Interesting Excerpts From Bernanke’s Jackson Hole Speech

Bernanke gave a speech this morning in Jackson Hole, Wyoming: “Reflections on a Year of Crisis”. Here are some interesting excerpts with my commentary:

TOO BIG TO FAIL:

The Federal Reserve has consistently maintained the view that the disorderly failure of one or more systemically important institutions in the context of a broader financial crisis could have extremely adverse consequences for both the financial system and the economy. We have therefore spared no effort, within our legal authorities and in appropriate cooperation with other agencies, to avert such a failure.

Too big to fail is now Fed doctrine. So much for creative destruction and failure (“Capitalism without failure is like religion without sin” – Allan Meltzer).

ON LEHMAN BROTHERS:

The case of the investment bank Lehman Brothers proved exceptionally difficult, however. Concerted government attempts to find a buyer for the company or to develop an industry solution proved unavailing, and the company’s available collateral fell well short of the amount needed to secure a Federal Reserve loan of sufficient size to meet its funding needs. As the Federal Reserve cannot make an unsecured loan, and as the government as a whole lacked appropriate resolution authority or the ability to inject capital, the firm’s failure was, unfortunately, unavoidable.

Bullshit. The Federal Government has shown a willingness to cross all kinds of lines and do whatever it takes when they feel the need to intervene or bailout. In retrospect, many have criticized the Fed for allowing Lehman to fail which they say caused the financial crisis last Fall. Bernanke is trying to rationalize his actions of Lehman by saying they had no choice and its failure was “unavoidable”.

MARKET FAILURE AND THE NECESSITY OF THE FED:

But liquidity risk management at the level of the firm, no matter how carefully done, can never fully protect against systemic events. In a sufficiently severe panic, funding problems will almost certainly arise and are likely to spread in unexpected ways. Only central banks are well positioned to offset the ensuing sharp decline in liquidity and credit provision by the private sector. They must be prepared to do so.

Interesting premise that in certain circumstances the private financial system will fail and the Fed is required to protect the system in these instances. So what if it does? Just let the chips fall where they will.

IT WOULD HAVE BEE WORSE WITHOUT BIG BROTHER:

As severe as the economic impact has been, however, the outcome could have been decidedly worse. Unlike in the 1930s, when policy was largely passive and political divisions made international economic and financial cooperation difficult, during the past year monetary, fiscal, and financial policies around the world have been aggressive and complementary. Without these speedy and forceful actions, last October’s panic would likely have continued to intensify, more major financial firms would have failed, and the entire global financial system would have been at serious risk. We cannot know for sure what the economic effects of these events would have been, but what we know about the effects of financial crises suggests that the resulting global downturn could have been extraordinarily deep and protracted.

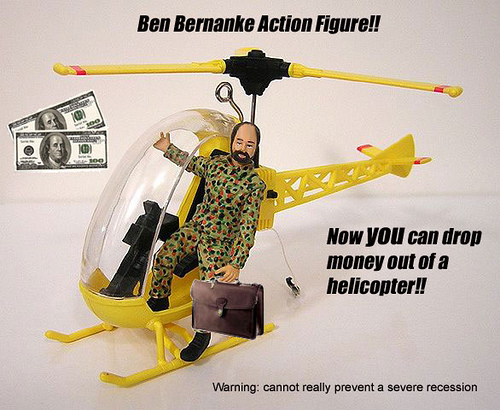

Bernanke: I am the Shiznit – which is also why I get my own action figure.

Uncle Ben: Shiznit

Uncle Ben, he’ll cut the rates,

And drop Ben Franklins in your face.

Uncle Ben don’t read Ayn Rand,

He’ll send gold to a thousand.

Uncle Ben the inflation hawk,

Dollar getting smaller than an Ewok.

Uncle Ben, his will will render,

A house of pain on foreign lenders.

Also see: “Judging Bernanke”, Top Gun FP, August 20, 2009