Bull Markets Don’t Last Forever

*****

A number of factors have coalesced in recent weeks that merit attention.

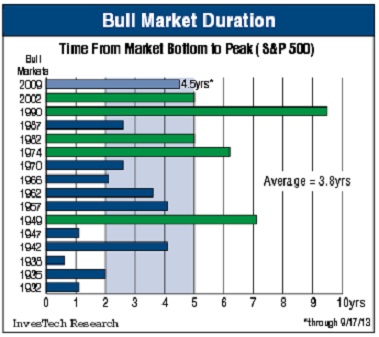

First, consider the overall context. We are now almost 5 years into one of the greatest bull markets in history. Bull markets don’t last forever. According to Jim Stack of Investech, the average bull market since 1932 lasts 3.8 years. Odds are that we are in the later stages of this one.

Third, Twitter (TWTR) stock has been heavy in the wake of its highly anticipated IPO. It closed at $41.72 on Friday – well below its $45.10 open on Thursday morning. This may be another tell that momentum is waning.

Finally, Thursday’s selloff was broad and deep with NYSE Composite Volume over 4 billion shares for the first time in quite a while. It is worth noting that this took place on the day of Twitter’s IPO. A follow through day of heavy selling in the next week or so would further confirm the beginning of at least a correction.

In sum, most of the news has been good in recent weeks, but stocks have reacted poorly suggesting that it may all be priced in at this point. If an accommodative Fed, solid earnings and a blockbuster IPO can’t propel this market higher, what will?

(916) 224-0113