$27 Trillion In Debt And Rising Fast: Are Treasury Yields Heading To 5% Or 3%?

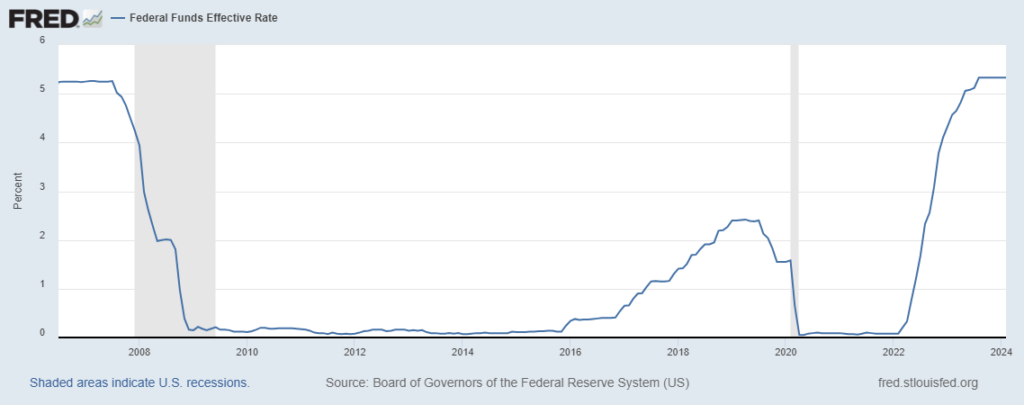

Interest rates matter. A lot. Depending on their level, interest rates can stimulate or restrict economic growth. The level of interest rates is also crucial in the valuation of financial assets.

Currently there is a lot of disagreement about where interest rates are going. The 10 year treasury currently yields 4.25%. Some investors see it going back to 5% where it peaked out last year – or even higher. Others see yields going lower. What are the arguments?

Jim Bianco – one of the sharpest financial commentators – is in the 5% camp. He believes the economy is weathering all of the Fed’s previous hikes just fine and there will be “no landing”. That is, the economy is going to be just fine. As a result, the Fed may not even cut rates at all this year. That would cause interest rates to head back up towards 5% – or even higher.

I’m of the opposite opinion. It’s a cliche that monetary policy acts with a lag – but it doesn’t seem to be this time. However, for various reasons, I think it’s taking longer for all of the Fed’s previous hikes to work their way through the economic system. When they do, it will hit the economy and interest rates will roll over toward 3%.

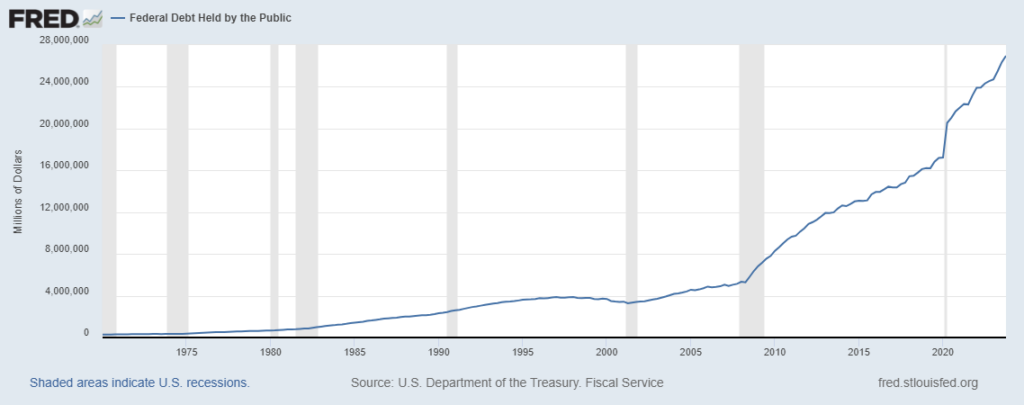

One concern I have, however, was laid out in a front page article in today’s WSJ by Eric Wallerstein (“The $27 Trillion Treasury Market Is Only Getting Bigger” [SUBSCRIPTION REQUIRED]). The federal government is running massive deficits and issuing tons of treasury to cover it. All that supply is putting pressure on treasury prices which are inversely related to interest rates. That is, lower bond prices mean higher interest rates. “Running a nearly $2 trillion deficit during a peacetime economic expansion – that’s a lot of bonds for the market to absorb”, said Stephen Miran, Adjunct Fellow at the Manhattan Institute and a former Treasury senior advisor.

While I am concerned about these huge deficits and massive debt in the long term, I’m more sanguine about the short term. Bond vigilantes have been issuing dire warnings about deficits and debt since at least the 1980s – and nothing has come of it. So if I’m right about the economy rolling over later this year, I think interest rates go lower in the short term.

Longer term all this debt is a disaster. In addition to the $27 trillion in outstanding treasuries, the federal government has multiples more in unfunded liabilities for Social Security and Medicare. The amounts are so large that it is obvious that they can never be financed via taxes. They will be financed by printing money. The problem with printing money is that at a certain point it results in inflation.

A few years ago, the novelist Lionel Shriver wrote a terrific novel, The Mandibles, in which the US government defaults on its debt resulting in hyperinflation. The government won’t explicitly default on its debt but all the money printing required to finance its operations could (will?) eventually result in a loss of confidence in the dollar and the hyperinflation Shriver imagines.

Permabears have been correctly arguing for decades that this is unsustainable. And they’re right. At some point, investors will lose confidence in the dollar and the pyramid scheme will come crashing down. I’m just betting that we can keep kicking the can down the road for at least a few more years.