25 Basis Points Is Likely But Not Sufficient

The war makes inflation more intractable – Steven Blitz, Chief US Economist, TS Lombard (quoted in Nick Timiraos, “Fed Wrestles With The Challenge Of How Quickly To Raise Interest Rates” [SUBSCRIPTION REQUIRED], WSJ A1, Tuesday 3/15).

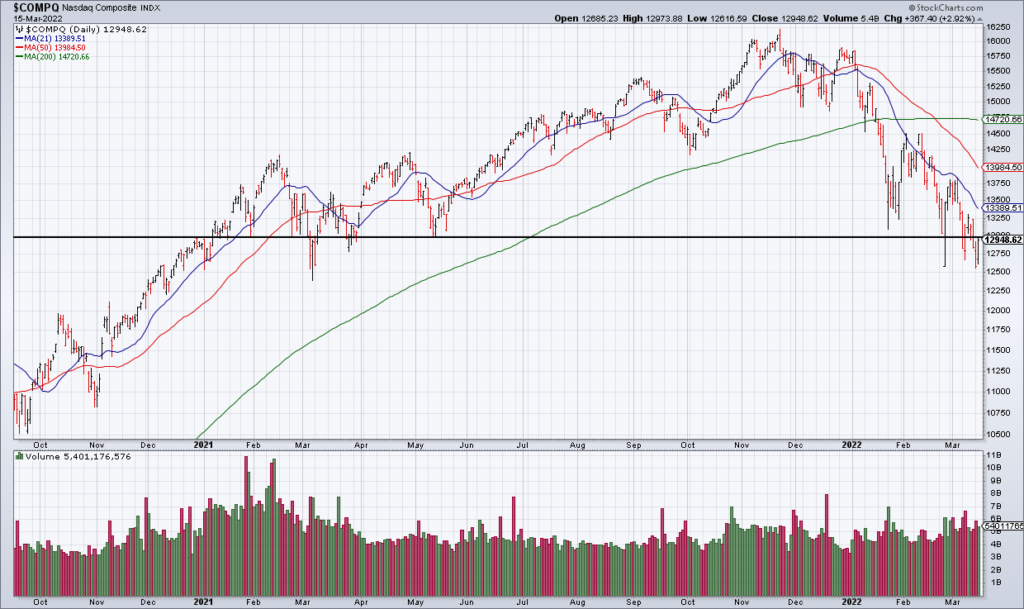

The Fed is highly likely to raise the Fed Funds Rate by 25 basis points Wednesday. While 50 basis points is probably the appropriate move, it would rattle financial markets at this point after Chairman Powell told Congress he supported a 25 basis point hike two weeks ago. While this amounts to kicking the can down the road in my opinion, financial markets love easy money and could well build on Tuesday’s relief rally in this scenario.

The February CPI came in at 7.9% last week – and that was before the full impact of Russia’s invasion of Ukraine on commodity prices and supply chains. The CPI is notorious for understating inflation and the actual level is probably double that. That’s why 50 basis points – while bold – is the right move for the long term health of the economy in my opinion. If Powell really wanted to emulate Volcker, that’s what he’d do.

Meanwhile – in the real world – Powell essentially tied his hands two weeks ago when he said he supported a 25 basis point increase. Nobody should be surprised by that which is why I think the market could build on Tuesday’s relief rally. Nevertheless, inflation is a menace and will contract the economy via rising interest rates, squeezing consumer budgets and pressuring profit margins. The long term trend is still lower in my opinion. Therefore, any rally should be used as an opportunity to clean up one’s portfolio in preparation for the hard times ahead.