BeSpoke: Analysts Most Bullish In Two Years

(Source: “Analysts At Most Bullish Level In Two Years”, BeSpoke Investment Group, October 7)

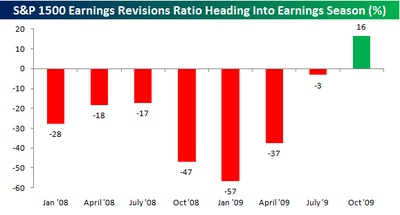

Very interesting chart from BeSpoke Investment Group. The chart measures up changes versus down changes in analysts earnings estimates in the four weeks preceding the last eight earnings season for the S&P 1500. They take the net number and divide it by 1500 to get a percentage. So, for example, analysts have raised estimates for 638 companies in the S&P 1500 over the last four weeks and lowered estimates for 391 companies for a net 247 raises. That’s 16.5% of the total index; hence the 16% bar on the chart.

This is the first time in the last eight earnings seasons in which estimate increases have outnumbered estimate decreases – and the margin is pretty significant. This suggests the analyst community has gotten on board the recovery and is pretty bullish. That means expectations for this earnings season are notably higher than they have been in recent quarters. That means companies are going to have to report better numbers to keep this rally going.