In the three weeks since the start of our third quarter on May 1st, which coincided with the expiration of the homebuyer tax credit, our per community deposits and traffic were up 23% and 11%, respectively, over last year’s comparable period.

– Robert Toll, CEO, Toll Brothers,

May 26

In the three weeks following our earnings conference call on May 26, 2010, our per-community deposits have been running about 20% behind the comparable period in last year’s third quarter and our per-community traffic has been running about 3% behind. Thus, for the first six weeks of our FY 2010 third quarter beginning May 1, 2010, we are slightly ahead of last year’s third-quarter pace of contracts signed on a per community basis.

– Joel Rassman, CFO, Toll Brothers,

June 16

Everyone expected the housing market to suffer at least a temporary hangover after the government’s $8,000 tax credit expired, but not necessarily this much. Preliminary data from around the country indicates that the housing market began swooning last month immediately after the credit was no longer available. In some places, sales dropped more than 20 percent from May 2009, when the worst of the financial crisis had subsided.

About 8 months ago I wrote about the lesson of cash for clunkers (

“Top Gun FP Client Note: The Lesson Of Cash For Clunkers”, October 6, 2009). The governments Cash For Clunkers program, meant to stimulate the new car market, gave subsidies to buyers who traded in old cars for newer ones with better gas mileage.

The program caused a surge in new car sales in August 2009. However, when the program ended, new car sales collapsed the following month. All Cash For Clunkers did was pull sales forward and divert spending from other areas of the economy. It gave a short term kick to the new car market but not a sustainable recovery.

Now, there are inklings that the same thing is occuring in the housing market as the $8,000 federal 1st time homebuyer tax credit expired on April 30. On Wednesday, Toll Brothers oddly reversed itself saying that per-community deposits were DOWN 20% the last three weeks compared to the year ago period. Just three weeks ago CEO Bob Toll said that per-community deposits for the first three weeks of the quarter were UP 23% from the year ago period. Obviously, Toll Brothers has seen a real change in buying behavior in just the last three weeks.

Toll Brothers (TOL) shares are off 6% Thursday and Friday. The S&P Homebuilders (XHB) are off more than 3% as well.

(It is worth noting that Toll sells higher-end homes to buyers that are generally not 1st time buyers. Toll attributes the drop to a decline in consumer confidence as a result of the turmoil in Europe, the BP oil spill and the decline in financial markets, not the expiration of the tax credit).

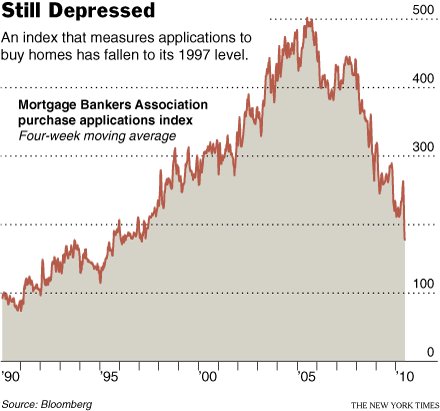

The New York Times ran a front page story yesterday on a decline in housing transactions since the expiration of the tax credit. The data is muddied since buyers who are in contract but don’t close until May or June can still claim the credit. Those sales will show up in May or June so the real effects of the expiration won’t be seen until later in the summer. But already mortgage applications have dropped precipitously.

Notably, the decline is not being seen in California. DataQuick, a real estate information provider, came out this week with median price and volume data for

Sacramento,

the Bay Area,

San Diego and

Los Angeles. All of those regions had a strong May with surging volume on higher prices. However, California is operating on a different dynamic from the rest of the country due to the new California 1st time homebuyer tax credit that went into effect on May 1.

The data is not definitive but it caught my attention and I will be keeping an eye on it.

*****

Financial markets have rallied the last two weeks but there continues to be a high level of concern about the potential for a double dip in the economy. The Wall Street Journal ran an interesting front page story on Tuesday about the Federal Reserve’s contingency planning for such an event (

“Fed Officials Weigh Growth Risks”, Jon Hilsenrath,

The Wall Street Journal, June 15, A1).

The Fed won’t make any changes to policy or the statement next week but the article says that they will be discussing the emerging challenges and some possible responses behind the scenes:

The Fed’s official posture is unlikely to change when policymakers meet June 22 and 23: The U.S. central bank is expected to leave short-term interest rates near zero and signal no inclination to change that for a long time.

But behind-the-scenes discussions at the meeting could include precautionary talk about what happens if the economy doesn’t perform as well as expected.

“If events in Europe evolve so that they have a more severe and broad impact on financial markets, then the scope of the problems for the U.S. could be magnified,” Charles Evans, president of the Federal Reserve Bank of Chicago, said in a speech last week.

SPECIAL OFFER – FREE INVESTMENT REVIEW: For a limited time I am offering a free investment review. Pick any stock, bond, ETF or mutual fund. I will do a comprehensive fundamental/macro/technical analysis, write a concise analyst report, and consult with you for 30 minutes by phone or in person for free.

Greg Feirman

Founder & CEO

A Registered Investment Advisor

9700 Village Center Dr. #50H

Granite Bay CA 95746

(916) 224-0113

CALL NOW FOR A FREE INVESTMENT REVIEW!