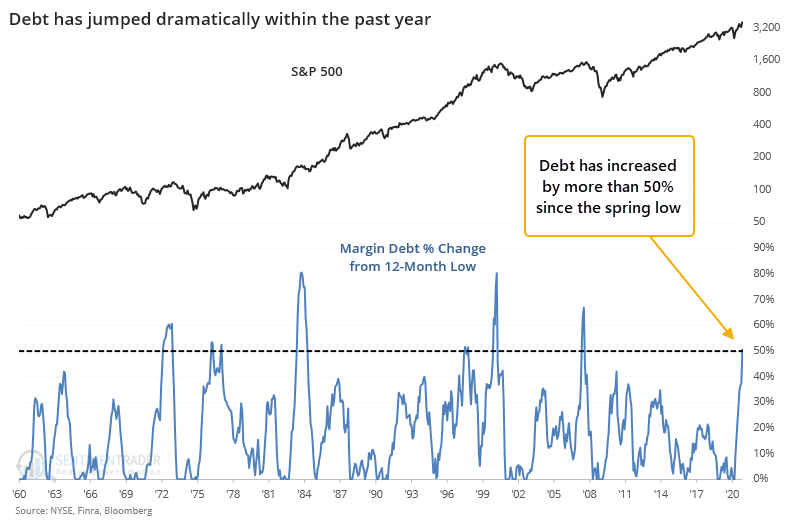

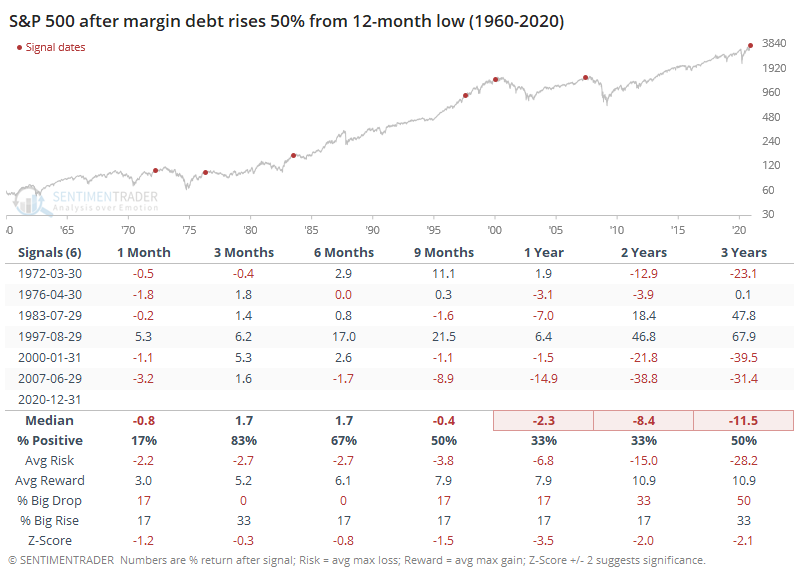

Another angle Margin Debt can be looked at from is its rate of change. What happens when Margin Debt increases 50% from a low in the previous 12 months?

Notice how we last saw this kind of rush into margin in 2007 and 2000 – the tops of the last two bubbles. In fact, it’s happened six times since 1960 with three significantly negative outcomes 3 years later, 2 significantly positive ones and one flat. The previous two signals were triggered in June 2007 and January 2000.

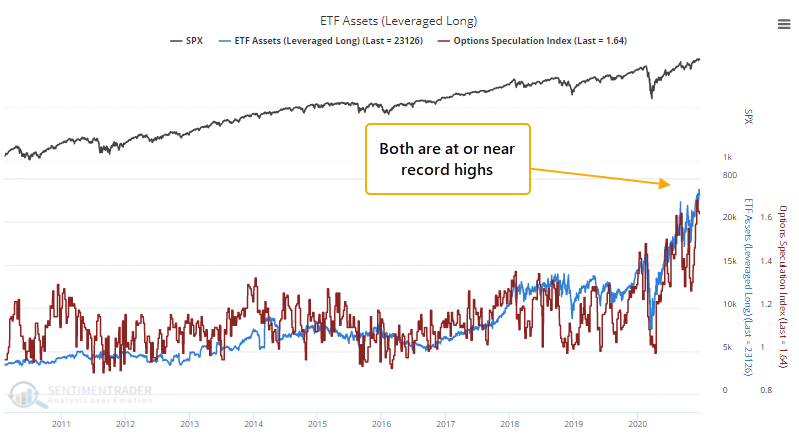

In addition to speculating on margin, investors are buying leveraged long ETFs and call options at levels we’ve never seen before.

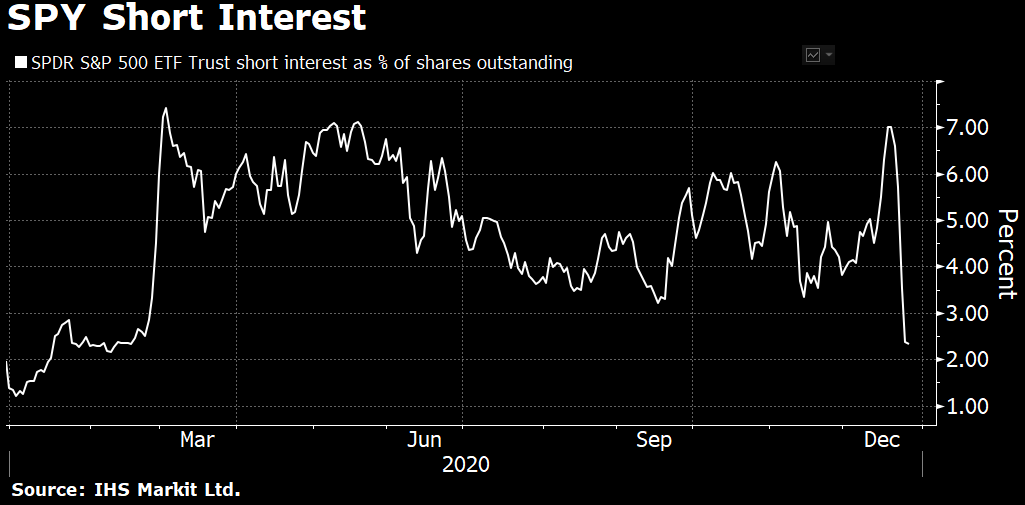

On the other hand, Short Interest in the SPY, and almost all stocks presumably, has plummeted of late (Chart Source: Sarah Ponczek Twitter, December 28, 7:14am PST).

So: Investors are All In. Nothing wrong with that. I go All In when the time is right too. The problem is they don’t have AA, KK, QQ or any other premium hand. As I showed recently, this is the most overvalued market in history (“The Most Overvalued Market In History”, Top Gun Financial, Wednesday December 23, Section 1).

In other words, if you’re extremely long this market, especially the hottest stocks and ETFs, Clint Eastwood is pointing his Magnum 44 at your head with either one bullet left or none and asking you “Do you feel lucky punk? Well do you?”